Want to offer payment plans on your WooCommerce store? Looking for a way to increase sales and conversions? Paythen makes it easy and painless to offer your customers payment plans. Start your free Paythen trial and install our WordPress plugin to get started. Paythen works with Stripe. Using Paythen, you can offer payment plans to customers in over 130 currencies and your business can be based in 40+ countries.

Here’s an overview of what we cover in this post. While it’s best to read it from start to finish, you can jump down to any section directly.

-

- What is Paythen? Jump to section

- What is Stripe? Jump to section

- Do I need to offer payment plans on my WooCommerce store? Jump to section

- Types of payment plans available for WooCommerce Jump to section

- WooCommerce deposits plugin vs. Paythen Jump to section

- Buy now pay later companies vs. Paythen Jump to section

- A step-by-step guide to WooCommerce payment plans using Paythen Jump to section

What is Paythen?

Paythen is a tool that lets you offer, manage and automate payment plans (and all payments) for your customers. With the Paythen WooCommerce Payment Plan plugin, you’ll be up and running in under a minute.

Paythen lets your customers pay using their existing credit or debit cards — without needing any new credit approvals or checks, and 100% of your customers will be able to access payment plans.

Start your free Paythen trial and download the plugin to get started.

Paythen is available anywhere Stripe is. If you can sign up for a Stripe account, you can use Paythen. Stripe is currently available to businesses based in over 40 countries (please see notes below for 'preview' countries), and almost anyone anywhere through Stripe Atlas. These are the countries supported by Stripe (and Paythen) at the moment:

You can accept payments in most currencies Stripe supports (over 130) – at the moment you can't accept zero decimal currencies with Paythen. There are some exceptions and limitations based on your account's currency. View the full list and more info here.

Are you in a country where Stripe is in preview?

Countries that show "Preview" above might have limited functionality as Stripe is just getting started there.You can read more about each supported country, including Stripe fees and sign up for a Stripe account here. Different preview countries might have different limitations.

For some countries, because of legal and Stripe restrictions, Paythen fees cannot be automatically deducted from each transaction like they usually are. In these cases, you can still use Paythen as normal – but your billing will be done monthly at the end of each month via a credit or debit card.

For some preview countries (like Indonesia and the Philippines), Paythen might only work if you have set up a Stripe account using Stripe Atlas but not if your account is based in your home country and currency. This is because of legal limitations in these countries that don't allow external platforms based in other countries to connect to locally-based accounts.

Is your Stripe account based in Japan?

Japan based accounts can use and accept payments with Paythen in all other currencies except JPY at the moment. Paythen does not support zero decimal currencies at the moment but we expect to add support in the future.

Is your Stripe account based in India?

Accounts based in India can currently only accept payments in INR using Paythen – we will be adding support to accept other currencies too, but at the moment, only INR payments can be accepted. If you're using Stripe Atlas with a USD account, then this does not apply.

Is your Stripe account based in Indonesia or the Philippines?

Unfortunately at the moment, due to legal and/or Stripe limitations, Stripe accounts based in Indonesia or the Philippines cannot connect to platforms like Paythen that are based in other countries, like Paythen is. We hope to support both countries in the future if and when this changes. You can use Paythen if you have a US based Stripe account created via Stripe Atlas though.

If Stripe is not available in your country, we recommend looking into Stripe Atlas. It's a great way to form a US company remotely and get all the benefits that come with it.

What is Stripe?

Stripe is the world’s leading payment processor — they handle the underlying payment infrastructure to ensure your customers’ payment information is secure. Millions of businesses across the world use Stripe as their payment processor. Paythen works with, and requires, Stripe. When you start your free Paythen trial, you can connect your existing Stripe account or create a new one in seconds. Paythen is a Stripe verified partner.

Do I need to offer payment plans on my WooCommerce store?

This is a valid question — you should consider whether payment plans are relevant for your business and your customers. Payment plans can add more admin, cost, and to some extent, more risk. And for some businesses, not having payment plans might be best.

However, for businesses where the average order value is higher than a few hundred dollars, of if you’re selling high-value products, courses, or a service, offering payment plans will typically help increase your customer base, sales, and revenue.

Offering payment plans increases average order value and decreases cart abandonment.

Payment plans make your product or service accessible to a broader audience and help your customers manage their cashflow. If payment plans are not common in your industry, offering them can even be a key differentiator vs. your competitors. Many businesses also increase their margins by charging more for payment plans.

What types of payment plans can I offer on my WooCommerce store?

There are a few different tools and types of payment plans you can offer on your WooCommerce store. We cover some of the most popular ones below and highlight the pros & cons of each.

An overview of the WooCommerce Deposits plugin

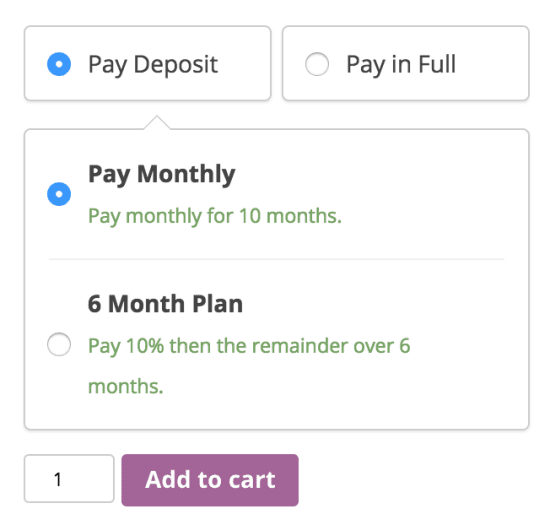

With the WooCommerce Deposits plugin, your customers can pay a deposit for one or more products and pay the rest over several installments you define.

Based on the settings you’ve configured, customers will see the option to pay a deposit today, and the rest in installments, or just equal installments starting today.

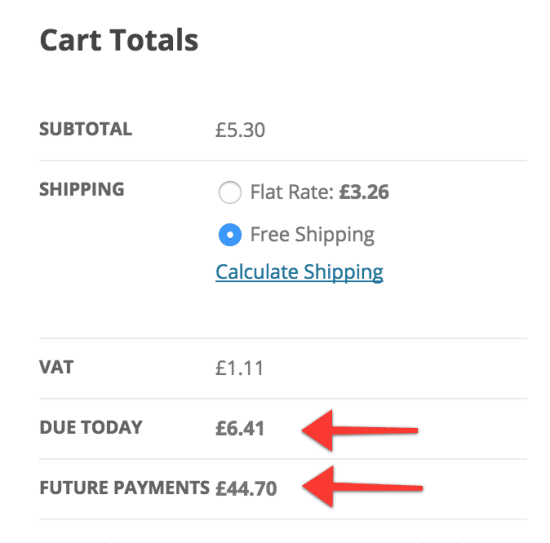

In the cart, customers will be able to see the amount they need to pay today and the total they owe in the future:

This sounds like the perfect solution. Right? Well, not quite. While this is a good solution up to this point, once customers have placed the order, instead of automatically charging their card for each scheduled payment, the WooCommerce Deposits plugin requires them to re-enter their card information every time!

The WooCommerce Deposits plugin requires your customers to re-enter their card information for every scheduled payment.

Before each future payment, the plugin will send your customers an email with a link that will then require them to re-enter their card information. If you have 12 installments, your customers will need to do this 12 times! This will be a big pain point for your customers, and you as an admin.

Each time a scheduled payment is due, you run the risk of the customer not seeing the email, forgetting to make the payment, the email ending up in spam, or the customer just ignoring the email altogether — requiring you to manually monitor and follow up with each customer.

While the WooCommerce Deposits Plugin is otherwise a good solution, we believe this lack of automated payments is a considerable downside. This will add dozens of hours of extra admin and headaches for you, while annoying your customers, and increasing the chances of defaults and delayed payments.

Paythen vs. WooCommerce Deposits Plugin for offering payment plans on your WooCommerce store

How does Paythen stack up vs. the WooCommerce Deposits plugin? We’re biased, but we believe Paythen has key advantages over the WooCommerce Deposits plugin.

- Paythen works with your WooCommerce store with our plugin, but also works everywhere else. If you run a business with different products and/or services outside of WooCommerce, Paythen can handle it all while giving you unified reporting and one central dashboard. Paythen also lets you offer payment plans, one-off charges, subscriptions and more, all with their own easy to share payment links.

- Paythen’s WooCommerce plugin not only lets you offer flexible payment plans with or without an upfront deposit, but it also automatically charges customers for each future payment. Once your customers sign up to a Paythen plan, everything is automated — with little to no manual admin needed. This can save you dozens of hours a month. Paythen automatically sends reminders 2 days before each payment is due to let customers update their billing info if needed, then automatically charges the card on file on the due date. If a scheduled payment fails, Paythen instantly notifies you and the customer, then automatically re-attempts the payment multiple times.

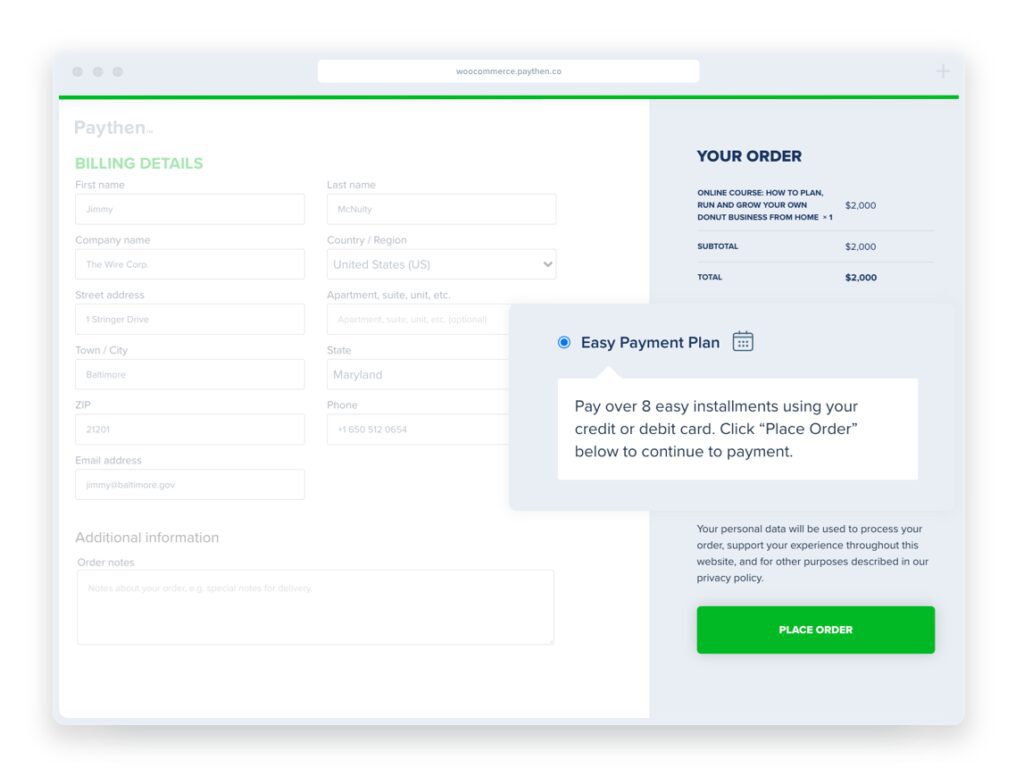

- Paythen’s WooCommerce plugin works on your entire shopping cart and is fully compatible with any other plugins or extensions you might be using, including tax, discounts and more. With Paythen, your customers see the payment plan option along with credit card or other payment options on the checkout page.

After your customers choose the payment plan option, they are taken to a secure payment page where they enter their card information, and after successful payment, returned to the WooCommerce order confirmation page.

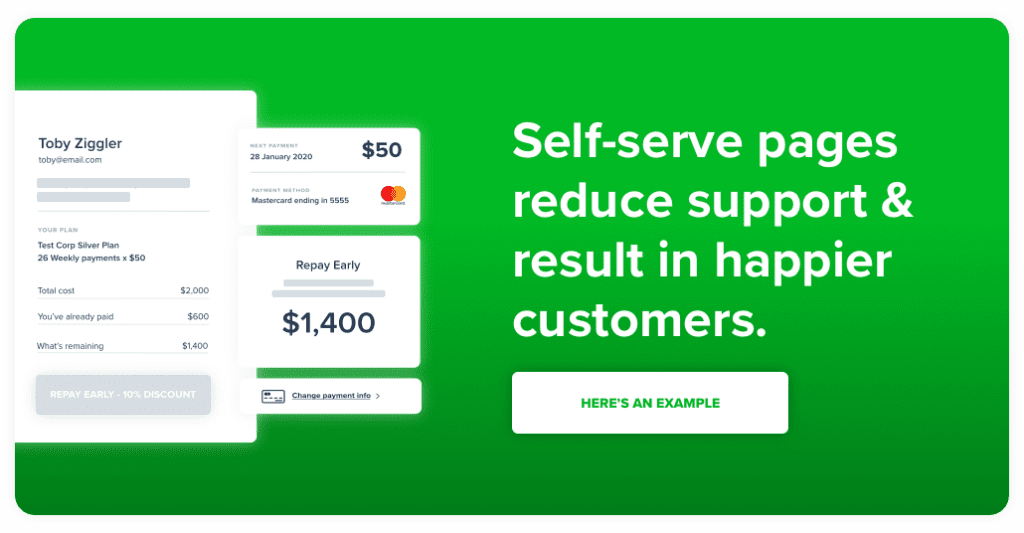

Each customer gets a unique self-serve link like this that lets them view and manage their payment plan, change their card, and even repay early.

Buy now pay later providers like Klarna, AfterPay, Sezzle & Affirm — An overview and how they compare to Paythen for WooCommerce payment plans

Most people have heard of or used a buy now pay later provider these days when shopping online or in-store. Depending on the country, there can be dozens of providers. The most well-known ones globally are AfterPay, Klarna and to a lesser extent, Affirm and Sezzle. There are also dozens of other country-specific ones.

Most buy now pay later providers operate with a standard model:

- You have to register (and get approved) as a merchant with each provider.

- Your customers choose the “Pay in 4 or 8” option at the point of payment and are taken to these providers sites to create an account. They complete the payment and are redirected back to your site.

- You get paid the full amount, less a big slice of their fees (often over 6%, and in some cases as much as 10%).

- Your customer repays the buy now pay later provider over a few weeks.

The advantage of buy now pay later providers for your customers is they offer interest free payment plans for purchases, and the checkout experience is fairly quick and painless, although customers do have to create an account, get approved, and in some cases complete a credit check.

The main advantage for you as a merchant (assuming you are in their list of eligible industries, and in a country they operate) is that you get paid the full amount upfront — even though customers repay in installments. However, this comes at a cost to you — often over 6% of your revenue, and you essentially hand over your customer relationship to the provider.

Everyone loves Snoop Dogg but who’s really paying for super bowl ads and celebrity endorsements? Hint: You are.

Shown: A tv ad by Klarna featuring Snoop Dogg. Image source: Forbes

All future emails they get are from the buy now pay later provider, with their branding, and they are often pushed to start any future shopping sessions from the provider’s site where all your competitors exist and your listing is one of dozens.

AfterPay, Klarna and other BNPL providers vs. Paythen — a side by side comparison

| Buy now pay later providers | Paythen | |

|---|---|---|

| Fees | You pay a lot – usually between 6% and 10% depending on the provider and country. In many industries, this can be a huge part of your profit margin. | You pay only 2% + Stripe fees |

| Who pays for the fees | Most providers make you sign a contract stating you won’t charge extra for their services – forcing you to absorb their fees. This is inherently wrong. You work hard to build your business and brand. A payment provider shouldn’t try to dictate what you can and can’t charge your customers. | With Paythen, if it makes sense for your business, you can easily add a surcharge to cover fees or other expenses. You can charge this fee over the payment plan, or upfront. You’re in total control. |

| Country availability | Most providers are available to businesses in certain countries only. Even the biggest ones are only available if you’re based in a handful of countries. Your customers must also be based in the same country. | Available to businesses in 40+ countries with customers anywhere in the world. |

| Eligibility | You need to “apply” and get approved. Only businesses operating in certain industries are eligible. Your customers also need to apply and get approved. In some cases, they must also complete credit checks. | Get started in under one minute – no approvals needed. All businesses across all industries can use Paythen. All your customers can use Paythen with their existing credit or debit cards. |

| Cart value | Most providers restrict the total credit available to customers to between $1,000 and $1,500. If you sell a higher value product or service or if customers have other purchases on a payment plan, they can’t buy what you’re selling. | With Paythen, there are no limits to the total order value so you can sell high value items without limits. In fact, most Paythen customers sell products and services over $1,000. |

| Flexibility | None. Each provider typically has a fixed repayment period – typically between 4 and 8 payments spread over 1 to 4 months. If this doesn’t suit your business, tough luck. For many businesses selling a high value service or product, the amounts per payment can still be quite high, reducing sales. | With Paythen, you have a lot of flexibility – set billing intervals weekly, fortnightly, monthly, or anything you want. Set repayments to be over a few weeks, months or even years if you need. Collect a larger amount upfront, add surcharges, hidden fields, and more. |

| Payment currency | You can only charge in your home currency. | Offer customers payment plans in 130+ currencies. |

| Your brand | Your brand takes a backseat to their brand. All communications and user interactions are from their brand. They build their brand at your expense. | Paythen lets your brand shine while handling the back-end admin for you. Your customers see your branding – your company name, your logo and your colors. |

| Your customers | Once your customers sign up to use one of these services, they essentially become their customer. You lose any direct relationship with the customer, and over time, the providers focus heavily on driving all customers to their home page, not yours. You basically pay these providers in dollars as well as customers. | Your customers are always yours. Paythen is software designed to help you provide a seamless payment plan experience. We don’t want your customer relationships.With Paythen, your customer communications and data are always fully controlled and owned by you. |

| When you get paid | You get paid the full amount upfront, less a big chunk of fees. | You get paid as your customers pay, with automated reminders and follow-ups that handle any failed payments. |

| Types of payments | One option only – their fixed payment plan. If you want to sell other types of services or products like subscriptions, you have to mix and match payment providers. | With Paythen, in addition to payment plans, you can offer subscriptions, one time payments, and our unique Pay your way plan that lets your customers choose to pay in full or via a payment plan, for the same product. |

| Where you can accept payments | Limited. You can only use these providers in your ecommerce or physical store. | No limits. Each plan in Paythen gets its own unique payment link that works everywhere – on your website, socials, WhatsApp, text messages, and anywhere your customers are so you can use Paythen in any context. |

| Reporting | Limited reporting on just a portion of your customers. | Unified reporting in a beautiful dashboard that lets you understand what you’re owed vs. paid, and lots more. |

While we are biased, we believe setting and controlling your own payment plans, with your own branding, and critically, your own customer relationships, is a better option for many businesses. The fact that you pay lower fees makes it even better. For certain types of businesses where you have to get paid the full amount upfront, despite higher fees, a buy now pay later provider might be more suitable. In fact, some customers use both Paythen and a buy now pay later provider.

The best way to see if Paythen is the right fit for you is to try it out. There’s a 7 day fee-free trial and it takes only a few minutes to get started.

A step-by-step guide to installing and using the Paythen WooCommerce Payment Plans plugin

Here’s a quick overview of how Paythen works with WooCommerce. We also explain each step in more detail below:

- You install the Paythen WooCommerce plugin and configure a few options

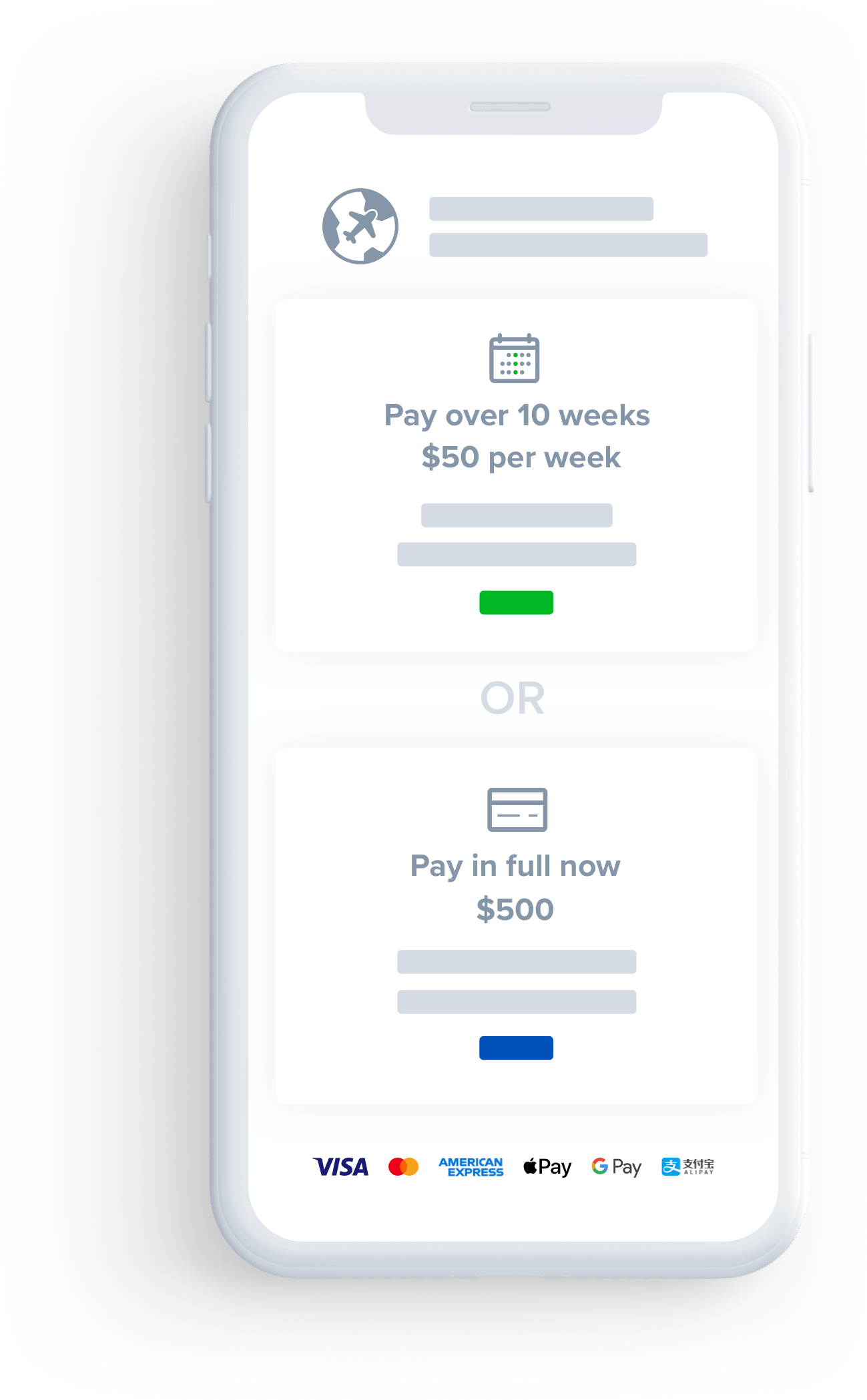

- On the WooCommerce checkout page, your customers will now see a new payment plan option. When they place an order using this option, they will be redirected to a Paythen payment plan page to complete payment. The order status changes to “on hold”.

- After successful payment, they are brought back to their WooCommerce order confirmation screen, just like other payment methods. The order status changes to “processing”.

- Customers will get an email from Paythen with their payment plan details and dates, in addition to any emails you have configured in WooCommerce

- You can see and manage their payment plan and information in the Paythen dashboard

- Your customers will be automatically charged for each future payment

Here are detailed instructions with screenshots on how to set up the Paythen WooCommerce plugin

In your Paythen dashboard

- Create a free Paythen trial account, or log in to your existing Paythen account. Go to settings > integrations and switch on the WooCommerce toggle.

- You will see a link to download the latest version of the Paythen WooCommerce plugin. Click on “click here” to download the plugin file. This will download a zip file to your computer.

- Before you install the plugin in your WordPress site, we suggest creating the Paythen template that you will need to complete setup. A Paythen template is just the rules you pre-set for your payment plans, like how many payments you want, whether they should be weekly, monthly, etc.

- You will notice a new “Templates” menu option appears in your Paythen option. Click on it, and then click on the “New template” button.

- Configure your Payment plan template how you want. We explain templates in more detail here. You can change the template settings any time.

- After creating your Paythen template, copy the template link. You will need to add this into the Paythen plugin settings.

In your WordPress dashboard

- Now log in to your WordPress site. Go to plugins > add new and click on the Upload plugin button on the top left. You won’t find the Paythen plugin in the plugins directory at the moment.

- Click on “Choose file” and upload the plugin zip file you download in step 2.

- Click on “Activate plugin”

- Go to woocommerce > settings and then switch to the Payments tab. You will see Paythen Payment Plan as a new option in this list.

- Ensure it is switched to “Enabled”, and re-arrange the order based on how you want customers to see it at checkout. We suggest moving payment plans to the top, so customers don’t miss this option and know they can pay via easy installments. This can help maximise sales.

- Click on “Manage”. You will see the Paythen plugin settings. Ensure you check the “Enable Paythen at checkout” option.

- For the other fields, you can add anything you want. Click on the tooltips (the question mark icon) to see an explanation for each field. Here are some suggestions for the text in these fields:Payment method title: Easy Payment Plan

Business name: Add your business or company name

Description: Pay over x weeks/months using your credit or debit card. Click “Place Order” below to continue to payment.

Minimum order amount To maximise your sales, and if it makes sense for your business, leave this blank. Otherwise, add in the minimum amount for the cart total before the payment plan option is shown.

Paythen template url Paste in the template link you had copied in step 6 above.Click on the blue “Save changes” button. - Your Paythen Payment plan option is now live on your WooCommerce store 🎉

- Test that everything is working as it should! You can use our WooCommerce demo store as a reference point to see the flow for your customers.

If you have any questions or need help setting this up, the Paythen team is here to help. Send us a message via the chat icon and we’ll help you get started!