Paythen is a better Afterpay alternative for many businesses

Here are some reasons why

👇

Afterpay is limited to specific types of business, five countries and eligible customers from your country. Paythen is available in 40+ countries and your customers can be anywhere in the world.

For many businesses, Afterpay isn’t even an option. But if you can open a Stripe account, you can use Paythen. Afterpay is limited to merchants in certain industries and only five supported countries. Your customers must also be in the same country as you. It’s also not available if you’re in any of these industries – experiences, ticketing services, software, health, auto services, cleaning services, other personal services. A range of other business types including b2b goods, antiques, jewellery, and others require “conditional approval”. With Paythen, you can be up and running in under 5 minutes and offer payment plans to your customers anywhere in the world.

Afterpay wants needs your customers to start their next purchase at afterpay.com, not your site.

With the amount of money Afterpay spends on sales execs and advertising, their business model only makes sense with huge volumes. To drive this volume, as soon as your customer uses Afterpay on your site, they essentially become an Afterpay customer – all future communications, emails, branding etc is Afterpay’s, not yours. Customers are strongly encouraged and incentivized to start their next shop on afterpay.com or via the Afterpay app where your business is just one among hundreds and easily replaceable. Giving up this direct customer relationship weakens customer loyalty and future sales for you.

Afterpay forces you to absorb their fees. This is hostile towards merchants and significantly impacts your margins.

We completely disagree with this approach. This only benefits Afterpay, and helps them gain market share – at your expense. If you offer an additional payment option like installments for customers’ convenience, you should be able to pass on the cost if you’d like to. No one should force you to give up your profits, especially in today’s tough economic environment. With Paythen, you can choose to add a payment plan surcharge or similar to cover our, or even Stripe processing fees. Our fees are lower too – at 2% (plus Stripe payment processing fees) vs. Afterpay’s 6% + the fees applicable for customers (like late fees) and even interest on longer plans.

Paythen gives you way more flexibility and control over how you structure your payment plan

Afterpay only allows 8 fortnightly repayments (and for some US customers, longer installments with interest). With Paythen, you can set weekly, fortnightly, monthly, custom or even date-based billing intervals to suit your business. With Paythen, you decide how you get paid – and can set up as many different plans as you need. There are even more granular options you can customize in Paythen – payment plan terms, custom fields, incentives to pay upfront, incentives to repay early, discount codes, gift cards, and more. And importantly, it’s your business, brand, color and logo front and center on all customer pages and emails – not ours.

Monthly repayments

Weekly repayments

Custom repayments

Instant no-code setup

Payment links that work anywhere

Offer discount codes, gift cards

No limit on order value

8 fortnightly repayments

Weekly repayments

Custom repayments

Requires development help

Only works on ecommerce sites

No discount codes or gift cards

Limited to ~$1,300 in most countries

Paythen is better value than Afterpay and has no fixed fees. We get paid only when you do.

Paythen has a fee-free 7 day trial, then a low 2% per transaction fee. That’s it. You also pay a separate payment processor fee for Stripe. With Afterpay, the fees starting with a whopping 6%+ transaction fee from you, as well as late and other fees from customers (even interest for longer plans). Paythen has no fixed or sneaky fees.

Paythen talks to all your other systems. Afterpay doesn’t – making it harder to see the big picture.

Need a slack notification when you have a new payment plan? Easy. Want to send new customer data into your CRM? Also easy. Paythen has an easy Zapier integration that lets you send dynamic payment plan links to customers via email, or send any data from Paythen into your other systems – whether it’s your CRM, comms tool, Google sheets, or whatever else you use in your business, if it’s on Zapier, you can send Paythen customer data to it. This ensures your payment plan system and customer data fits in with your existing business, minimizing any additional admin.

Afterpay can be a better option for some businesses. Paythen is better for many others.

If your business is eligible for Afterpay and you’re in an eligible country with customers only from that country, and your margins allow it, Afterpay can be a good option for you. Specially if what you sell falls into the sub $1,000 ecommerce or physical retail category. Since Afterpay is a BNPL service and you get paid immediately, and if their fees work with your margins, that can be a better fit.

Paythen is a much better fit for businesses selling services, experiences, events, courses, coaching, consulting, travel, high value retail, made to order retail, and more. Since Paythen is not a BNPL service, and you get paid as your customers pay you, it is more suited to businesses that can align their payment plans with ongoing service delivery or where customers are willing to pay all/most of their plan before they get the product or service.

It’s easy to see if Paythen is right for you.

Create your free account 7 day and try it out – it takes only about three minutes to get started.

Better design and a better customer experience

This is subjective, but we believe Paythen delivers a better designed and more thoughtful experience for your customers during and after the initial purchase. With Paythen, in addition to beautifully designed payment pages with your logo and branding, each customer also gets their own unique and secure customer page that they can access anytime – no logins or accounts needed. They can use this to update their billing information, get receipts and repay early.

Every email they get from Paythen is designed to work perfectly on all devices and screen sizes and includes your logo, not ours. From the time customers sign up for a payment plan till they finish, they get a world-class experience, delivered by Paythen, on your behalf and with your branding.

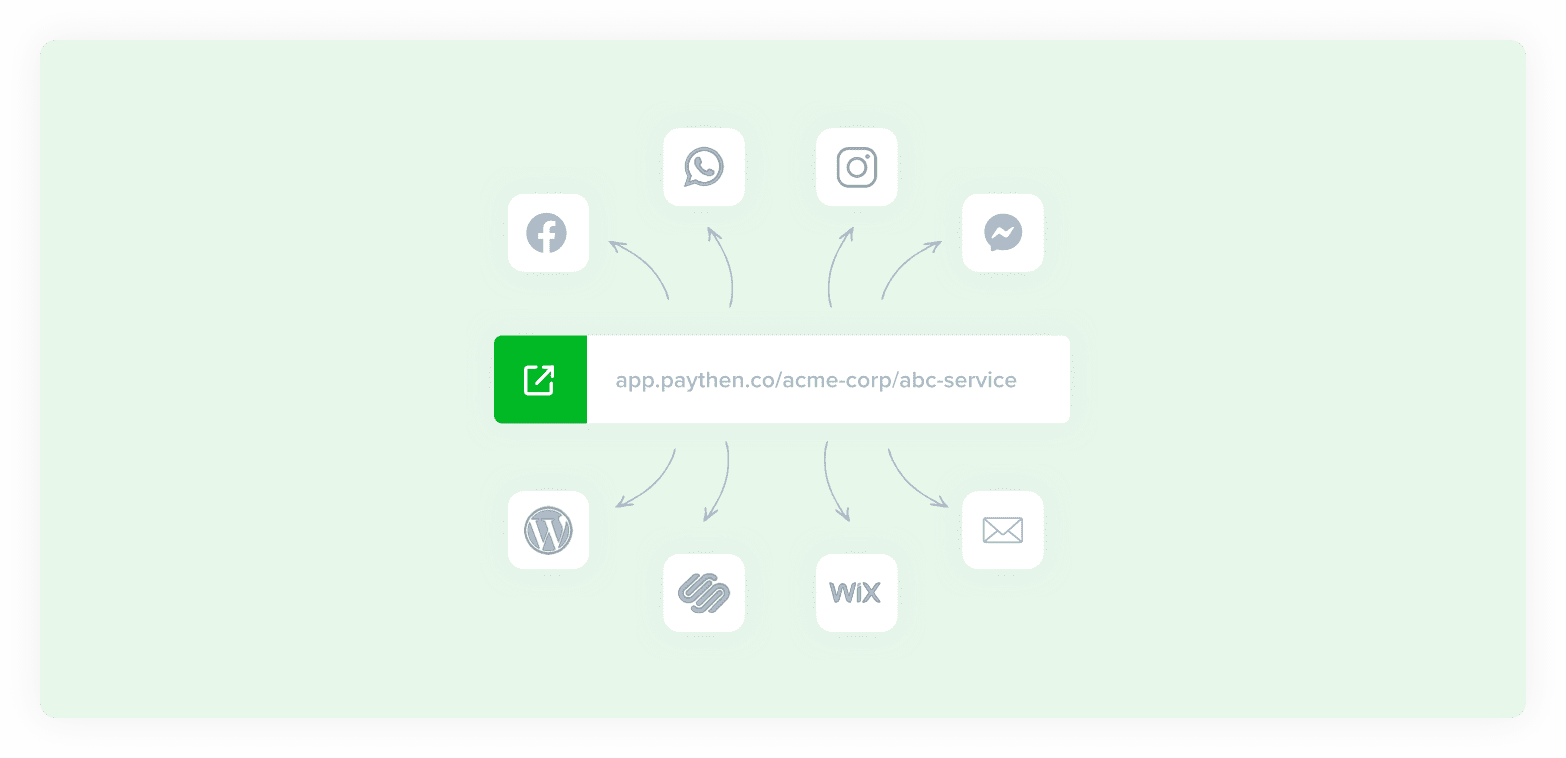

Afterpay works with ecommerce sites. Paythen works everywhere – no website needed.

Paythen’s simple but powerful payment links work everywhere – without even needing a website. You configure a plan and share the link for your customers to pay. You can add links to your bio, Linktree, or share directly in Messenger, Whatsapp and more. Of course, you can also integrate Paythen into your site with our customizable embed buttons, WooCommerce plugin, or Shopify workflow.

- afterpay

Should I choose Paythen or Afterpay?

The only way to find out whether Paythen or Afterpay is more suitable for your business is to try them. We’re biased but we believe Paythen is a better solution for many businesses that want to offer payment plans. It is more flexible, designed for small and medium sized businesses, requires no technical setup and typically takes about 3 minutes to set up. It also comes with fast, friendly customer service

and a 7 day fee-free trial you can start now.

Paythen is a better Afterpay alternative for many businesses

Easy payment plans

Offer your customers a flexible payment plan set by you, to increase conversions and sales.

Easy payment links

An easy to share payment link that works on any website and any device - matching your brand.

Flexible plan types

Offer payment plans, pay your way plans where customers can choose, subscriptions or one-off payments.

Automated reminders & emails

We automatically send handy reminders before payments & follow-ups if a payment fails.

Change payment info easily

Your customers can change their card info anytime they want, with zero time spent by your team.

Integrate with other apps

Send Paythen data to over 7,000+ other apps with our Zapier integration.

Discover more features, check out these examples or see our FAQs