Paythen is a better Splitit alternative

For your business and your customers

Here are some reasons why

👇

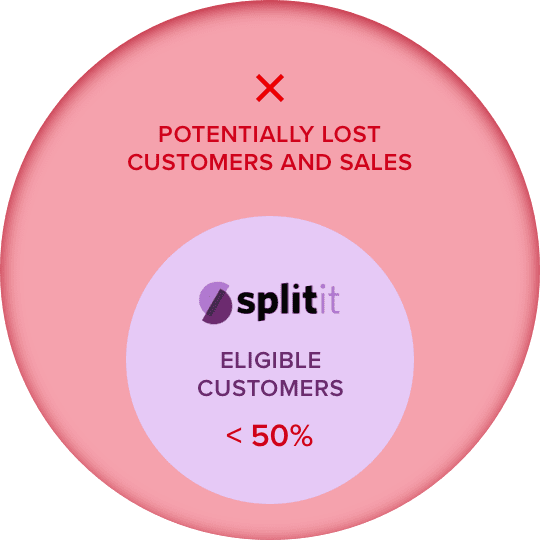

More than half your potential customers can’t use Splitit. Splitit doesn’t accept debit cards or American Express. Paythen does.

Splitit only works with Visa and Mastercard credit cards. According to a 2019 study by the US Federal Reserve, debit cards are used twice as often as credit cards. And this trend is only accelarating with younger people that don’t have credit cards. With Splitit, you’re saying no to all these potential sales.

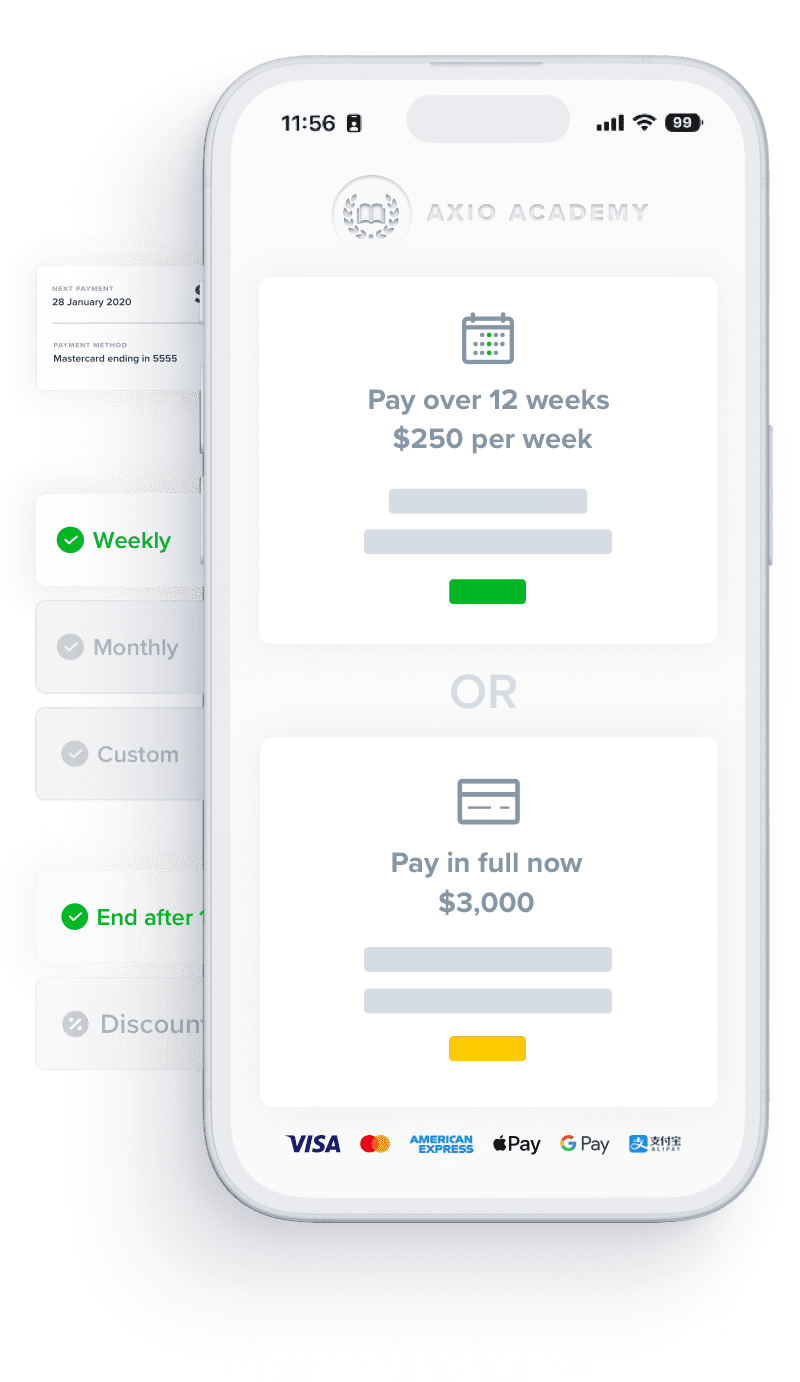

With Paythen, you can accept credit cards, debit cards (including Amex, Mastercard, Visa, Discover, JCB, China UnionPay, and others), Apple Pay, Google Pay, and even Alipay for eligible transactions.

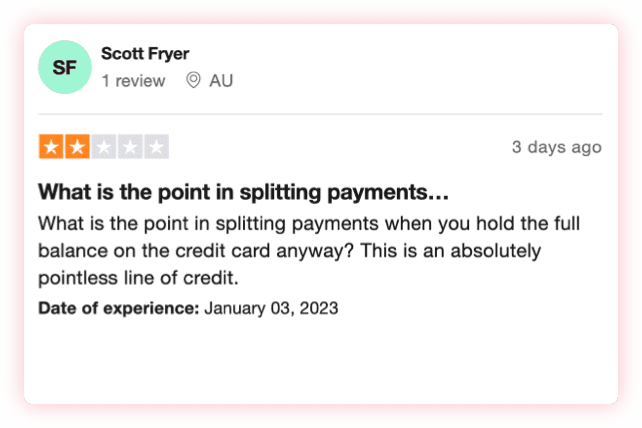

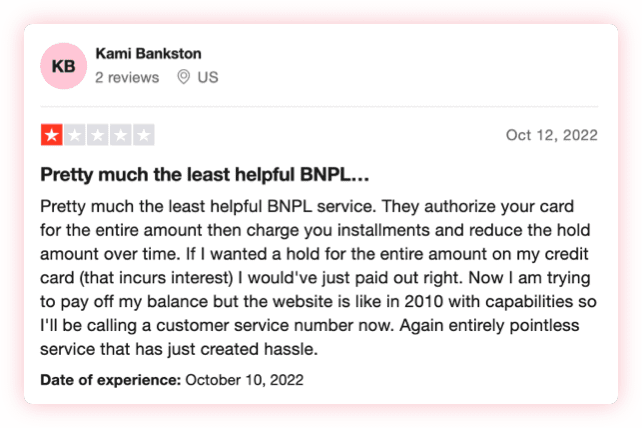

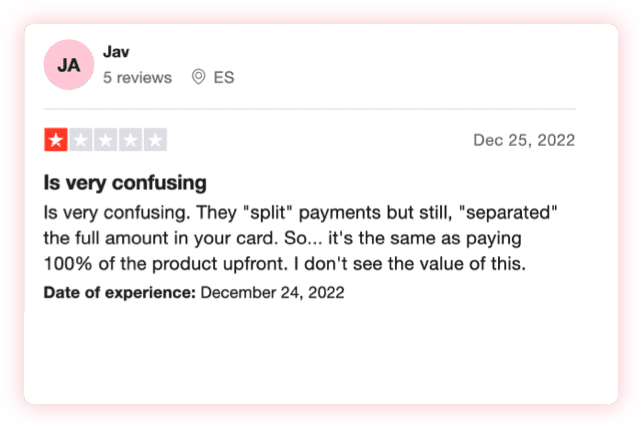

Splitit blocks the full amount of purchases on customer cards. This frustrates customers and leads to a poor experience.

Splitit holds the full amount of the purchase on your customers’ credit cards from day one. This defeats the purpose of choosing a payment plan for many customers since people typically choose payment plans to help with cashflow. Splitit’s approach can and often does lead to frustrated customers, especially since most don’t realize how it works till after they’ve signed up and see a large hold on their card.

This is not a great way to drive repeat business and build trust in your brand. With Paythen, there is no such hold – customers just need to have the funds for each payment available on the due date.

Paythen gives you more flexibility and control over your payment plan

Splitit only allows between 2 and 12 monthly repayments. With Paythen, you can set weekly, fortnightly, monthly, or even custom billing intervals to suit your business. With Paythen, you decide how fast you want to get paid. Splitit has a $10,000 order limit. Paythen does not – if you sell higher value services or products, you can use Paythen.

There are even more granular options you can customize in Paythen – payment plan terms, custom fields, incentives to pay upfront, incentives to repay early, discount codes, and more. Try it out with a fee-free 7 day trial.

Monthly repayments

Weekly repayments

Custom repayments

Instant no-code setup

Payment links that work anywhere

No fixed monthly fee

No limit on order value

Monthly repayments (up to 12)

Weekly repayments

Custom repayments

Requires development help

Only works on ecommerce sites

Fixed fee + higher variable fees

Limited to $10,000

Paythen is better value than Splitit and has no fixed fees. We get paid only when you do.

Paythen has a fee-free 7 day trial, then a low 2% per transaction fee. That’s it.

With Splitit, the fees add up – starting with a 1.5% – 6.5% transaction fee, another $1.50 per transaction and even another fixed monthly $75 fee! Paythen has no fixed or sneaky fees.

Paythen lets you send your data to your other systems – with our easy to use Zapier integration. Splitit doesn’t integrate with Zapier.

Need a slack notification when you have a new payment plan? Easy. Want to automatically generate and send a custom payment plan link to customers based on data in your other apps? Also easy. Paythen has an easy Zapier integration that lets you send customer data from Paythen into your other systems as well as send custom payment plan links via email – whether it’s your CRM, communications tool, Google docs, or whatever else you use in your business. This ensures your payment plan system and customer data fits in with your existing business, minimizing any additional admin.

You can see some examples of Zapier workflows here.

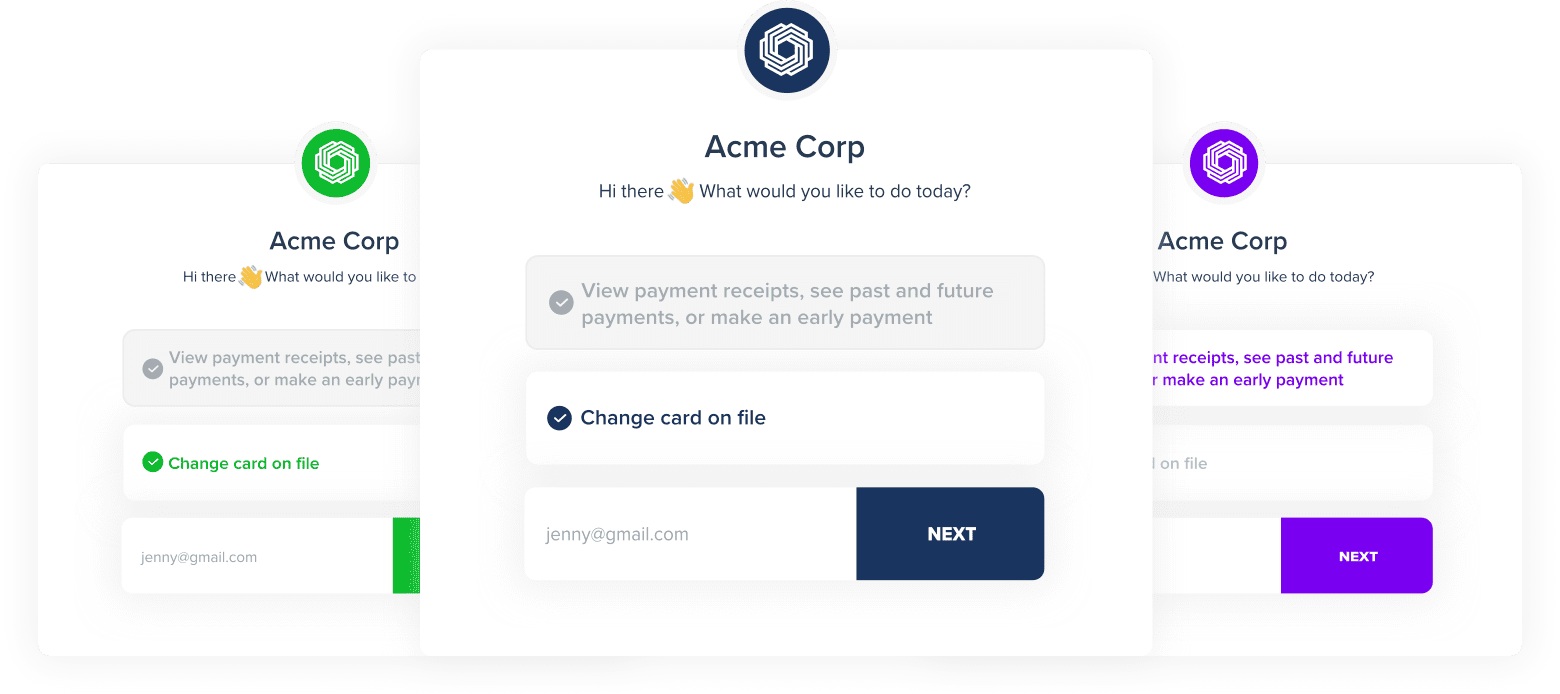

Better design and a better customer experience

This is subjective, but we believe Paythen delivers a better designed and more thoughtful experience for your customers during and after the initial purchase. With Paythen, in addition to beautifully designed payment pages with your logo and branding, each customer also gets their own unique and secure customer page that they can access anytime – no logins needed. They can use this to update their billing information, get receipts and repay early.

Every email they get from Paythen is designed to work perfectly on all devices and screen sizes and includes your logo, not ours. From the time customers sign up for a payment plan till they finish, they get a world-class experience, delivered by Paythen, on your behalf and with your branding.

Paythen is designed for business owners and operators. Splitit is focused on Enterprise.

If you like powerful simplicity and jargon-free straight-talk, you might prefer Paythen over Splitit. While Splitit wants to empower the entire payments value-chain 🙄 we just want to empower you – the business owner – to have full control over your payment plans, with no added complexity.

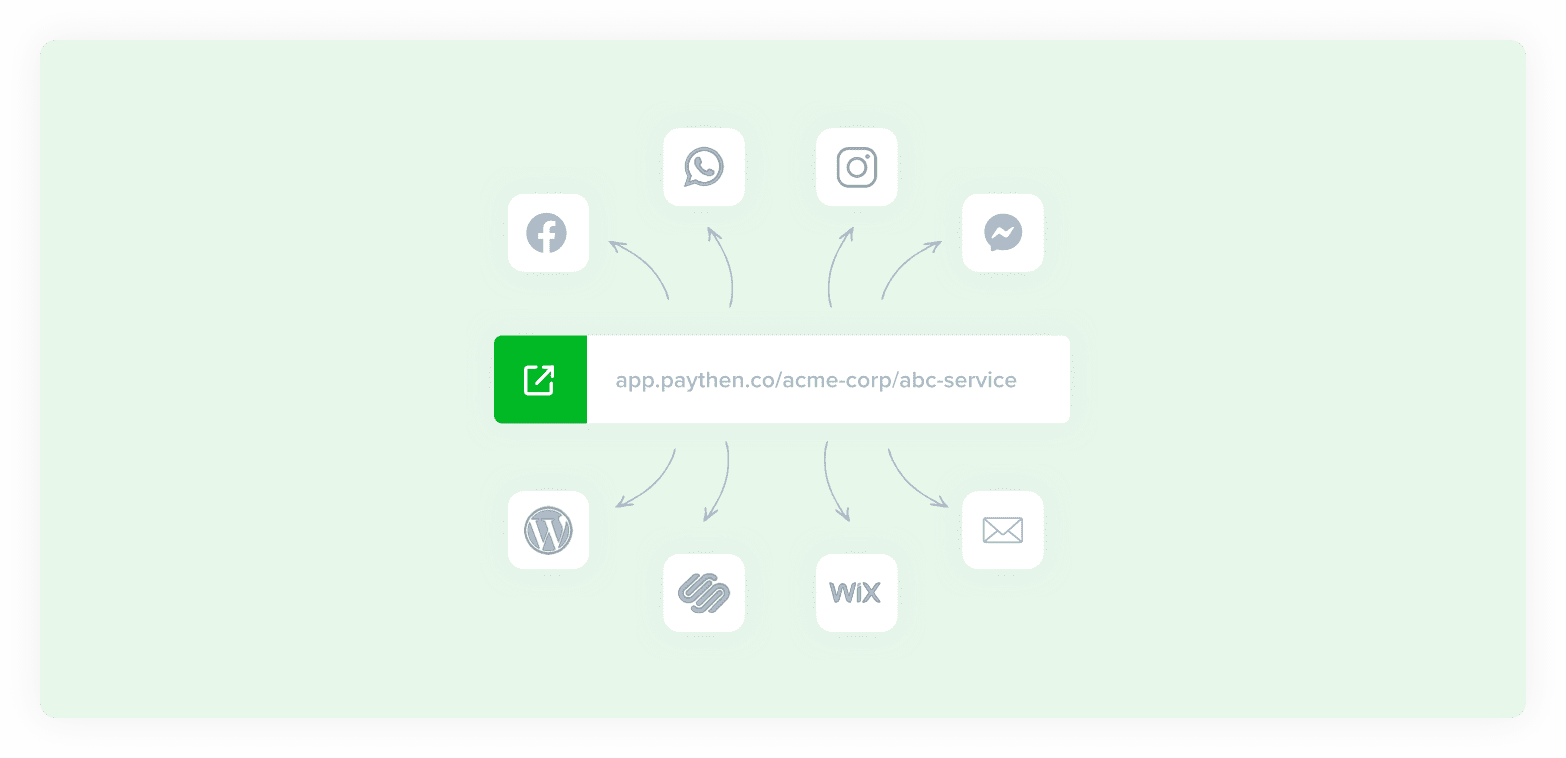

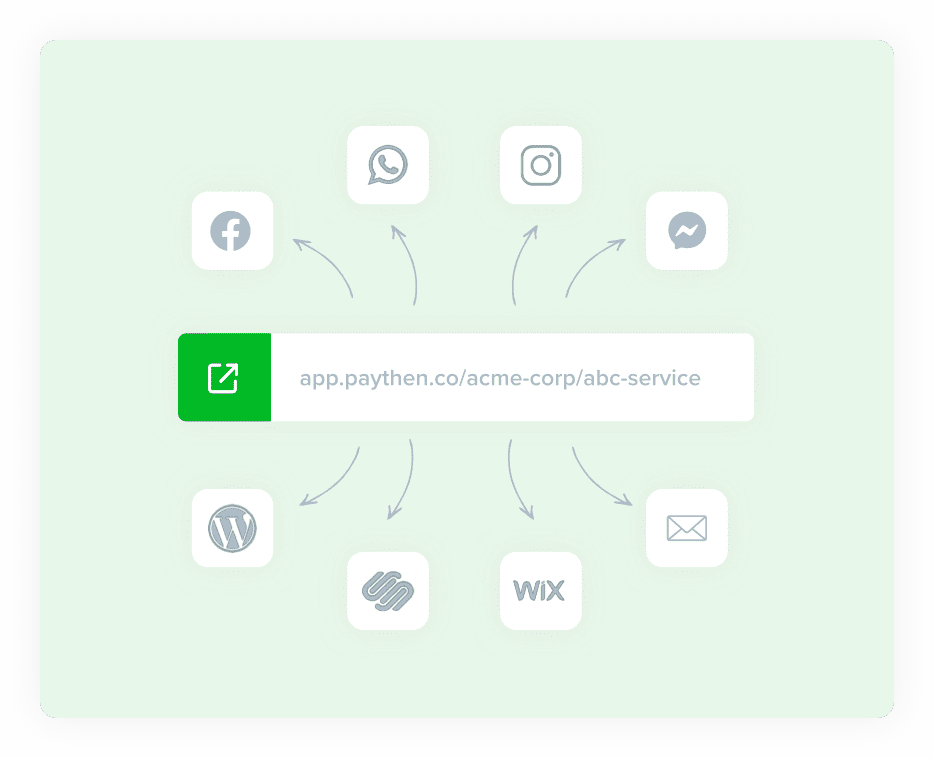

Splitit works only with an eCommerce site. Paythen works anywhere for any business – services, education, events, travel and more.

Paythen’s simple but powerful payment links work everywhere – without even needing a website. You configure a plan and share the link for your customers to pay. Of course, you can also integrate Paythen into your site with our customizable embed buttons, WooCommerce plugin, or Shopify workflow.

- Splitit

Should I choose Paythen or Splitit?

The only way to find out whether Paythen or Splitit is more suitable for your business is to try them. We’re biased but we believe Paythen is a better solution for many businesses that want to offer payment plans. It is more flexible, designed for small and medium sized businesses, requires no technical setup and typically takes about 3 minutes to set up. It also comes with fast, friendly customer service and a 7 day fee-free trial you can start now.

See some examples of Paythen plans and links in action. Complete payments using test cards.

Let your WooCommerce customers pay over weekly, monthly or custom installments via a fully integrated experience.

Paythen is a better Splitit alternative for payment plans

See if it works for you with a fee-free 7 day trial.

We’ll ask you to connect your Stripe account or create a new one once you sign up. Paythen works with Stripe.

Easy payment plans

Offer your customers a flexible payment plan set by you, to increase conversions and sales.

Easy payment links

An easy to share payment link that works on any website and any device - matching your brand.

Flexible plan types

Offer payment plans, pay your way plans where customers can choose, subscriptions or one-off payments.

Automated reminders & emails

We automatically send handy reminders before payments & follow-ups if a payment fails.

Change payment info easily

Your customers can change their card info anytime they want, with zero time spent by your team.

Integrate with other apps

Send Paythen data to over 7,000+ other apps with our Zapier integration.

Discover more features, check out these examples or see our FAQs