Sell more tickets to your

Choose from two approaches

There are two different ways to offer payment plans on your Eventbrite page – with separate ticket types or by using the offline “pay by invoice” payment method. Each one has pros and cons and detailed setup instructions outlined here. Here are demo events of each approach so you can see them in action.

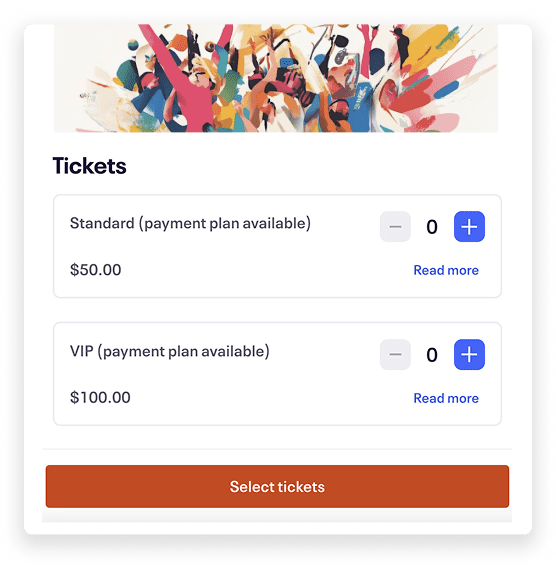

Approach 1: Separate ticket types

Approach 2: Same ticket types

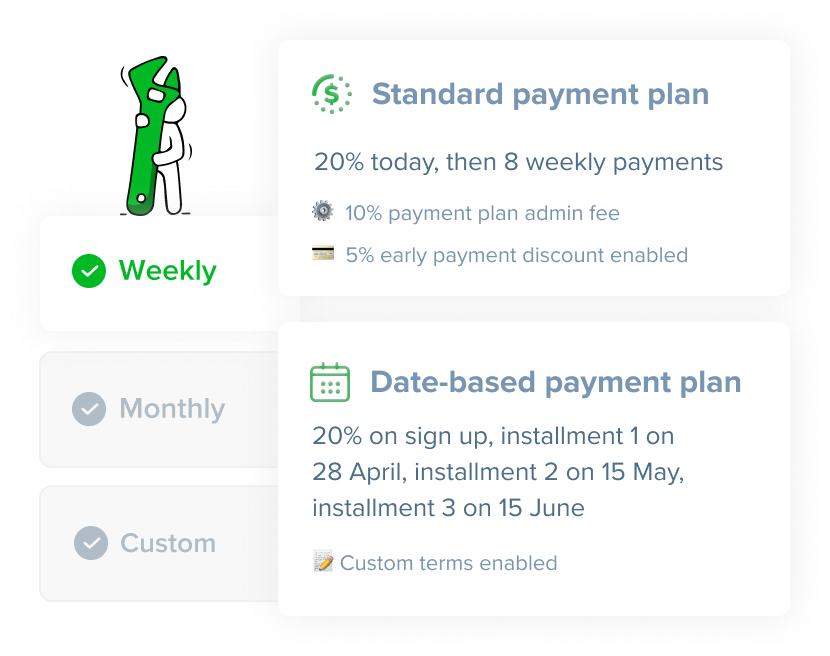

Payment plans your way

Or align everyone’s installments to pre-set dates with our date-based plans. It’s your business – you’re in full control.

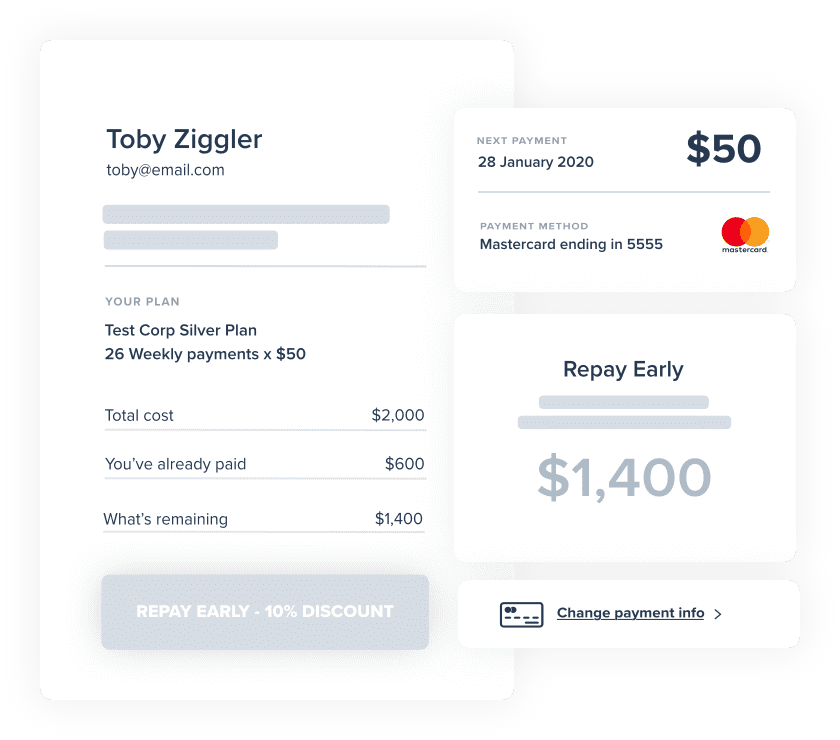

Attendees can help themselves 24 x 7

Deliver an exceptional experience without extra admin.

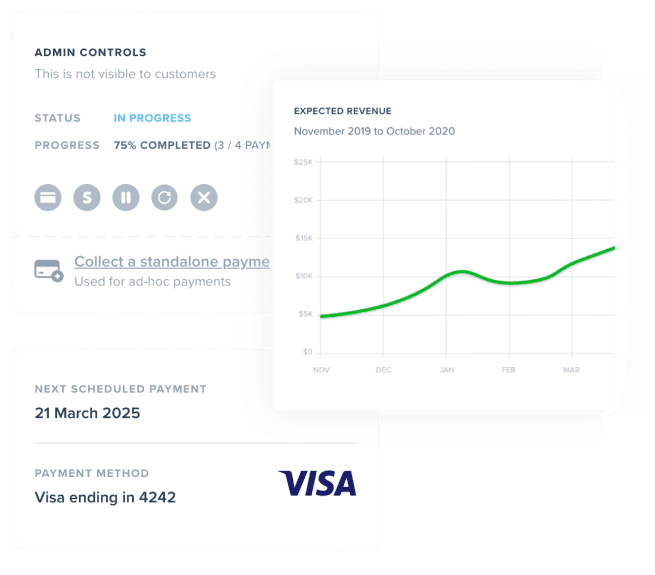

More sales, not admin with automatic everything

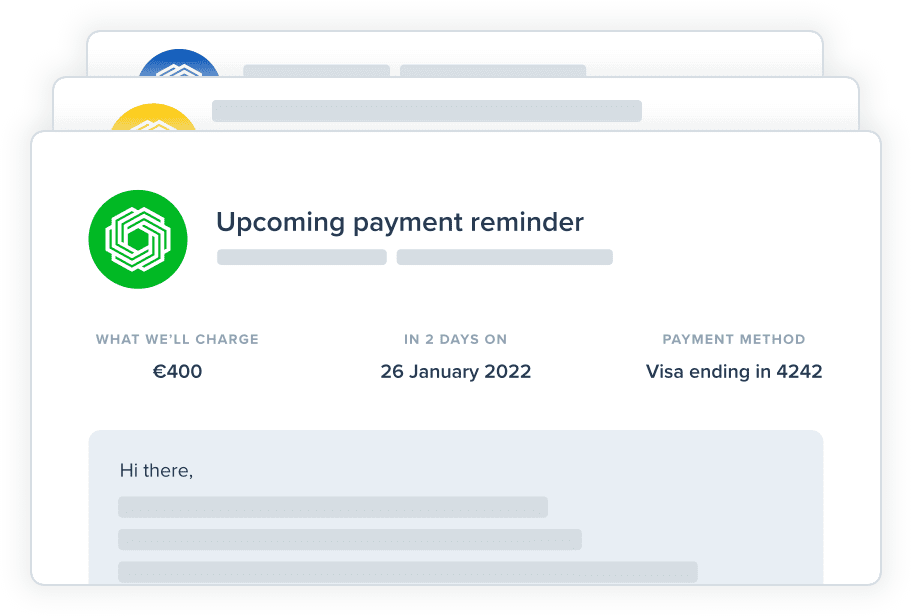

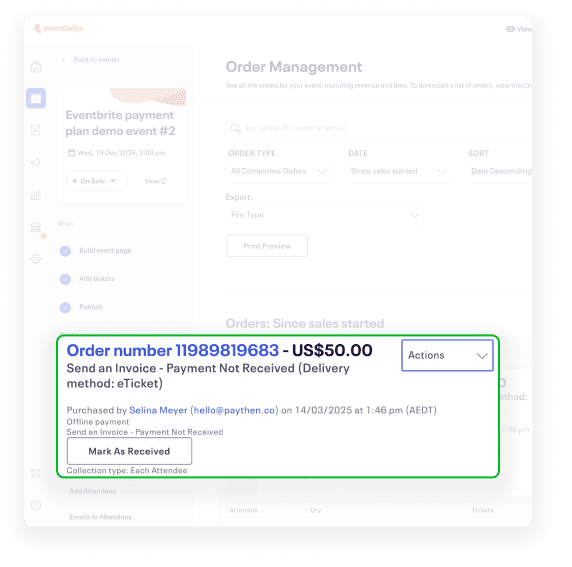

You’re always in the loop for any failed payments via email notifications and easy to spot overdue statuses in the dashboard.

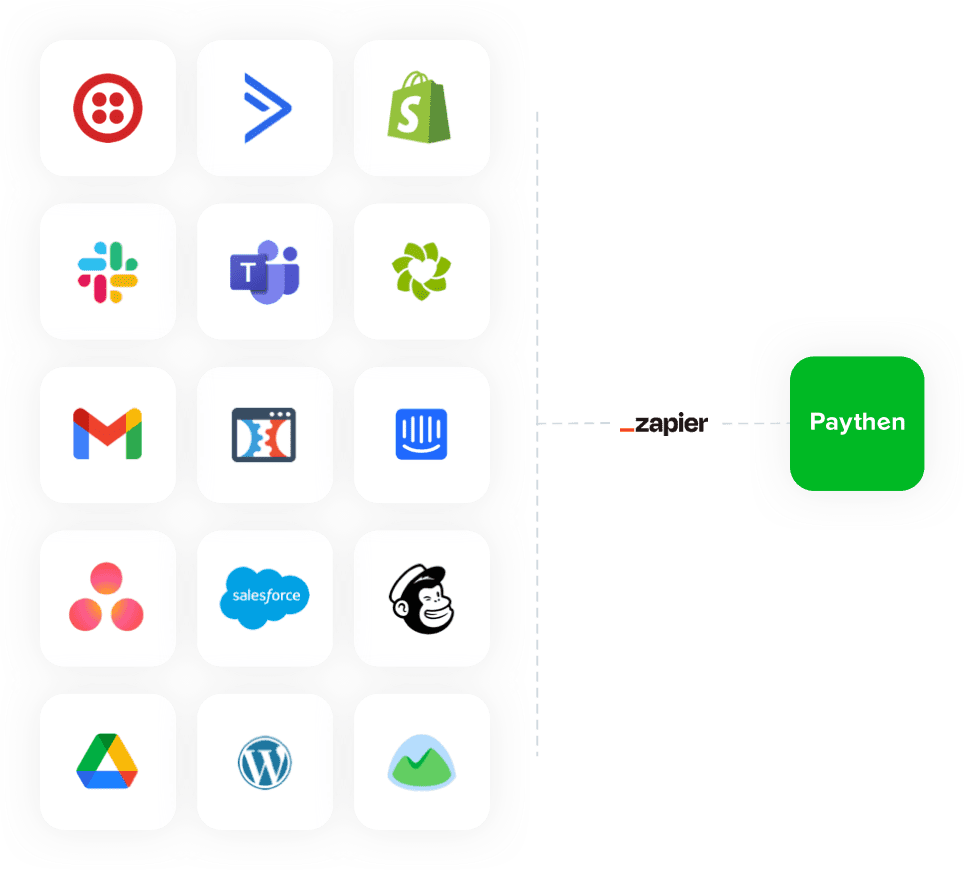

Works with your workflow

Integrate with almost any tools you use including Slack, Gmail, Salesforce, Google Sheets & more.

An intuitive admin dashboard

You can even create direct shareable payment links for custom orders or tailored payment plans, create coupon codes, collect one-time payments and more.

No risk, just upside

This means you’re not paying for something that doesn’t help you sell more. We only make money when you do.

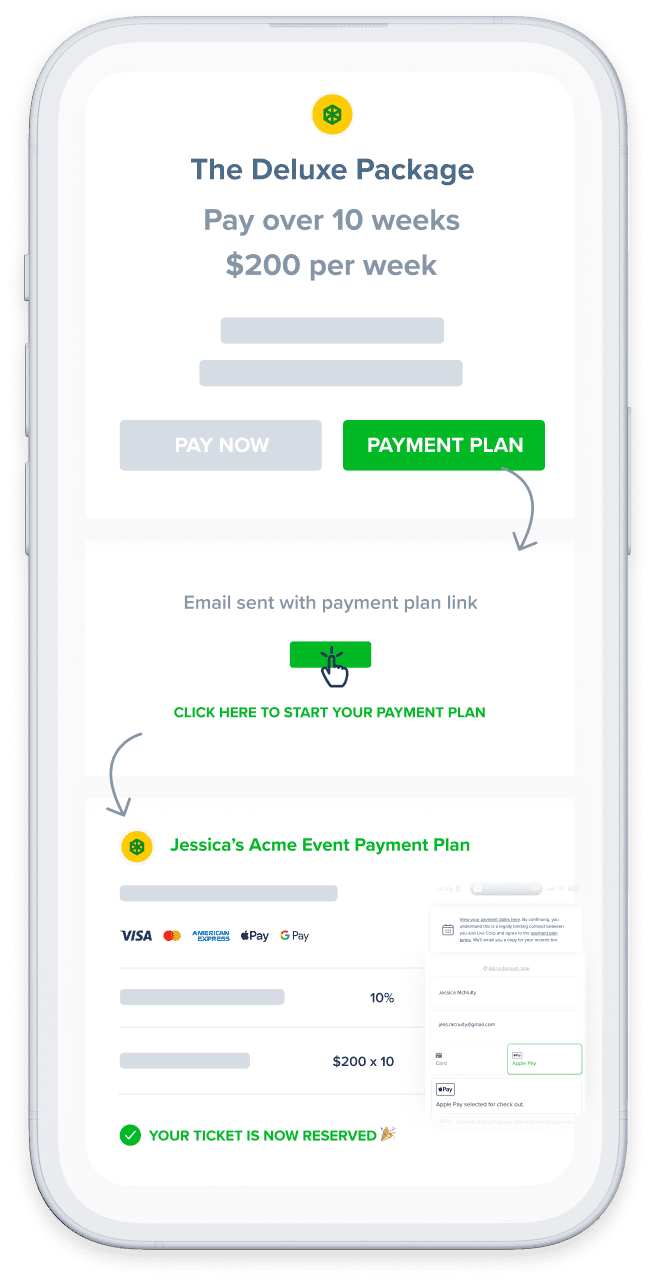

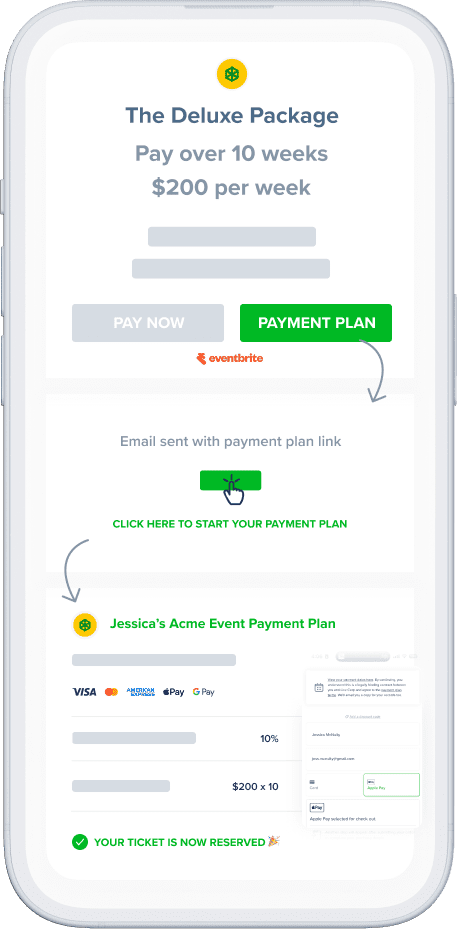

How does it work?

Because of limitations imposed by Eventbrite on third party payment apps, we are unable to offer a direct integration that shows a payment plan option inside the Eventbrite checkout. However, with less than 15 minutes of setup time and a Zapier account, you can easily offer payment plans on your Eventbrite event and deliver a seamless experience for your customers. See step-by-step instructions to set up this workflow for your own event. We’re here to help if you need it.

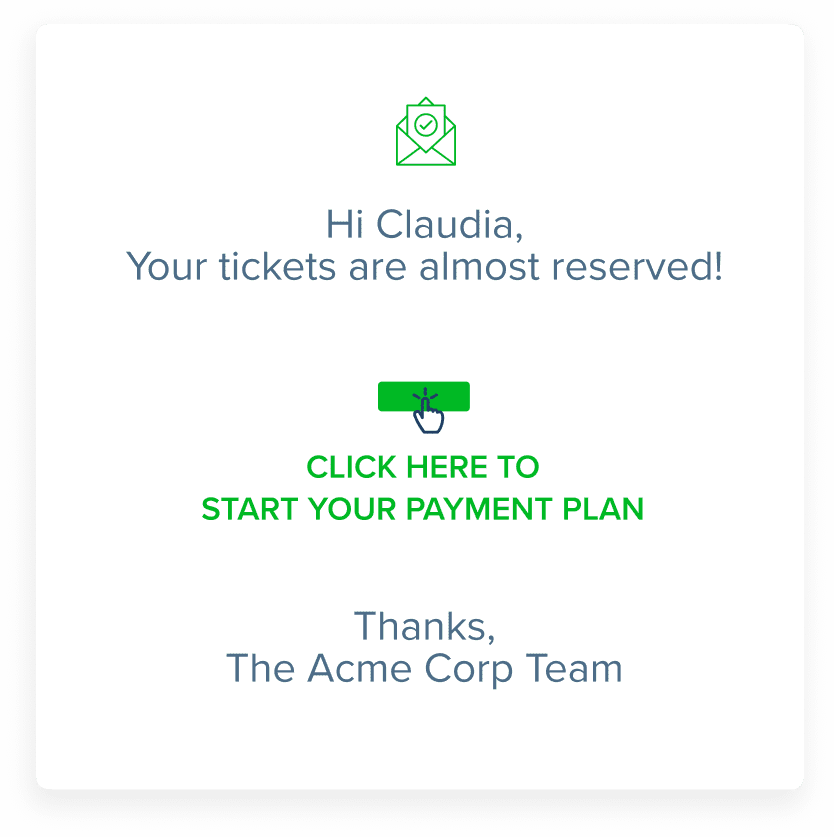

Attendees get an email with their custom payment plan link that lets them pay and start their payment plan. This is sent using the Paythen Zapier app.

⚡ Set it up now for your event with our step-by-step instructions. Takes about 11 minutes. Reach out via the chat icon if you need a hand 🙋♀️

- Eventbrite