Sell more courses with Paythen

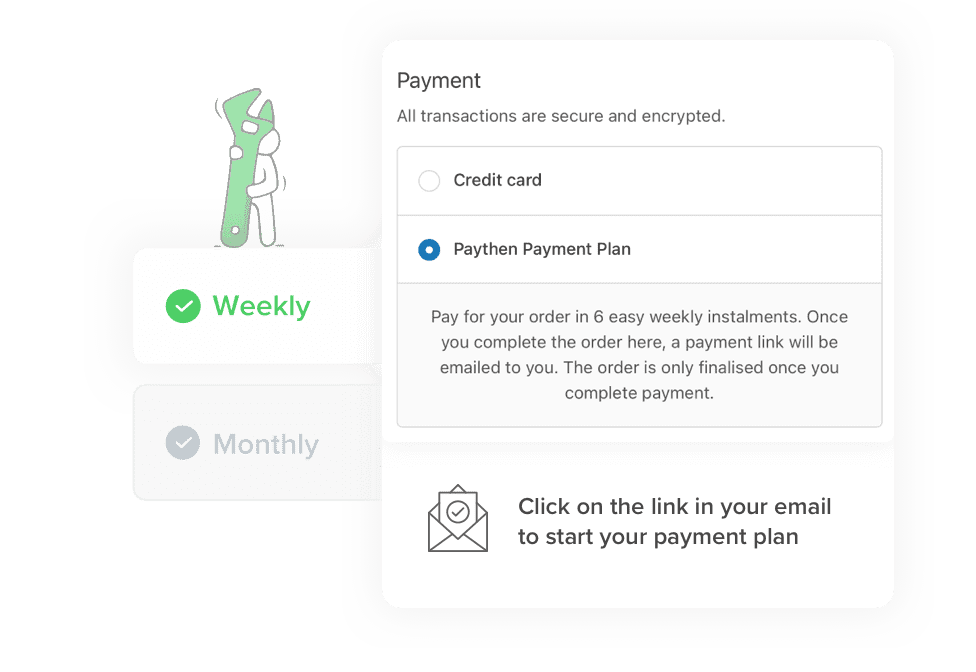

A Paythen payment plan like this turns course fees into small and easy payments— making your courses accessible and affordable for more people. Built-in smarts reduce busy-work and admin. No code or technical know-how needed.

Offer standard payment plans, date-based payment plans and even collect subscription or one-off payments using one easy system.

Payment plans make your courses accessible to more people. This helps increase sales, conversion rates and drive revenue.

Reduce admin and support time, with smart self-serve tools, automatic payment reminders, retries and more.

You set the rules.

Unlike BNPL providers, Paythen puts you in control of your payment plans. Choose the billing interval – 8 weeks, 8 months or anything else – even specific dates. Add surcharges, deposits and much more.

It’s your business – you’re in full control. Design your payment plan to suit your customers and your business model.

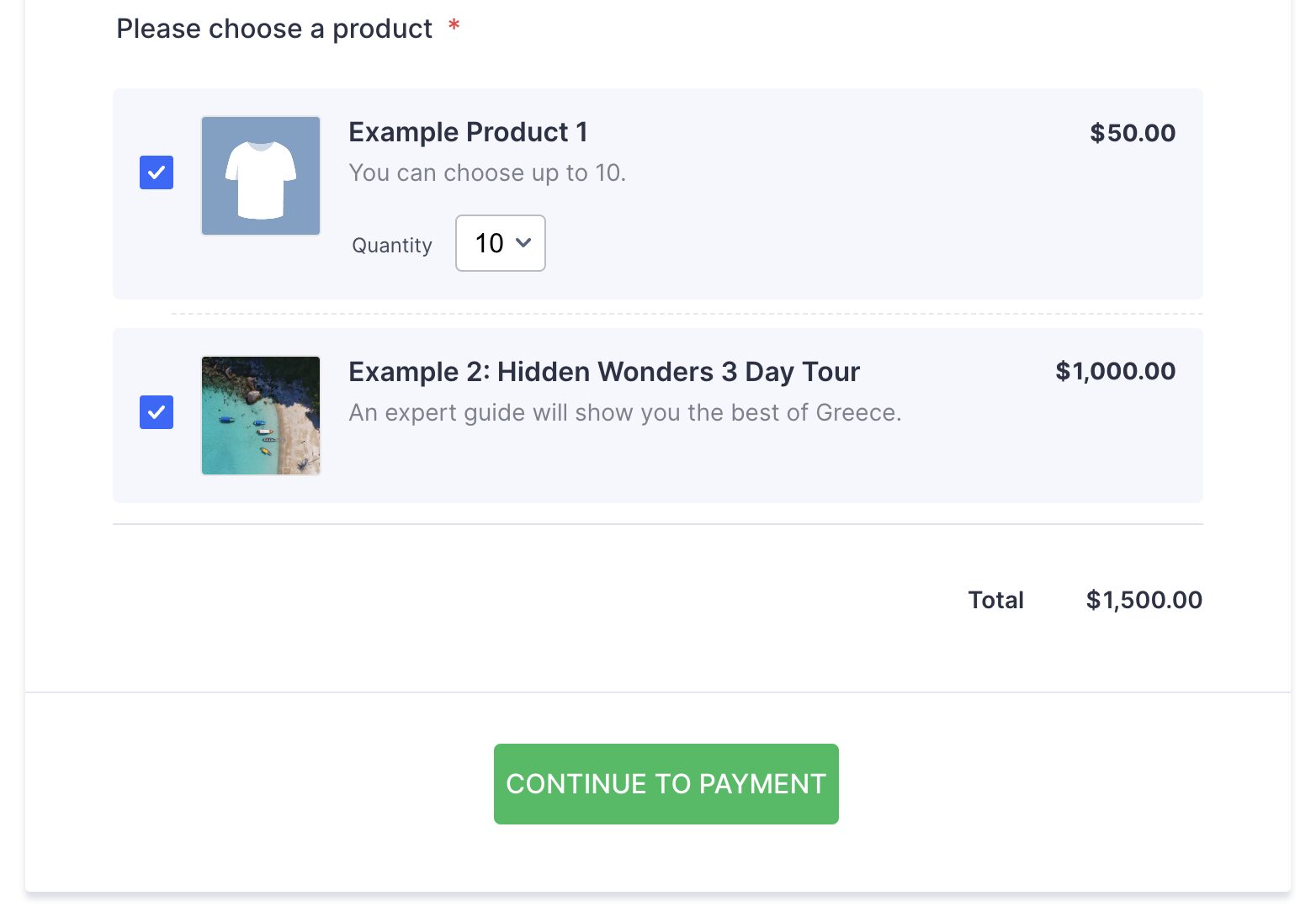

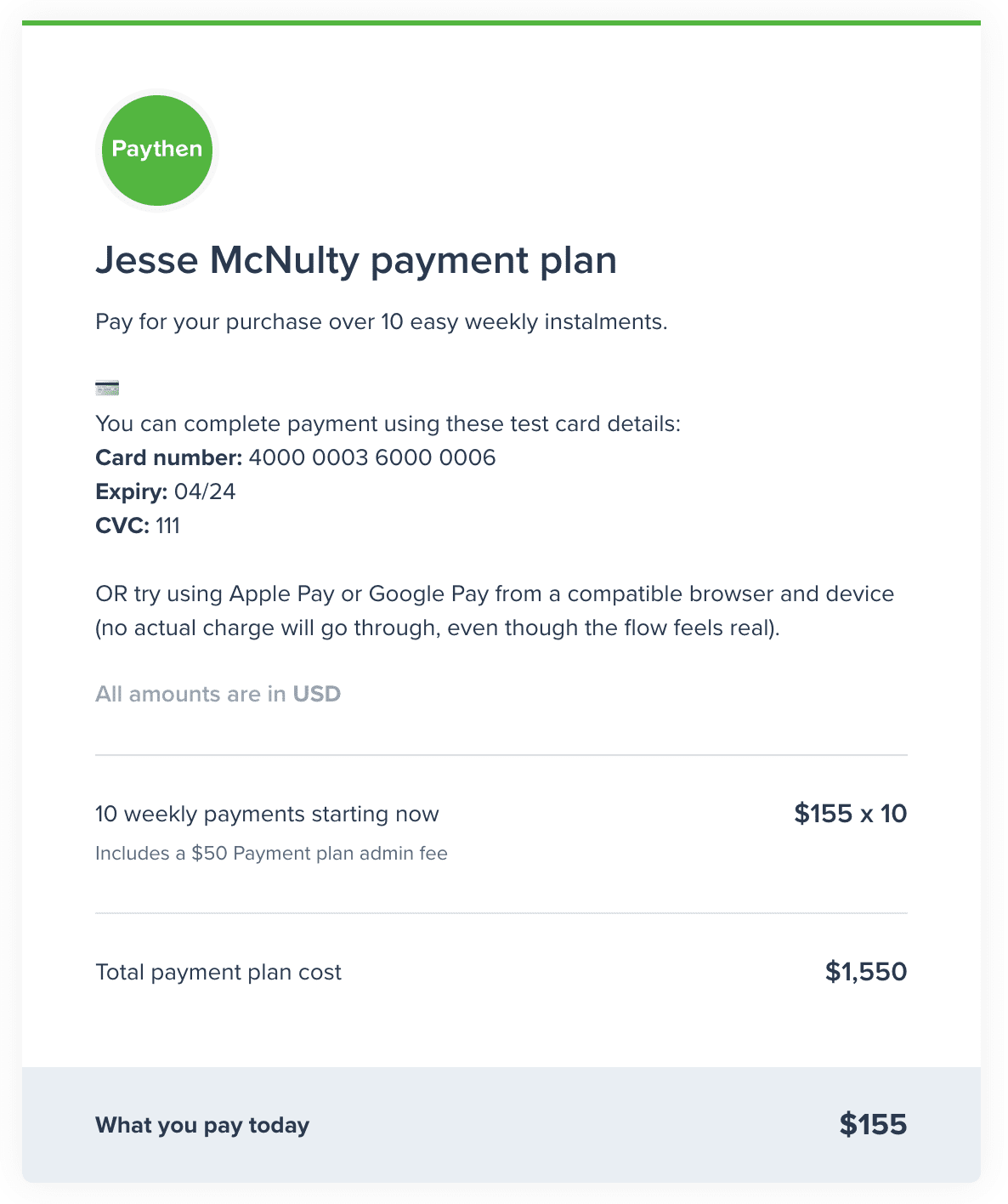

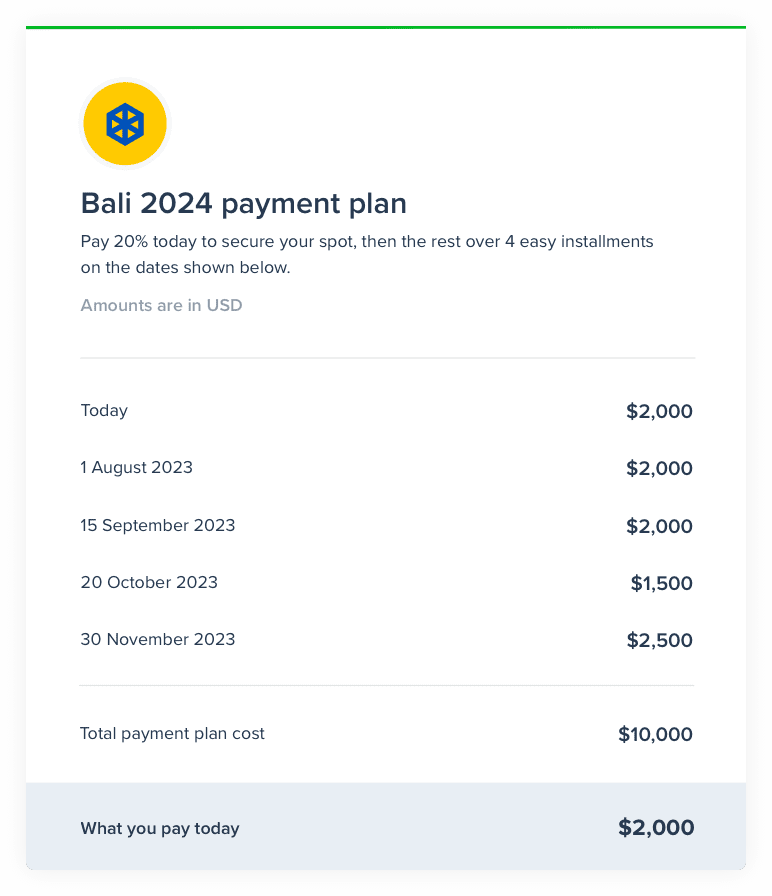

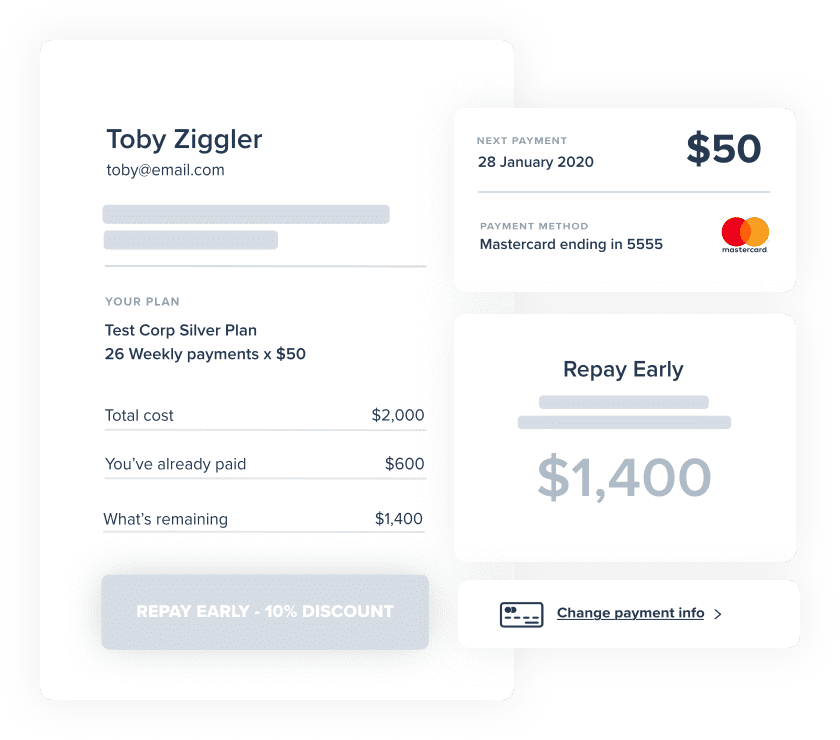

Here’s an example of a Paythen payment plan.

Align payment plans to key course dates.

Our unique date-based payment plans are perfect for worksops, cohort-based courses or just to align everyone’s payments to specific pre-set dates.

Whether you want all students to have paid x days before the start date, or collect payments based on key course milestones, you can do it easily with our date-based payment plans. Here’s an example.

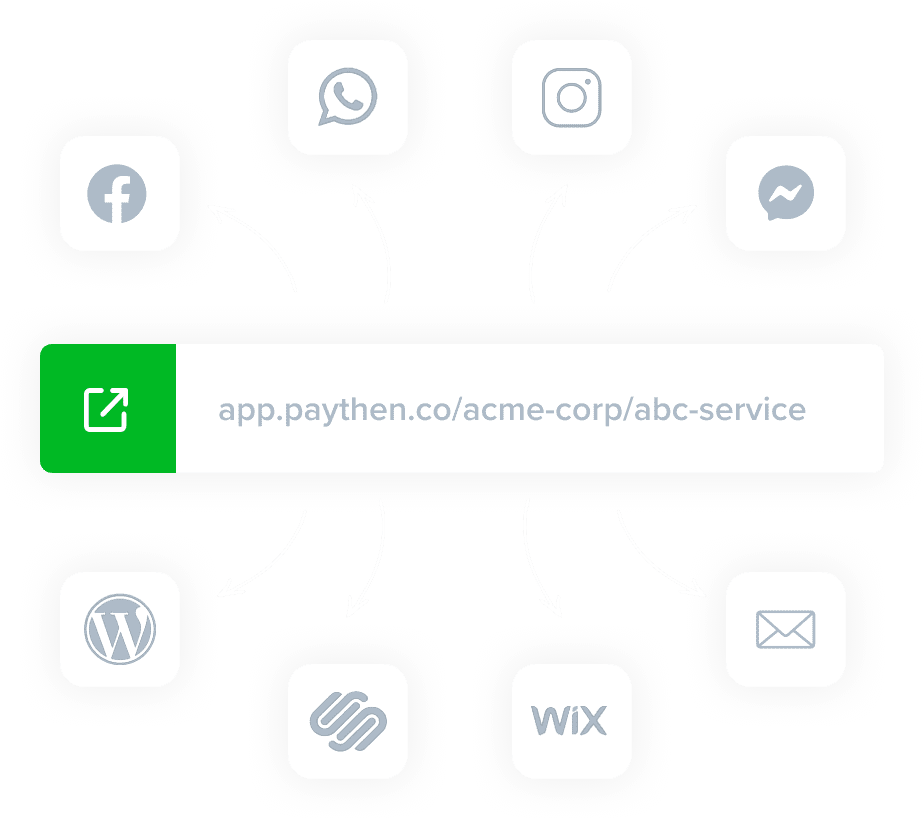

Get paid anywhere with easy payment links.

Each Paythen plan gets a payment link like this that works wherever your customers are – whether it’s email, Whatsapp or Insta. Or add it to your site in seconds.

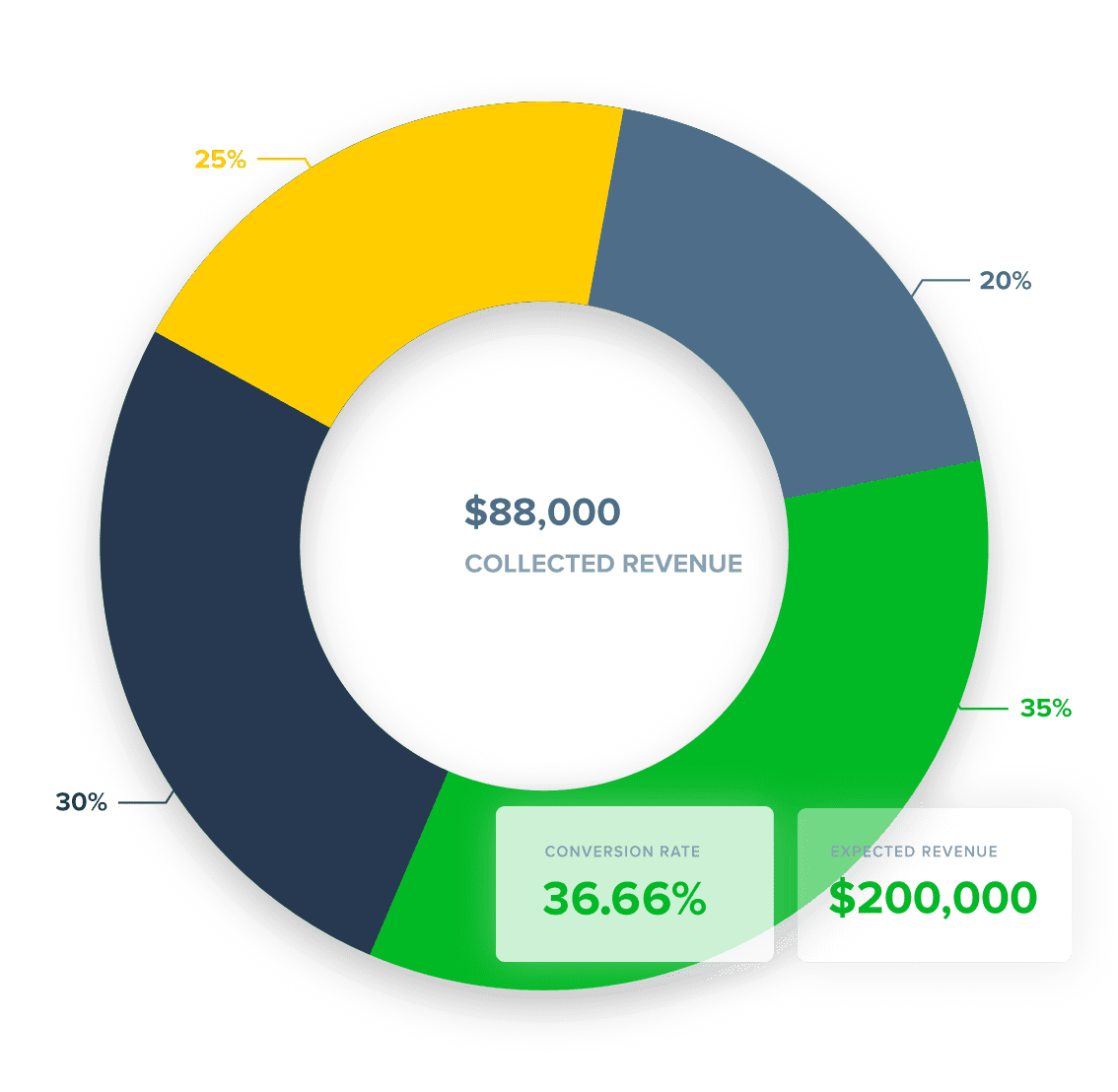

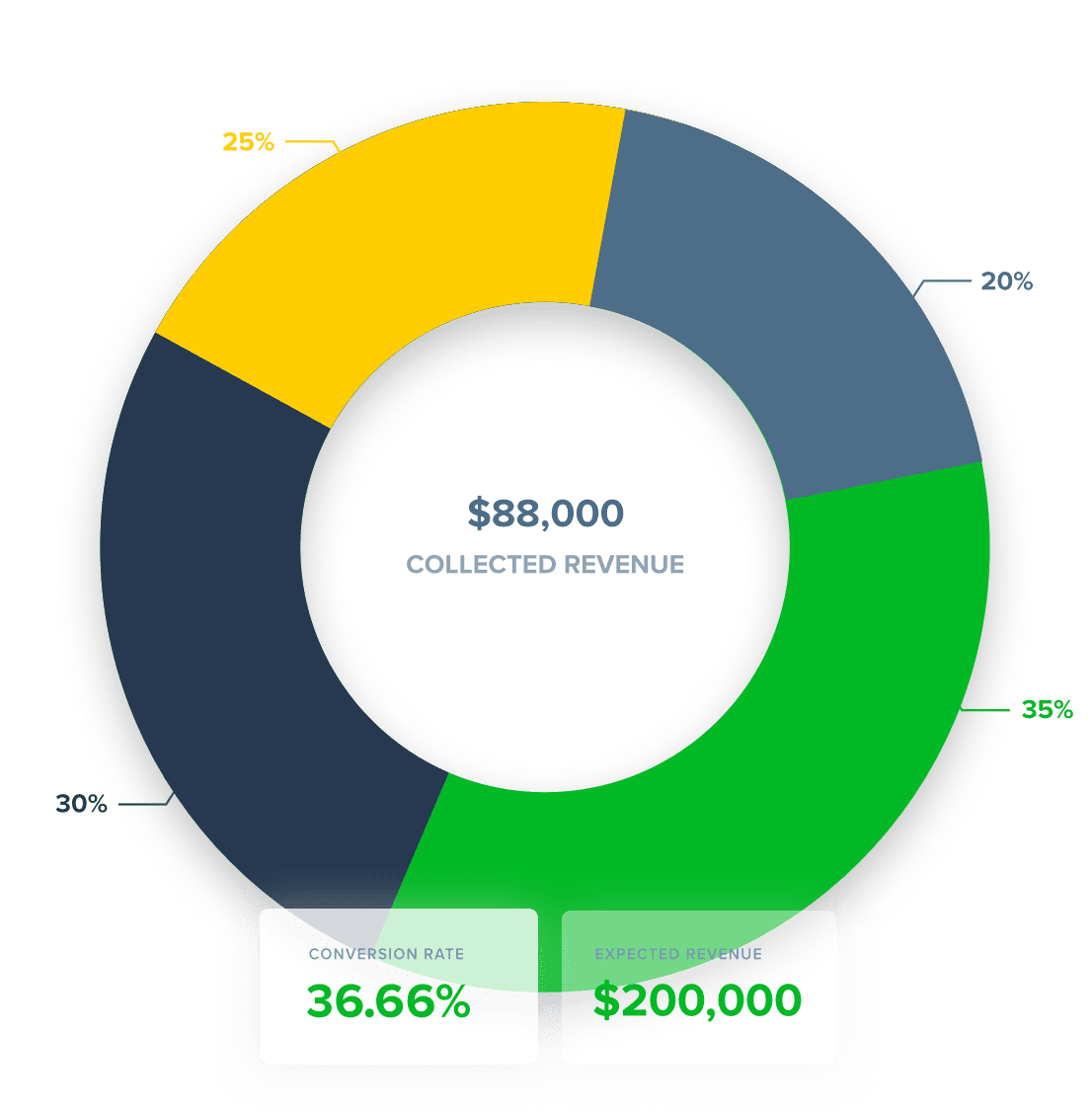

See useful insights without the fluff.

Instead of dozens of reports you’ll never use, we show you key insights right on your dashboard – for the business, for each plan and for each student. See your total booked revenue, what’s collected, how people choose to pay, and more.

Let your students help themselves 24 x 7.

With self-serve links like this one automatically generated for each participant when they sign up, they can see what they’ve paid, what they owe, repay early, change their card info, access receipts and more – via a secure link they can access whenever they want.

Paythen helps you reduce support and related admin costs while delighting your students 😍

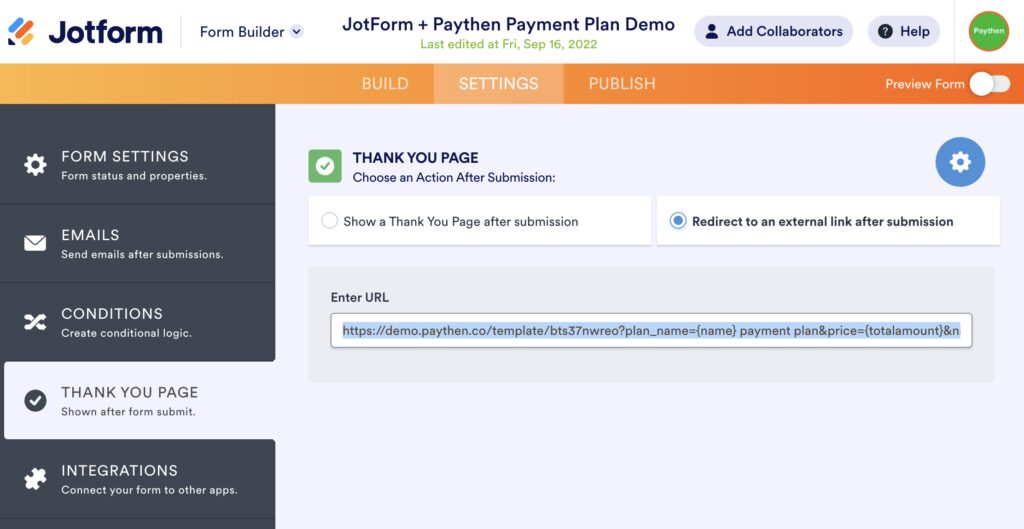

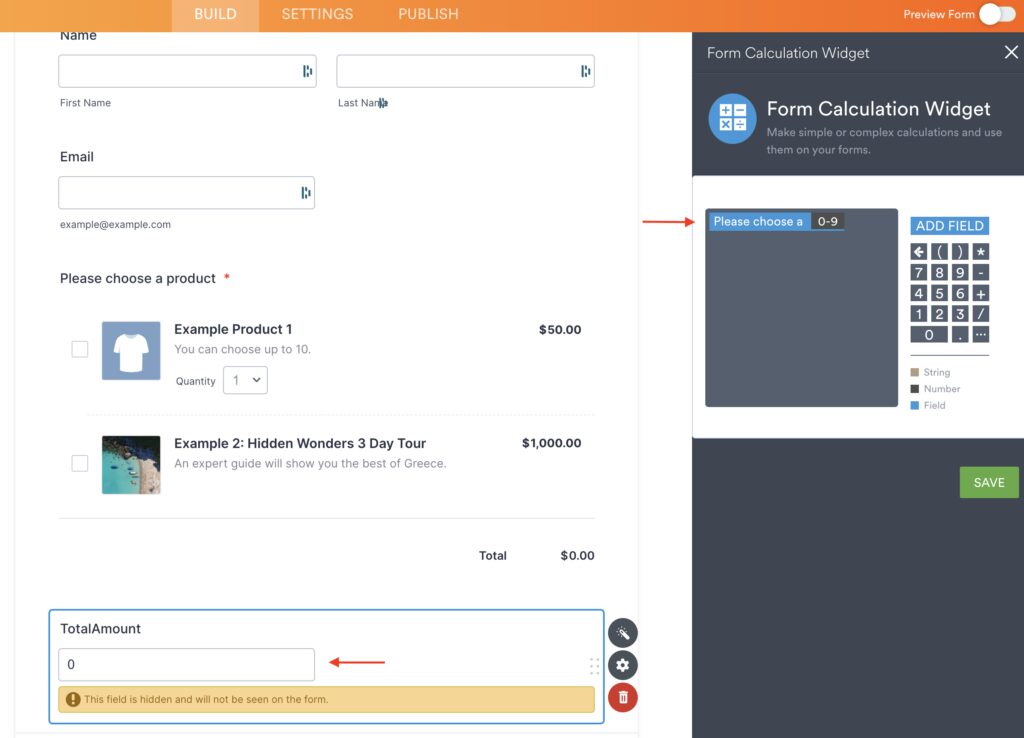

Easily send data to your LMS and other systems.

Automatically enrol students into courses, create profiles in your LMS or CRM, set up custom slack and email notifications, or send customized payment plan links to customers based on data and triggers from your existing systems with our Zapier app.

With over 7,000+ apps like Thinkific, Teachable, Gmail and more supported by Zapier, you can set up almost any workflow you can imagine. We’ve highlighted some popular ones here.

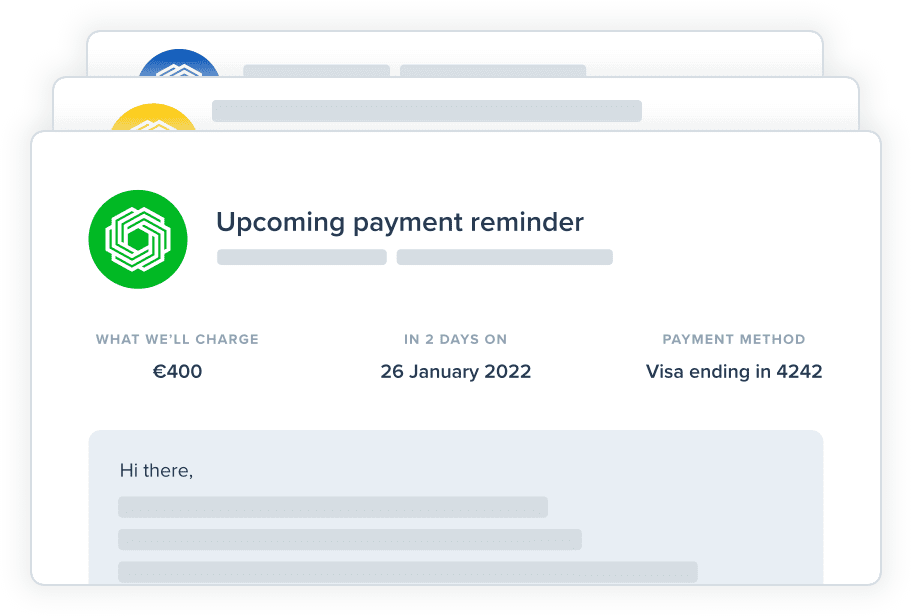

Reduce failed payments. Automate follow ups.

Students get reminders 2 days before each scheduled payment and automated follow-ups as well as retries if a payment fails. This reduces failed payments, chances of defaults, and eliminates manual follow-ups in most cases. Overdue statuses in your dashboard easily let you see who’s falling behind and if anyone needs manual intervention.

Let your best customers bring you new ones with branded e-gift cards.

Offer branded digital gift cards for your business in minutes that can be redeemed for any Paythen plan, on your WooCommerce site or even manually for in-person or phone redemptions.

Your customers can now become your ambassadors while giving their loved ones a meaningful gift for any ocassion.

Risk-free with no fixed fees

We believe in our product and are continually improving it to ensure the value we deliver to you is way more than what you pay in fees. This makes Paythen completely risk-free for you.

- Education course

Easy payment plans

Offer your customers a buy now, pay later option set by you, to increase conversions and sales.

No-code, no-fuss setup

Once you connect your Stripe account, it takes under a minute to get started using Paythen.

Flexible plan types

Offer payment plans, pay your way plans where customers can choose, subscriptions or one-off payments.

Easy payment links

An easy to share payment link that works on any website and any device – matching your brand.

Flexible discount codes

Offer seasonal discounts & promotions with flexible discount codes that work on all plan types.

Integrate with other apps

Send Paythen data to over 7,000+ other apps with our Zapier integration.

Automated reminders & emails

We automatically send handy reminders before payments & follow-ups if a payment fails.

Encourage early repayments

Offer customers on a payment plan an easy way to repay early at any time – increasing your cashflow.

Payment plans or subscriptions

End charges after a set number of payments or continue indefinitely. Choose what works for you

Change payment info easily

Your customers can change their card info anytime they want, with zero time spent by your team.

Customer summaries

Your customers want to know what they’ve paid, and how much they owe. Now they can.

Payment receipts

Reduce support time spent sending customers copies of their receipts. All receipts available to them 24 x 7.

Get powerful, simple insights

Useful, easy to understand reports at the company, product and customer level.

Custom branding

Easily change the colors and logos shown on customer facing pages and some emails.

Flexible billing intervals & more

Choose any billing interval you can think of, add a setup fee, trial period and lots more for each product.

We get paid when you do

With our simple, low 1.4% fee, we only get paid when you do. No fixed or hidden fees. No fees during your free trial either.

Many payment methods

Let your customers pay with Visa, Mastercard, Amex, Apple Pay, Google Pay, plus region-specific cards like Discover & UnionPay.

We’re getting better every day

With regular updates based on your feedback, Paythen constantly gets better and more useful for you and your customers.

Try it free for 7 days.

No credit card required, ever.

We’ll ask you to connect your Stripe account or create a new one once you sign up. Paythen works with Stripe.