Sell more risk-free with a modern layaway plan.

Our Wait for it plans let you easily offer a modern layaway / lay-by option for customers to pay their installments first, then receive their product or service after they’re fully paid up.

This gives you and your customers all the benefits of a payment plan, with zero risk for you.

Eliminate risk

You’re selling a high-value product or service and to avoid any risk of non-payment, you want customers to pay their installments before you provide them the product or service.

Reduce abandoned carts

Offering a wait for it / layaway plan can help you boost sales. You can offer this in addition to any existing payment plan or BNPL option you already offer to maximize sales.

Incentivize customers to wait

Limited stock for your product or limited availability for your service? Sell made to order? Encourage some customers to wait by offering them an inbuilt discount.

Who uses wait for it plans?

If you sell high-value items, provide high-value services or sell physical products in general, consider offering a Wait for it plan. It let you offer customers easy-to-digest payments, increasing the likelihood of them buying, without the risk of non-payment. Many businesses selling high-value items and services aren’t eligible for BNPL companies like Affirm, Klarna, or Afterpay.

A Wait for it plan provides the benefits of a buy now pay later solution with lower fees and a better customer experience. If you already offer layaway, it’s an excellent way to modernize your offering, integrate it into your checkout flow, and reduce admin – all while improving the customer experience. Wait for it plans are useful for various industries and almost any type of business, but the ones that commonly use them are:

Jewellery

Electronics

Art sales

Department stores

Cohort-based courses & workshops

Furniture

Clothing

Homewares

Dental services

High value services or experiences

Supercharge your sales, not your admin

With the current economic environment and high cost of living, people are looking for and using any way to reduce their cashflow and manage their monthly expenses. Offering a wait for it plan lets more potential customers buy your product or service that would have been unaffordable for them as a lumpsum.

You can easily add setup fees, surcharges and even automated early cancellation fees.

Works with your existing payment plan or buy now pay later option

Wait for it plans are complementary to your existing payment plan option if you have one and work seamlessly with those on your ecommerce checkout. You can continue to offer payment plans using Paythen or your BNPL provider while also offering the “Wait for it” option as a separate checkout option for customers that are happy to wait – you can even incentivize this with an inbuilt discount 👇

Reward patience while improving cashflow

Not everyone is in a hurry. Some people are happy to wait a bit. If you’re running low on stock, sell something made to order, or sell a service, course, or anything with limited availability, you can encourage some of your customers to start paying now but receive their product or service once they have paid in full by including a built-in “wait for it” discount. This helps you better manage demand.

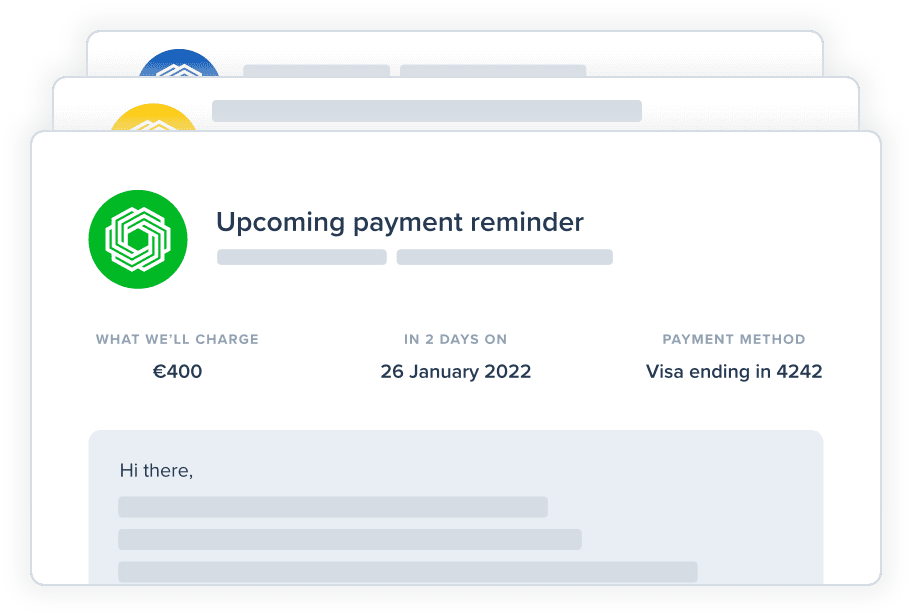

Fewer failed payments. Automated follow ups.

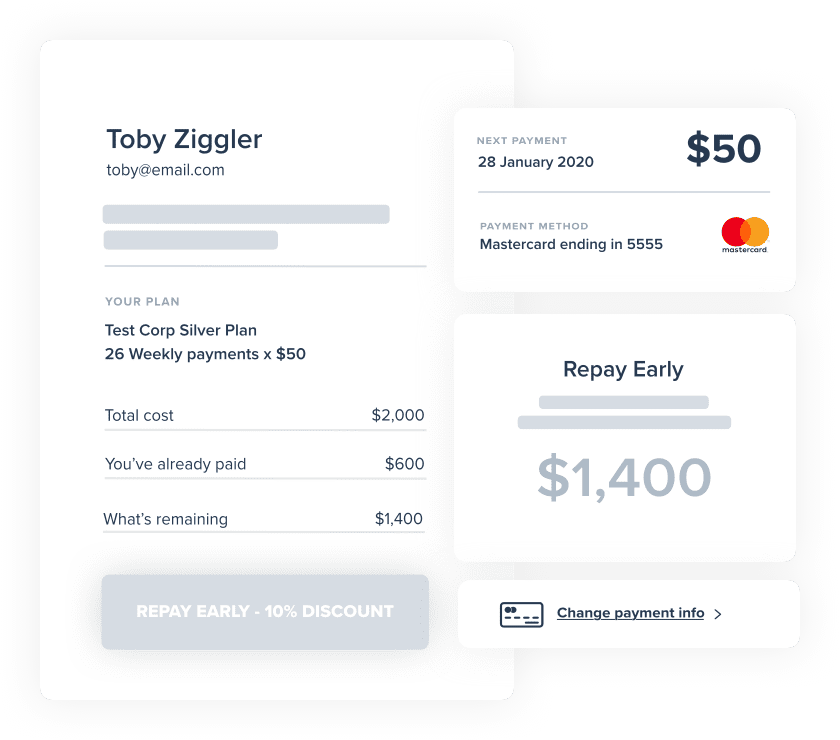

Let your customers help themselves and pay early at any time.

With self-serve links like this, your customers can see what they’ve paid, what’s remaining, pay some or all installments early, change their card info, get receipts and more – via a secure link they can access anytime. No logins or extra support time needed.

Leverage other plan types to suit your business

Our payment plans support almost any business model – from events and travel through to services, courses, dental, high value items like jewellery, machinery, and much more. With four different payment plan types and lots of customization within each, you can offer payment plans that fit your business perfectly. And to keep things simple, you can even offer subscriptions and one-time purchases using Paythen.

Payment plan

Payment plans with weekly, monthly, or any custom billing intervals that suit your business. Useful for a range of businesses and business models.

Date-based payment plan

Everyone pays on pre-set dates regardless of when they sign up. Useful for events, travel and education businesses and if you’re selling anything tied to a specific date.

Wait for it payment plan

Offer layaway or lay-by plans that let customers pay off their plan, then receive their product or service. Useful for physical items, services, or anything with limited spots.

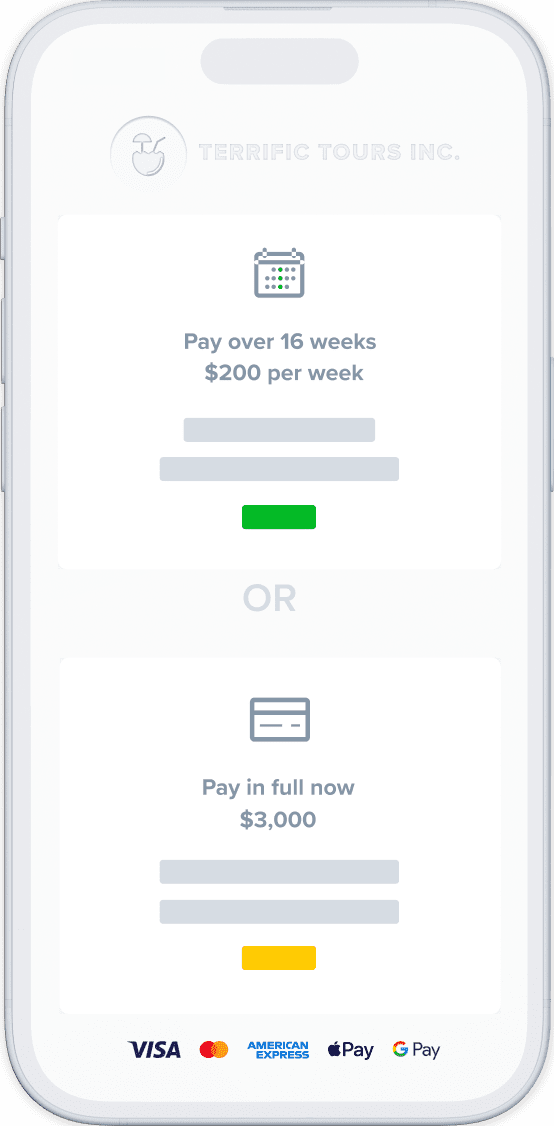

Pay your way plan

Encourage customers to pay in full or choose the payment plan option via the same payment plan link. Improve your cashflow while still giving your customers choice.

- Wait for it plan

Increase sales by offering easy payment plans in one minute.

Start with a fee-free 7 day trial.

We’ll ask you to connect your Stripe account or create a new one once you sign up. Paythen works with Stripe.

Easy payment plans

Offer your customers a flexible payment plan set by you, to increase conversions and sales.

Easy payment links

An easy to share payment link that works on any website and any device - matching your brand.

Flexible plan types

Offer payment plans, pay your way plans where customers can choose, subscriptions or one-off payments.

Automated reminders & emails

We automatically send handy reminders before payments & follow-ups if a payment fails.

Change payment info easily

Your customers can change their card info anytime they want, with zero time spent by your team.

Integrate with other apps

Send Paythen data to over 7,000+ other apps with our Zapier integration.

Discover more features, check out these examples or see our FAQs