Layaway (also known as layby, or lay-by) is a payment method that allows customers to reserve a product/service item by making an upfront deposit and paying the remainder in instalments over time. It’s similar to a payment plan or buy now pay later option but with one key difference – with layaway, customers pay all installments first, then get their product or service.

Functionally it is the exact opposite of the now popular get now pay later mindset and model since customers pay first and then get their product later. However, there are many reasons this might be more suitable for certain businesses.

Layaway is a risk-free way for businesses to help customers with limited cash flow or even bad credit to be able to afford higher value items and services. If the customer doesn’t pay in full, they don’t get the item and in many cases would be charged a cancellation fee to cover the business’ administration costs.

Paythen makes it easy for any business to offer a modern layaway plan in minutes. Try it free now, or continue reading for information on how it works, the benefits and risk with layaway and more. Here’s what we cover:

How it works

The benefits of layaway

The risks to consider

Legal considerations

Layaway best practices

Should you offer layaway plans?

Why choose Paythen for layaway?

Buy Now Pay Later (BNPL) vs Layaway comparison

Step-by-step guide to get started

How layaway works

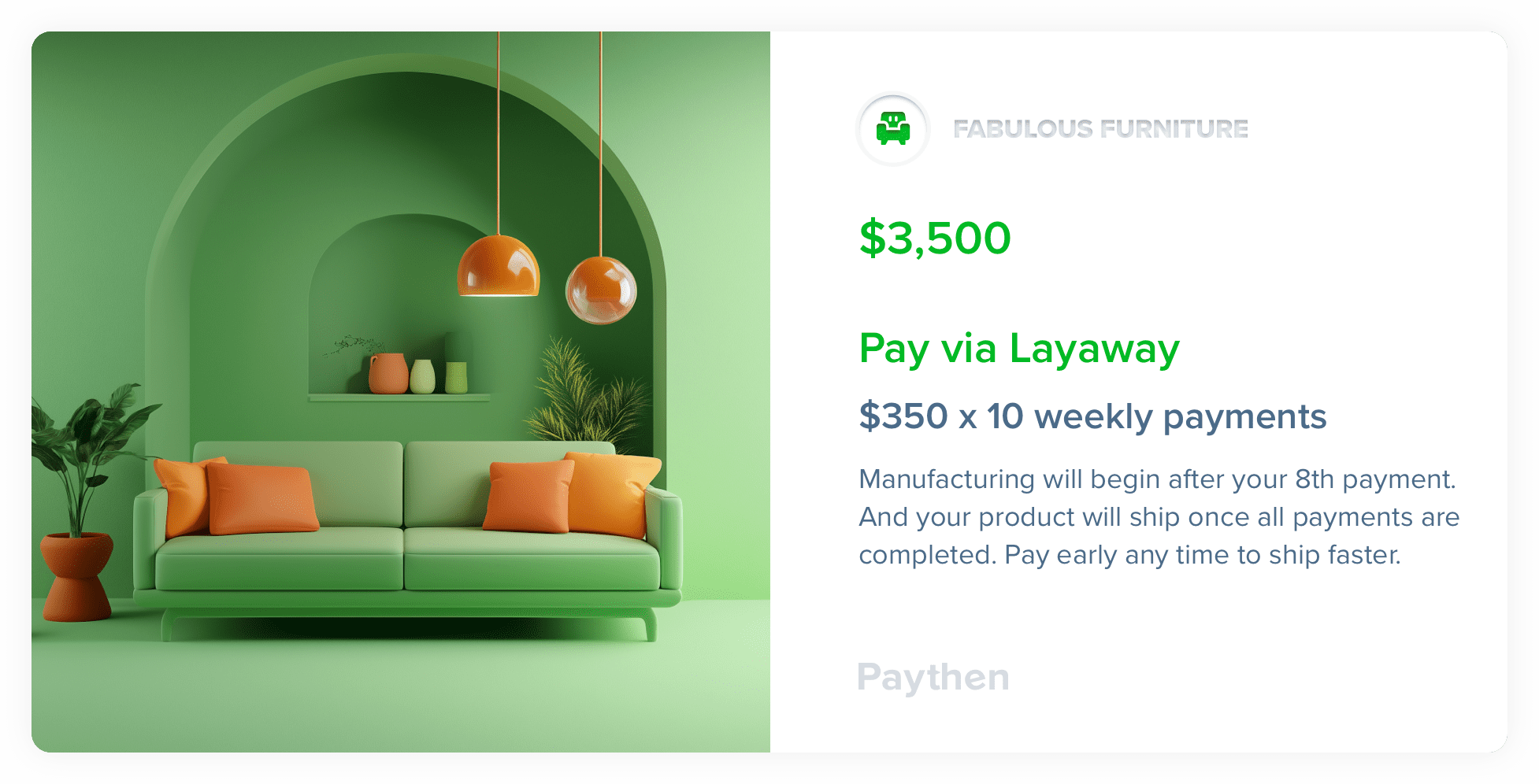

Layaway transactions work differently for each business. The basic framework is usually the same. Different businesses tend to set their own rules and parameters for their layaway programs, but typically they involve the following basics and steps:

- The customer selects the items or service for layaway and chooses the layaway option at checkout (or if in store, goes to the relevant area)

- The customer then pays a down payment – which is either a percentage of the total or a fixed amount

- The customer agrees to the business’ layaway terms, payment schedule, and any early cancellation fees or other terms.

- Once the customer completes all their installments, the item or service is provided to them or for in-store layaway, the customer would collect the items.

The benefits of offering layaway plans for businesses

In today’s hyper competitive world, businesses that thrive adapt to what a range of customers want. Here are some key reasons layaway can be useful for businesses.

Increases revenue and average order value

Layaway allows businesses like yours to increase the average order value and make what you sell accessible and affordable to a broader customer base. It also encourages customers to spend more as they can afford more with the improved cashflow a layaway plan provides.

Minimal risk

Since layaway plans are pay first and get later, as a business there is almost no risk for you. You get an upfront payment for something you don’t have to provide till later, and in cases where a customer decides to cancel early, they would typically pay a cancellation fee, while you are able to sell the same item or service for its full price. Traditionally for in-store layaway, the physical item was put aside for the layaway customer, but if you specify in your terms, you can advise customers that if the item is out of stock when they finish their layaway plan, they might need to wait a certain amount of time before they are able to get the item. This ensures you’re not holding on to any inventory and further reduces your risk.

Builds long-term loyalty

Offering a layaway option helps customers save on credit card debt and reduce the interest they might pay for other lending options. Those with a limited income can appreciate this and make them return to your business, building loyalty for the long term.

Improves customer satisfaction

Layaway allows customers to purchase the items they want without incurring debt. This creates a positive shopping experience, adding value to their journey and leaving them with a favorable impression of your business. Having multiple flexible payment options also helps you appeal to and attract more customers, leading to improved customer satisfaction with your business.

Gives you an edge over competitors

Layaway has long been a popular payment method across generations of shoppers. Customers seeking financial flexibility and manageable payments are naturally drawn to businesses that offer this option. For a lot of online businesses, layaway is not an option offered that commonly. By offering a layaway option in addition to any buy now pay later or payment plan options, you can appeal to a different type of customer and get a competitive edge.

Boosts sales without credit risk

Unlike credit-based payment options, layaway doesn’t require credit checks or lending. This reduces the risk of bad debt and ensures that you can generate additional revenue without taking on the risk of non-payments.

Attracts budget-conscious shoppers

Layaway appeals to customers who prefer paying in smaller, manageable amounts rather than making large upfront payments. This option broadens your customer base by attracting those with a tighter budget.

Encourage responsible shopping

Layaway gives people the same cashflow benefits as buy now pay later or credit based options but encourages shoppers to shop responsibly without overextending themselves. Because customers haven’t yet received the product or service, cancelling is also easier for those where their cashflow situation changes with little to no downside for you as a business. This is a more responsible way to shop vs. BNPL which encourages more debt and credit.

Reduces inventory costs

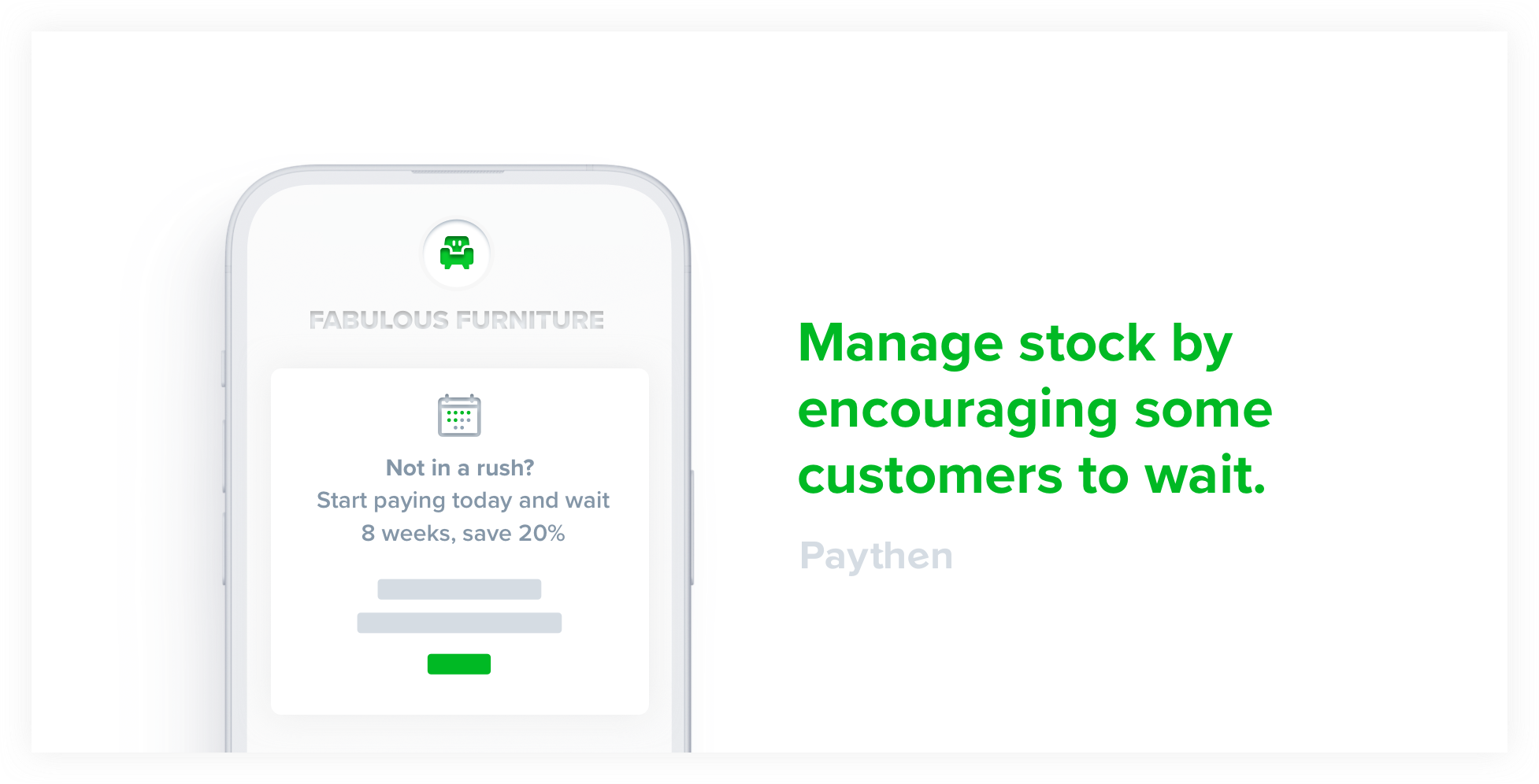

Layaway helps businesses manage inventory by encouraging customers to commit to purchases upfront, clearing stock more effectively and minimizing the risks associated with overstocking. With some layaway software (like Paythen), you can even offer a discount to encourage some customers to wait – this can be helpful for low or out of stock items or just to assess demand before ordering more stock.

Increases profit margins

When businesses use layaway strategically—such as by charging a small fee or requiring non-refundable deposits—they can enhance profit margins without adding significant costs, making it a win-win strategy. Layaway also lets you capture a broader market, which in itself helps boost margins.

Downsides of layaway (traditionally)

While layaway plans offer several advantages, there are also some drawbacks to consider, although many of these are mitigated when using modern layaway software like Paythen.

Administrative costs

Managing layaway payments, customer accounts, and tracking inventory typically required additional resources. A modern layaway tool like Paythen makes it easy and automated to offer and manage layaway plans.

Revenue delays

Layaway plans delay full payment and it can impact cash flow if too many customers use this option.

Risk of cancellations

If customers cancel their layaway plans or default on payments, businesses need to handle refunds, charging cancellation fees and then finding other customers to buy the same product or service. This is minimized if you are not holding inventory specifically for items on layaway.

Storage challenges for bulky items

Reserving items for layaway customers means storing products for extended periods, which can strain storage space and logistic if you sell bulky items.

Legal compliance

Some countries and jurisdictions have specific laws in relation to layaway plans. It’s important to understand and follow the laws applicable to you based on your business and customer locations. While the below is not legal advice and should be treated as general advice only, we have attempted to highlight the key legal requirements in some countries. Following these regardless of where you’re based should help ensure you’re following relevant laws and guidelines.

Legal considerations

Layaway programs work under different legal frameworks in various countries. While most countries don’t have specific laws governing layaway programs, here’s a breakdown of key legal considerations in the US, UK, and Australia:

Layaway legal requirements in the US

- The Federal Trade Commission Act (FTCA) prohibits deceptive or unfair business practices. For example, failing to disclose a cancellation fee for a layaway plan upfront would be considered deceptive and a violation of the FTCA.

- The Truth in Lending Act (TILA) may apply if your layaway plan includes a written agreement. This law requires businesses to clearly disclose the total cost, including fees, and provide transparent payment terms to customers.

State-specific and local laws can also affect layaway. For example, under California state rules, businesses must provide written agreements for layaway plans which must have the following:

- The amount of the upfront deposit

- A description of the goods

- The duration the store will hold the items

- The total price and any handling or processing fees

- Any other terms and conditions, including refunds if the item is not in the same condition as when it was first sold

Laws can vary by state, so verify the legal requirements in your specific location before offering layaway programs.

Layaway legal requirements in the UK

Layaway practices in the UK fall under general consumer protection laws. Two in particular affect this payment option the most.

- The Consumer Rights Act 2015 requires all goods, including those under layaway, to meet the following quality standards before being sold:

- The goods must serve the purpose they’re being sold for. For example, if a customer reserves a heater on layaway, it must function effectively to heat the space.

- The reserved item must match its description. For example, you can’t give a customer paying for a new smartphone a refurbished model unless clearly stated upfront.

- Goods must be in good condition and free from damage or defects.

- 0-30 days: A full refund is due if the item is unsatisfactory or defective.

- 30 days to six months: The business gets one chance to repair or replace the item before offering a refund.

- Six months or longer: The customer may request a repair or replacement before claiming a partial refund, provided they can prove the item was faulty.

- The Consumer Contracts (Information, Cancellation, and Additional Charges) Regulations 2013 mandates all businesses to provide certain information to be provided to customers before a sale. The specifics depend on whether the transaction takes place at a distance (e.g., online, over the phone) or in-store.

Transactions at a distance require the following details:- A description of the goods or services and the commitment required from the consumer, if applicable.

- The total price and payment details.

- The upfront payment amount and any details about payment frequency or minimum payments.

- The seller’s identity, contact details, and location.

- Information on additional costs, such as return shipping fees for cancellations.

- Details about who bears the cost of returns if the customer cancels.

- A standard cancellation form (optional, but encouraged for simplicity).

In-store transactions don’t need to be as detailed, but basic information about the items, price, and delivery costs still must be provided.

Failure to comply with these regulations can lead to extended cancellation rights, potentially lasting up to a year.

Layaway legal requirements in Australia

The Australian Consumer Law (ACL) have five following rules for layby transactions:

- Lay-by agreements must be in writing, and a copy must be provided to the customer.

- A customer can cancel their lay-by at any time, but they must pay a termination charge. This charge cannot exceed the loss the business incurs due to the cancellation.

- The business can cancel the lay-by agreement if it closes down if the customer breaches the terms of the agreement, or if the goods are no longer available.

- If the lay-by is canceled by either party, the customer is entitled to a full refund of the amount paid.

- If a customer cancels the agreement, the business can charge a reasonable fee to cover costs. This fee must be fair and not excessive. The fee can be deducted from the amounts already paid, or if the payments don’t cover the fee, the business can request the remaining balance from the customer.

It could lead to penalties and customer dissatisfaction if your business doesn’t follow these obligations.

Layaway best practices

An effective layaway program can build brand loyalty and increase revenue. These best practices can help you stay on top of your game.

Be transparent

Your layaway program should be explained clearly in simple language your customers can understand and agree to. This should clearly state your policies and any fees around refunds, cancellations, shipping times or any other relevant information. We recommend making this available as general terms in your site’s footer, but also clearly highlighting them in the layaway terms your customers agree to when signing up to the plan. Tools like Paythen make it easy to add custom terms in the checkout flow directly.

Start immediately

Launching your layaway program sooner rather than later allows more customers to hear about it, plan their purchases, and spread the word. The earlier you begin, the more time you have for word-of-mouth marketing, social media buzz, and media coverage. It also gives customers ample time to engage with your offer, especially during peak shopping seasons like the holidays.

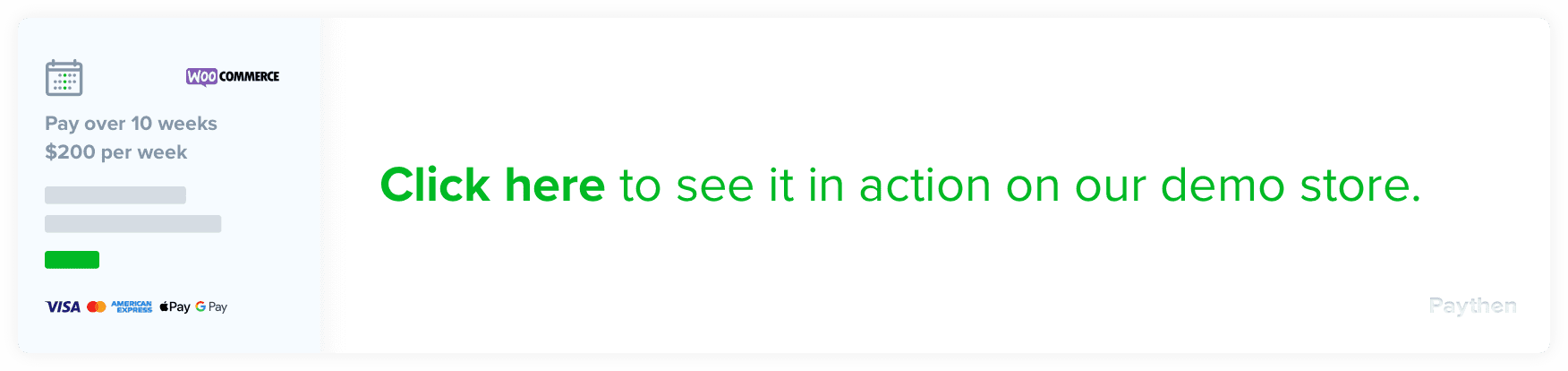

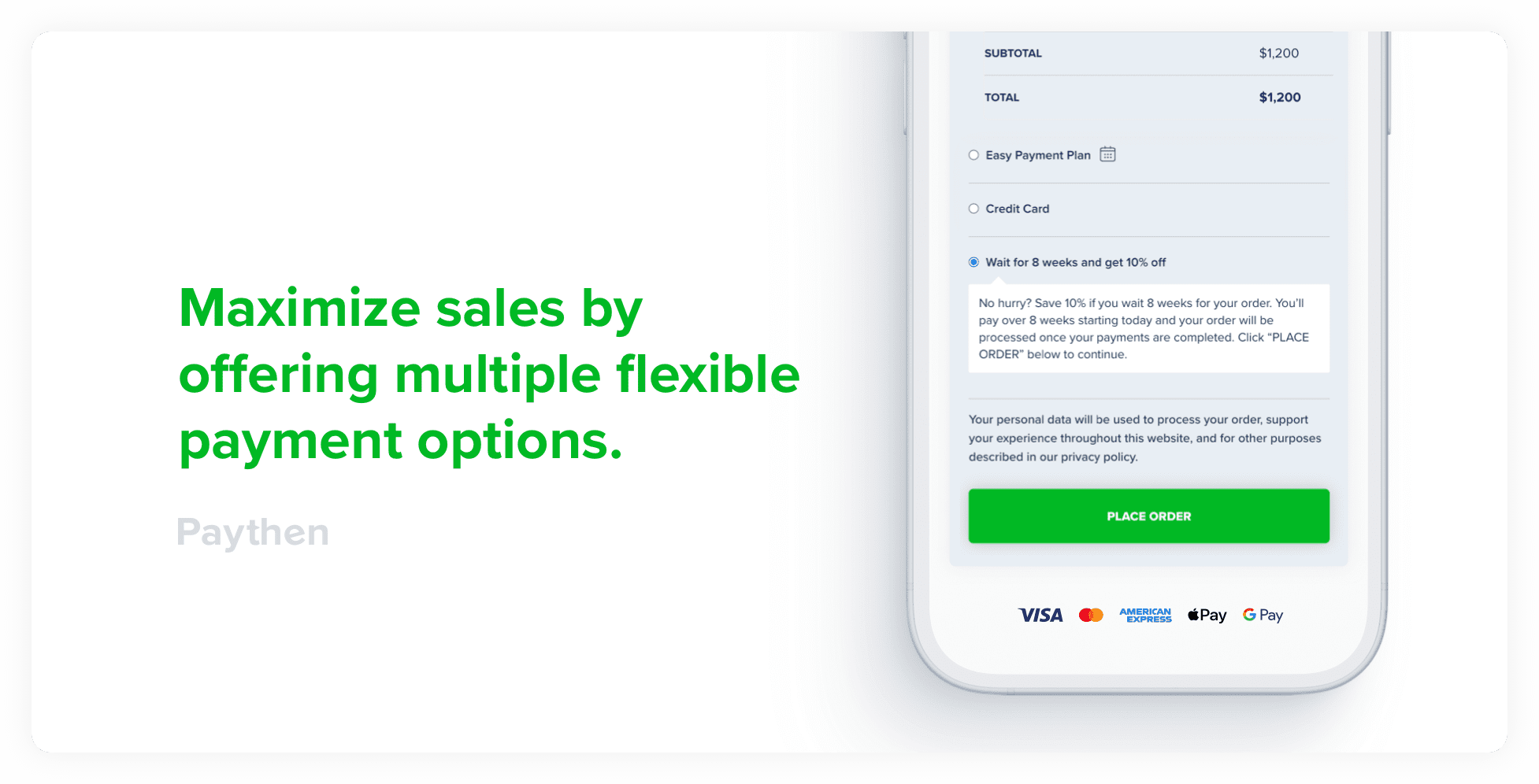

Offer flexible payment options

To appeal to a broader range of customers, provide flexible payment options that suit different financial situations. Let customers choose a payment schedule that works for them—whether it’s weekly, bi-weekly, or monthly. Offer layaway options in addition to payment plans or BNPL and support common wallets like Apple Pay and Google Pay. Most eCommerce platforms make this easy to do with a few clicks. For example, you can offer both flexible payment plans and an easy layaway option on WooCommerce using Paythen.

Tell your customers about it

The more visibility your layaway program gets, the better. Make sure to include details about your program across multiple channels. Highlight it in your email newsletters, website updates, and social media posts, especially on social platforms like Instagram and TikTok. Engaging content and promotions on these channels can significantly increase awareness and participation. We also recommend clearly highlighting and explaining it in your site’s home page and linking to more information in the site’s footer.

Run an online layaway program

Global eCommerce sales will account for $6.3 trillion in 2024, an 8.76% increase from last year. This trend shows no sign of stopping as shoppers are getting more and more comfortable with the flexibility to shop anytime and from anywhere. Bringing your layaway offering online means you’re capturing even more of your potential customer market and making purchasing even more convenient for them. And with risk-free tools like Paythen that make it easy, there’s really no reason not to try it out.

Should you offer layaway plans?

If you’re using modern software, layaway plans are extremely easy to set up and have mostly upside, making them a worthwhile option to try. They allow you to offer flexibility to customers while driving sales without complicated setups or high costs. Layaway plans are a great option for any business where it makes sense for customers to wait – eg: you sell high value items, made to order items, or a high value service.

To eliminate risk of non-payment but maximise reach and availability that BNPL options won’t have, you can offer layaway which gives customers all the cashflow benefits of BNPL without the credit checks, and for you it gets you paid upfront without having provided any product or service, improving your cashflow and typically increasing average order value too.

How to offer layaway plans

Traditionally businesses would set up and manage their own layaway programs and many large retailers still do. This approach makes it expensive and time consuming to offer layaway, not to mention a typically very clunky and inflexible interface for customers. However, with easy to use off the shelf tools like Paythen, businesses of any size can now offer flexible, branded layaway programs online or even in-store while delivering a world-class customer experience with no setup or fixed ongoing costs. Here’s why we think Paythen is an excellent choice for any business and the easy steps to getting started.

Why choose Paythen for your layaway program

Paythen is software that makes it easy to offer and automate a modern layaway program. You can offer layaway plans with direct links or easily integrate it into your ecommerce flow with our dedicated WooCommerce plugin or Shopify email-based flow. Paythen requires no upfront or fixed ongoing commitment, no credit card, and takes just a few minutes to set up with no technical know-how needed.

Sell more, without extra admin

Paythen is designed to give you maximum flexibility, and automates all the admin of running a layaway program – once a customer signs up to a plan, they are automatically sent reminders before each scheduled payment, given a unique link to manage their plan and view receipts, payments are charged automatically, failed payments are reattempted automatically and you and customers are always kept in the loop for any failed and overdue payments. For most customers on a layaway plan, you will have zero extra admin from sign up to completion.

You retain full control of your plans and your customers

Unlike BNPL companies that take over your customer relationships and branding, Paythen is designed to put your brand front and center while we just do the heavy lifting in the background.

We don’t make money if you don’t

We only charge fees when we help you sell more. This is deliberate to ensure Paythen gives you insane value and when we do, we charge a small percentage of that. There are no setup or ongoing fees – this ensures Paythen is always laser-focused on helping you sell more, with the least amount of admin.

Easily offer multiple flexible payment options

When offering your layaway plan using Paythen, you can easily combine it with payment plans (through Paythen or any other provider), offer other BNPL and other payment options. This makes it easy to have layaway available for those customers that want it, while appealing to other customers that prefer other payment options.

No lock-in

With Paythen, there is no lock-in and no annual contracts. If it’s not delivering the value you need, you can walk away any time with your data and your Stripe account. We don’t hold your data hostage.

Buy Now Pay Later (BNPL) vs Layaway comparison

As businesses look for ways to offer more flexible payment options, Buy Now, Pay Later (BNPL) options have gained popularity, often even replacing layaway entirely. This was mainly because retailers typically administered their own layaway programs and their systems and processes were often clunky and outdated.

Now though, many retailers are turning back to offering layaway in addition to any BNPL options. But the ones going back to layaway as well as many smaller retailers who never offered layaway are using off-the-shelf tools (like Paythen) which take away most of the admin work involved with traditional layaway while giving retailers full control and flexibility over their layaway plans, surcharges, customer relationships, refund policies and more.

In this comparison, we’ll break down the main features of buy now pay later offerings vs layaway to help you determine which method aligns better with your business. Many businesses find the best approach to maximize revenue is to offer layaway in addition to any BNPL services.

| Buy now pay later (BNPL) | Layaway (using a modern tool) | |

|---|---|---|

| Control | The BNPL provider controls approval, payment terms, and eligibility. | You have full control over what items go on layaway, payment terms, and fees. |

| Eligibility | BNPL is only available in specific industries, and your business must be approved to offer it. Moreover, there’s no guarantee that you’ll get approved. | There’s no limit on industries and you can set up layaway plans instantly, especially with platforms like Paythen. |

| Ease of setup | Requires integration with a BNPL provider, which can take a few days to a few weeks, eating up your time. | Simple to implement with the right tools—no third-party approval needed. |

| Fees | Most BNPL providers charge a hefty fee, usually 6%-12% per transaction, cutting into your profit margins. They typically also prohibit businesses from passing on fees to customers. | You pay lower fees and have the option to pass on the fee to customers. Most customers are happy to pay a fee for the convenience of being able to pay in installments. |

| Risk and non-payment | The BNPL provider takes on the financial risk of customer cancelling, and defaulting, not the business. | If a customer cancels, you may need to refund payments by law. However, you can sell that same product or service to someone else, and there’s usually a non-refundable upfront and/or cancellation fee so you can even end up with more total revenue even in cases where people cancel their layaway. |

| Cash flow | You get paid upfront (minus a hefty BNPL fee), even if the customer pays in instalments. | Cash flow is slower, as payments come in over time – but this can be preferable as cash flow is more predictable and smoothed out over weeks and months instead of big ups and downs. |

| Flexibility | Payment schedules and duration are fixed by the BNPL provider (typically weekly, bi-weekly, or monthly). | You decide how payments work—frequency, amount, surcharges, terms and everything else. |

| Refunds and cancellations | Returns follow the policies of the BNPL provider, limiting your control | You decide on the refund/cancellation policy. |

| Customer satisfaction | Despite its rising popularity, 57% of users regret using BNPL. Unexpected fees, high-interest penalties for missed payments, and debt accumulation can lead to dissatisfaction. | Customers feel more in control since they aren’t taking on debt or risking late fees. They can budget their payments without pressure, leading to higher satisfaction and trust in the business. You give them the benefits of installments without the guilt of debt / credit. |

While BNPL has become increasingly popular, Layaway programs offers a simple, low-risk option that benefits both your business and your customers. With layaway, you maintain full control over your terms and fees, and it provides a stress-free alternative for customers who prefer not to take on debt. Plus, since customers are paying upfront with no interest or late fees, customer satisfaction tends to be higher, leading to greater trust and loyalty.

If you’re looking for a way to offer flexible payment options without the hefty fees and risks associated with BNPL, layaway might just be the perfect solution to boost your sales and build long-term customer relationships.

Step-by-step guide to getting started with layaway using Paythen

Setting up a layaway plan with Paythen is quick and easy. Here are the steps:

Step 1: Create a free Paythen trial account or log in to your existing account.

Step 2a: If you want to send customers plan links directly (i.e. without an ecommerce site) click on the green + icon in the main menu and choose the “Wait for it payment plan” option from the list of available plan types

Step 2b: OR if you’re planning on offering layaway as an option in your ecommerce site checkout, instead of creating a plan above, click on the Templates link in the main menu, then create a new template and choose “Wait for it payment plan there”

Step 3: Now enter the relevant fields shown on the plan or template creation page and click “create plan” or “create template”

Step 4: If you’re using direct plan links, you will now be shown a link you can share with customers directly. They can pay via this link. If you’re using a template, then you’ll be shown the template link you can use with your eCommerce site.

Step 5: If you’re using WooCommerce, follow the instructions here or if you’re using Shopify, follow the instructions here. Or if you’re planning on using a third party form tool like Jotform, Gravity forms etc, then sending people to a payment page after that with varying totals for each person, follow the instructions here.

If you need help getting set up with any of the above, just reach out to us via the chat icon and we’d be happy to help you get up and running with your layaway program.