FAQs

We answer questions below about Paythen, split billing and more. Can’t find what you’re looking for? Ask us via live chat or email – hello@paythen.co.

- All

- 1. What is Paythen?

Paythen is a no-code billing and payment system that works with Stripe (for payment processing) and lets businesses offer payment plans and split payments in under a minute. Create highly flexible plans and let customers pay for your product or service via a payment plan or upfront. Once you create a plan, we generate an easy payment link you can add on your site or share with your customers via email or social. It's beautifully simple, but very powerful with features designed to improve your customer experience, while reducing admin, and giving you powerful insights.

Paythen requires Stripe to work. Once you sign up, we'll ask you to connect your Stripe account.

- 2. Is Paythen available in my country?

Paythen is available anywhere Stripe is. If you can sign up for a Stripe account, you can use Paythen. Stripe is currently available to businesses based in over 40 countries (please see notes below for 'preview' countries), and almost anyone anywhere through Stripe Atlas. These are the countries supported by Stripe (and Paythen) at the moment:

You can accept payments in most currencies Stripe supports (over 130) – at the moment you can't accept zero decimal currencies with Paythen. There are some exceptions and limitations based on your account's currency. View the full list and more info here.

Are you in a country where Stripe is in preview?

Countries that show "Preview" above might have limited functionality as Stripe is just getting started there.You can read more about each supported country, including Stripe fees and sign up for a Stripe account here. Different preview countries might have different limitations.For some countries, because of legal and Stripe restrictions, Paythen fees cannot be automatically deducted from each transaction like they usually are. In these cases, you can still use Paythen as normal – but your billing will be done monthly at the end of each month via a credit or debit card.

For some preview countries (like Indonesia and the Philippines), Paythen might only work if you have set up a Stripe account using Stripe Atlas but not if your account is based in your home country and currency. This is because of legal limitations in these countries that don't allow external platforms based in other countries to connect to locally-based accounts.

Is your Stripe account based in Japan?

Japan based accounts can use and accept payments with Paythen in all other currencies except JPY at the moment. Paythen does not support zero decimal currencies at the moment but we expect to add support in the future.Is your Stripe account based in India?

Accounts based in India can currently only accept payments in INR using Paythen – we will be adding support to accept other currencies too, but at the moment, only INR payments can be accepted. If you're using Stripe Atlas with a USD account, then this does not apply.Is your Stripe account based in Indonesia or the Philippines?

Unfortunately at the moment, due to legal and/or Stripe limitations, Stripe accounts based in Indonesia or the Philippines cannot connect to platforms like Paythen that are based in other countries, like Paythen is. We hope to support both countries in the future if and when this changes. You can use Paythen if you have a US based Stripe account created via Stripe Atlas though.If Stripe is not available in your country, we recommend looking into Stripe Atlas. It's a great way to form a US company remotely and get all the benefits that come with it.

- 3. Does Paythen work with other payment processors?

No. Paythen is designed to work with Stripe. This is because Stripe is the leader in terms of the features, flexibility, security, ease of use, global availability, and more when it comes to payment processors. We believe it is the best payment processor available for most businesses in the countries it is available. Building Paythen to work with Stripe means we can offer you advanced features that would be impossible with most other payment processors. We have no short-term plans of integrating with other payment processors but will re-evaluate this position as needed.

- 4. Do I get paid the full amount upfront as a merchant?

No, Paythen is not a credit service. You get paid as your customers pay their payment plan. Paythen is software that makes it easy and mostly automated for you to offer easy installments to your customers but Paythen does not provide loans or credit to customers. When you use Paythen, you are offering payment plans to your customers – Paythen makes it painless to do so.

- 5. Is Paythen a buy now, pay later service? How is it different?

No. Paythen is not a buy now pay later credit service like AfterPay. We use AfterPay as an example below, but the points below apply to most buy now, pay later services like Klarna, Affirm and many others.

Once you create a plan in Paythen, your customers get to choose to pay the full amount immediately or via a payment plan that you've defined. Both options require your customers to use their credit or debit card to pay. This means 100% of your customers can choose a payment plan option instead of only those that get approved for credit.

- AfterPay is a credit service. With Paythen, your customers can get get a payment plan, but they can use their existing credit or debit card to do so.

- AfterPay is like a mini-loan, with Paythen, there is no credit provided – this is not only more responsible, but also more flexible and better. Your customers get to choose how they want to pay, and which payment method they want to use, while you pay lower fees and deliver a better customer experience.

- AfterPay has a fixed 8 week repayment period. This is rigid, and can still be very high for high value items. With Paythen, you can set the payment plan interval to whatever you want – weekly, monthly, fortnightly, or any other custom interval – and you also choose how long it goes for.

- AfterPay takes away your direct relationship with your customer – and build their brand, instead of yours. With Paythen, there is little to no Paythen branding involved – we just give you the mechanism to offer split payments, while giving you the reporting and flexibility you need.

- AfterPay takes away a big chunk of your profit margin with each transaction. With Paythen, you get to decide – you pay a low 2% per transaction with no monthly or other fees. You do pay the payment processing fee to Stripe, which is the payment processor.

- Paythen is a complete billing and payment system that gives you ease of use, reporting and insights and important features for your customers whereas AfterPay and others are just credit providers.

- Paythen is built on top of Stripe – the world's most popular (and in our opinion, the best) online payment processor. This means from day one, you can accept payments in hundreds of currencies.

We go into more depth on the comparison as well as the pros and cons of BNPL vs Paythen in this article.

- 6. What support do we get?

We offer personalized support via email, chat and self-service to all our customers. Most support enquiries are answered and resolved within an hour. We're happy to help with almost anything related to getting you set up, whether it's within Paythen or on your site/store. Just ask.

- 7. Does Paythen work with WooCommerce?

Yes it does. The Paythen WooCommerce plugin is now available for all Paythen users. Read more about our WooCommerce functionality here. If you're interested in using the WooCommerce plugin, just create your free Paythen account, switch ON the WooCommerce integration, and install our WordPress plugin. Here's a step by step guide.

The current version of the Paythen WooCommerce plugin will let you offer a Payment Plan option on the checkout page. You will have defined some parameters of the payment plan beforehand. Here's an overview:

- You install our WooCommerce plugin and configure a few options

- On the checkout page, your customers will see a new payment plan option

- They will place the order and be taken to the Paythen plan page to complete payment. Your WooCommerce order status will be "On-hold" while they complete payment.

- Once they have successfully signed up to the payment plan, they'll be brought back to the WooCommerce order confirmation page and the order status will change to "Processing".

- Customers will get an email from Paythen with their payment plan details and dates, in addition to any emails you have configured in WooCommerce

- You can see their payment plan and information in the Paythen dashboard

- Your customers will be automatically charged for each future payment

Start your 7 day free Paythen trial to see if it's right for you.

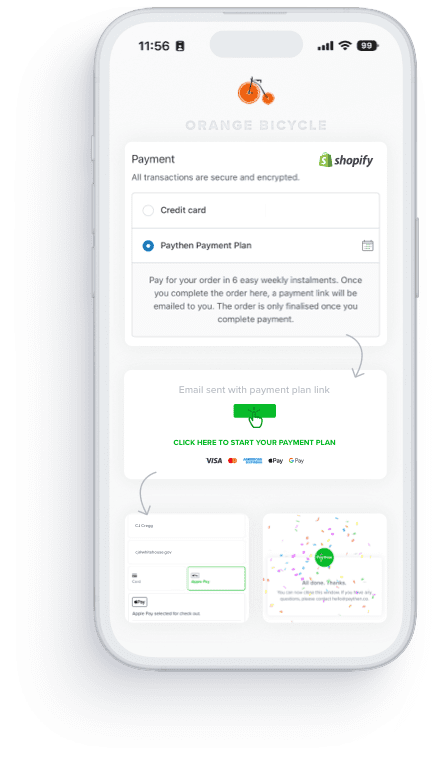

- 8. Does Paythen work with Shopify?

Yes, but with an email based workflow. There is no Paythen app for Shopify because of limitations imposed by Shopify. Your customers will get an email with a link to start their payment plan after completing the checkout on your Shopify store. Read more here and check out our Shopify demo store.

- 9. Does Paythen work without Stripe?

No. Paythen works with Stripe to process payments. Once you sign up, we will ask you to connect your existing Stripe account or create a new one.

- 10. Is there a free plan?

No. There is a free 7 day trial though, with no limitations and no credit card needed. During your trial, you pay no Paythen fees either. To continue to offer a quality, secure product, free plans aren’t sustainable.

- 11. Are there any other fees?

With Paythen, there are no fees during your trial, and after that, a low 2% fee per transaction you process through Paythen. Keep more of your revenue where it belongs – in your pocket. As with all billing systems, this is separate to Stripe’s fees.

- 12. I use Stripe already. Why should I use Paythen?

Paythen is built on top of Stripe to take advantage of the built in features, and world-leading payment processing Stripe already offers. Paythen builds on top of that to offer powerful features specifically for businesses that offer or are planning to offer payment plans to their customers. Paythen makes the creation, sharing and reporting on payment plans super easy.

- Connect your Stripe account

- Create your plan in seconds

- Share the easy payment link with your customers or add it to your site

- Your customers can choose between upfront payment and payment plan options at the time of purchase - this makes them more likely to complete the transaction

- Get powerful insights and reports

Your customers can also manage their own payment plans, change their payment info, view past receipts, see how much they've paid vs. owing, and even repay early anytime. Start with a free 7 day trial to see if Paythen works for your business. Your customers will love it. We hope you do too.

- 13. Can I offer Eventbrite payment plans with Paythen?

Yes you can. Offering payment plans on Eventbrite is possible with Paythen using Zapier. This requires about 10 minutes of setup for which we've provided step-by-step instructions below. You can continue reading this setup guide or if you'd like some general information on how Paythen works with Eventbrite, you can go here instead.

You can offer payment plans for your event using two different approaches outlined below. Both use an email based workflow – buyers will choose their ticket and quantity and complete the checkout process on Eventbrite and they will get an email with their customized payment plan link based on their total.

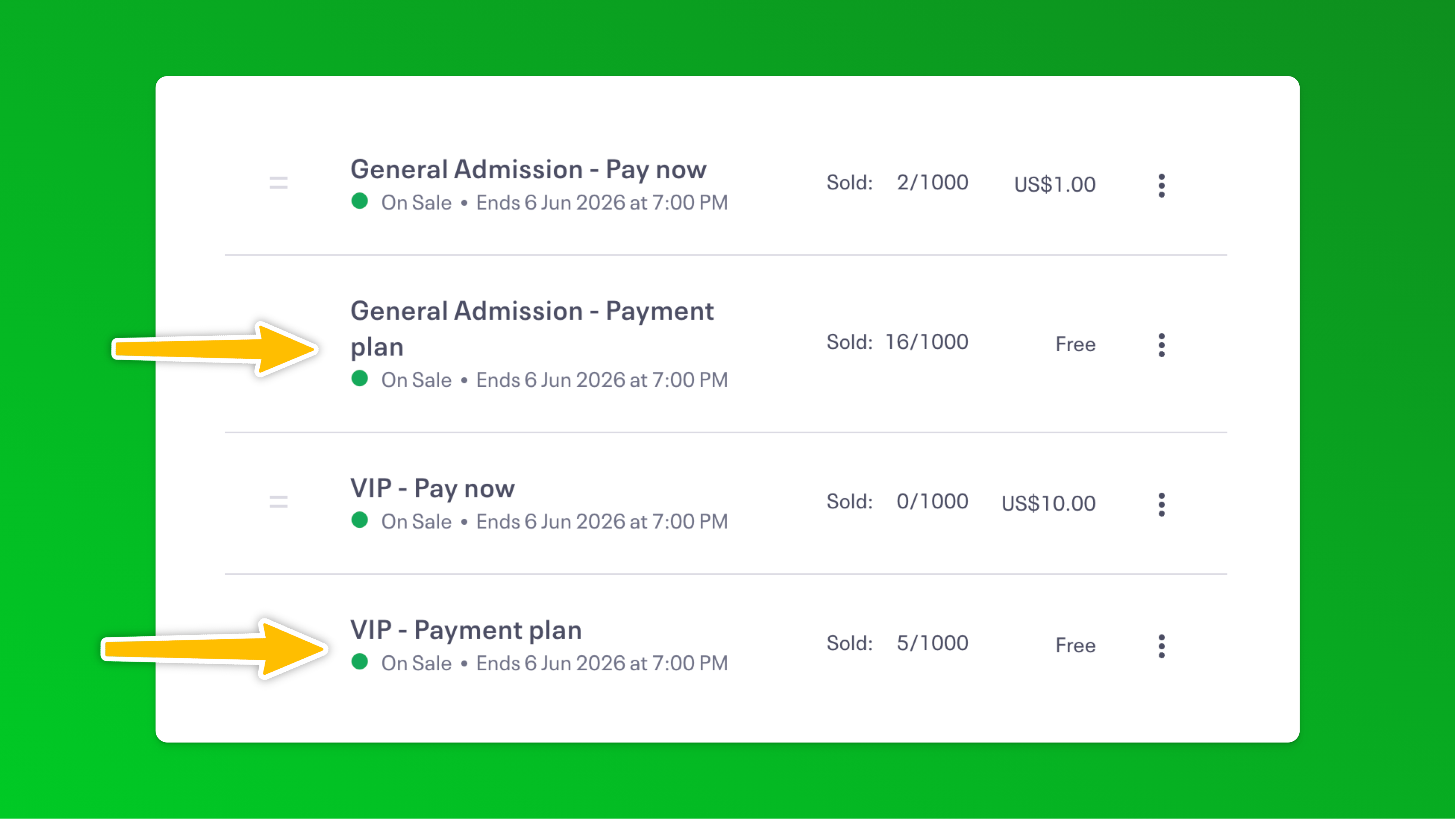

Approach #1: Create separate ticket types for people that want to pay via a payment plan

Eg: If you have two ticket types, Standard and VIP, you can create two additional ones called: Standard - Pay via a payment plan and VIP - Pay via a payment plan and when attendees buy those tickets, they get an email with their payment plan link. This approach gives you more flexibility by letting you offer payment plans only for some ticket types if you'd prefer – eg: if you just wanted your higher tiers to have a payment plan option, you can do that. You can also manage the quantity of this ticket type separately. You also don't pay Eventbrite service fees on these tickets with this approach since they are set up as free tickets.

👉 Try a working demo of this approach

⚙️ Jump to setup instructions for this approach

Approach #2: Use your existing ticket types and enable an offline payment method like "Pay via invoice" for payment plans

Eg: For any of your existing ticket types, you would enable Eventbrite's built in offline payment method – pay via invoice, and when customers choose this in the payment options, they get an email with their payment plan link. This approach is good because it keeps your ticket types cleaner and easier to understand but has some downsides to consider:

1. Eventbrite still charges their service fees since this uses "offline" payment methods in Eventbrite which still incur service fees.

2. This approach enables payment plans on all ticket types. You can't offer them only on specific ticket types.

3. You can't control the quantity of "payment plan tickets" separately with this approach

👉 Try a working demo of this approach

⚙️ Jump to setup instructions for this approach

Approach #1 Separate ticket types step-by-step setup instructions

- Before you start, if you haven't already done so, create your Paythen account and a Zapier account.

- In Eventbrite, create a free ticket type for each category of tickets you want to offer payment plans on – eg: VIP Tickets Payment Plan, etc.

- In the ticket description, under advanced settings let attendees know what will happen next: Eg: Choose this ticket to pay over 8 easy monthly payments. Once you complete this, we'll email you a link for your payment plan. Your ticket is not reserved until you complete this step.

We recommend clearly highlighting the fact that the ticket is not reserved until they complete their first payment plan payment even in the event description so potential buyers don't miss that.

We recommend clearly highlighting the fact that the ticket is not reserved until they complete their first payment plan payment even in the event description so potential buyers don't miss that. - In addition to the ticket and event description, we also recommend clearly highlighting on the order confirmation apge what attendees who chose the payment plan option need to do to reserve their tickets. You can add a custom message there by going to Order Options > Order Confirmation in Eventbrite and adding some text here:

👉 It's important to repeat this messaging in as many places as possible to counter the Eventbrite default messaging which can make it seem like the order is completed which can lead to attendees who choose the payment plan option forgetting to complete the payment step. 👈

👉 It's important to repeat this messaging in as many places as possible to counter the Eventbrite default messaging which can make it seem like the order is completed which can lead to attendees who choose the payment plan option forgetting to complete the payment step. 👈 - Complete one purchase with each payment plan ticket type so that data is available as test records in the Zapier setup below. Buy each ticket type in a separate order. Eg; if you have three payment plan ticket types, complete three separate purchases – we recommend choosing more than 1 in the quantity so in the later step you can be sure the total payment plan amount is accurate based on the order total.

- In your Paythen dashboard, create a new template

We recommend either the standard payment plan template or if you'd like to align all payment plan buyers payments to the same future dates, consider the date-based payment plan template. You can read more about each template type here. In the template setup, you can choose the amounts, billing intervals, etc – most of these fields can be overwritten and replaced with dynamic data from Eventbrite when we set up Zapier below. You can also edit the template fields any time.

We recommend either the standard payment plan template or if you'd like to align all payment plan buyers payments to the same future dates, consider the date-based payment plan template. You can read more about each template type here. In the template setup, you can choose the amounts, billing intervals, etc – most of these fields can be overwritten and replaced with dynamic data from Eventbrite when we set up Zapier below. You can also edit the template fields any time. - Once you've created the template, it will generate a template link that you will need for the Zapier step below.

- In your Zapier account, create a new zap. This will use the "New order" trigger from Eventbrite, a filter to check and organize the ticket types and then paths for each ticket type.

Zapier doesn't support templates for zaps with paths so we can't share a pre-set Zapier template link for this approach (like we have for approach 2 below) but here is exactly what you need to set up in each step of the Zap:

Zapier doesn't support templates for zaps with paths so we can't share a pre-set Zapier template link for this approach (like we have for approach 2 below) but here is exactly what you need to set up in each step of the Zap: - Zapier step 1: Choose Eventbrite as the app and New order as the trigger. Connect your Eventbrite account and choose your event. In the "Test" step you should see one or more of your test orders you placed earlier. If you can't we recommend placing an order on your even with the payment plan ticket type selected to make it easier to map data in the following steps. Select a test order and continue your Zap.

- Zapier step 2: Add a Paths step and add one path for each payment plan ticket type you're offering. In our demo, we have two ticket types and each has a payment plan option so we have two paths.

- Zapier step 3: In your Path conditions for each path, choose Custom rules then Only continue if Attendees Ticket Class Name (inserted from the Eventbrite step) – Text (Contains) – "VIP - Payment plan" or "Standard - Payment plan" – in this step, enter the exact name that corresponds with the ticket type name you set up in Eventbrite. This will filter this path for specific ticket types.

- Zapier step 4: We will now calculate the total payment amount for each order based on the ticket type and number of tickets they chose. Complete this step for each path you have.This can't be calculated in Eventbrite since the ticket type in Eventbrite is set to free. For this step, you can use any app that lets you calculate the total but we've found the easiest way is to use the new "AI by Zapier" app. Choose Analyze and Return Data in the Action event dropdown.

In the Configure step for this, what we need to do is give the AI some basic instructions, the cost per ticket for this ticket type and the Eventbrite order quantity field as shown and ask it to calculate a total by multiplying the cost per ticket with the order quantity (number of tickets) and return a final total that we will use in the next step.

In the Configure step for this, what we need to do is give the AI some basic instructions, the cost per ticket for this ticket type and the Eventbrite order quantity field as shown and ask it to calculate a total by multiplying the cost per ticket with the order quantity (number of tickets) and return a final total that we will use in the next step. This is the exact text we used you can copy and paste:

This is the exact text we used you can copy and paste:

---------------------------------------------

Given the following formula:

Number of attendees = [Insert number of attendees field from Eventbrite here, delete this text]

Cost per ticket = 500.00 [Manually update this value without symbols to match your ticket price - then delete this text]

Formula = Number of attendees * Cost per ticket

Please calculate the total using the provided formula and numbers.

Limitations:

- Use only the provided formula and numbers

- Round the final result to two decimal places

Desired output format:

Provide your answer in a clear, step-by-step format, concluding with the final total.

---------------------------------------------

In Output fields, add this:final_total A string representing the final calculated total, rounded to two decimal places.Now in the test step, in "Data in" you should see the values from your test order: And in the Data out tab or if you continue, you should see the correct final_total value. In our example, it would be 4 * 500 = 2,000In our Paythen payment plan template, we have added a 10% payment plan admin fee that will now be added on top of this amount when the payment plan link is generated and sent to customers. We recommend handling any payment plan specific surcharges and other changes there to keep your Zapier setup simple. So in this instance the customer's total payment plan amount will be $2,200 on the payment page.

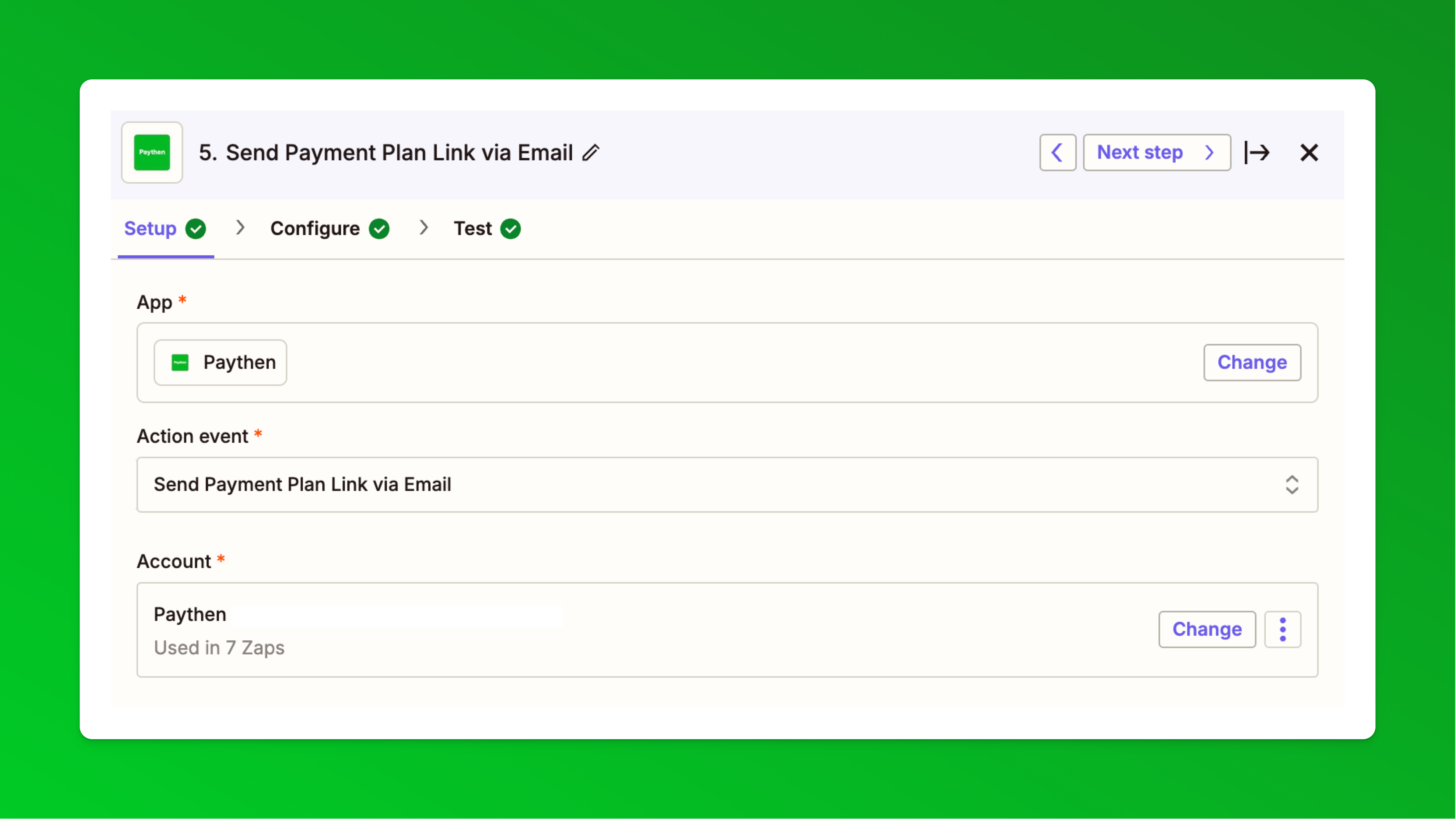

And in the Data out tab or if you continue, you should see the correct final_total value. In our example, it would be 4 * 500 = 2,000In our Paythen payment plan template, we have added a 10% payment plan admin fee that will now be added on top of this amount when the payment plan link is generated and sent to customers. We recommend handling any payment plan specific surcharges and other changes there to keep your Zapier setup simple. So in this instance the customer's total payment plan amount will be $2,200 on the payment page. - Zapier step 5: Now we'll configure the final step of each path – to send a custom payment plan link via email to customers that chose the payment plan ticket types at checkout. Choose Paythen as the app, then choose the Send payment plan link via email action, and authenticate your Paythen account if you haven't already:

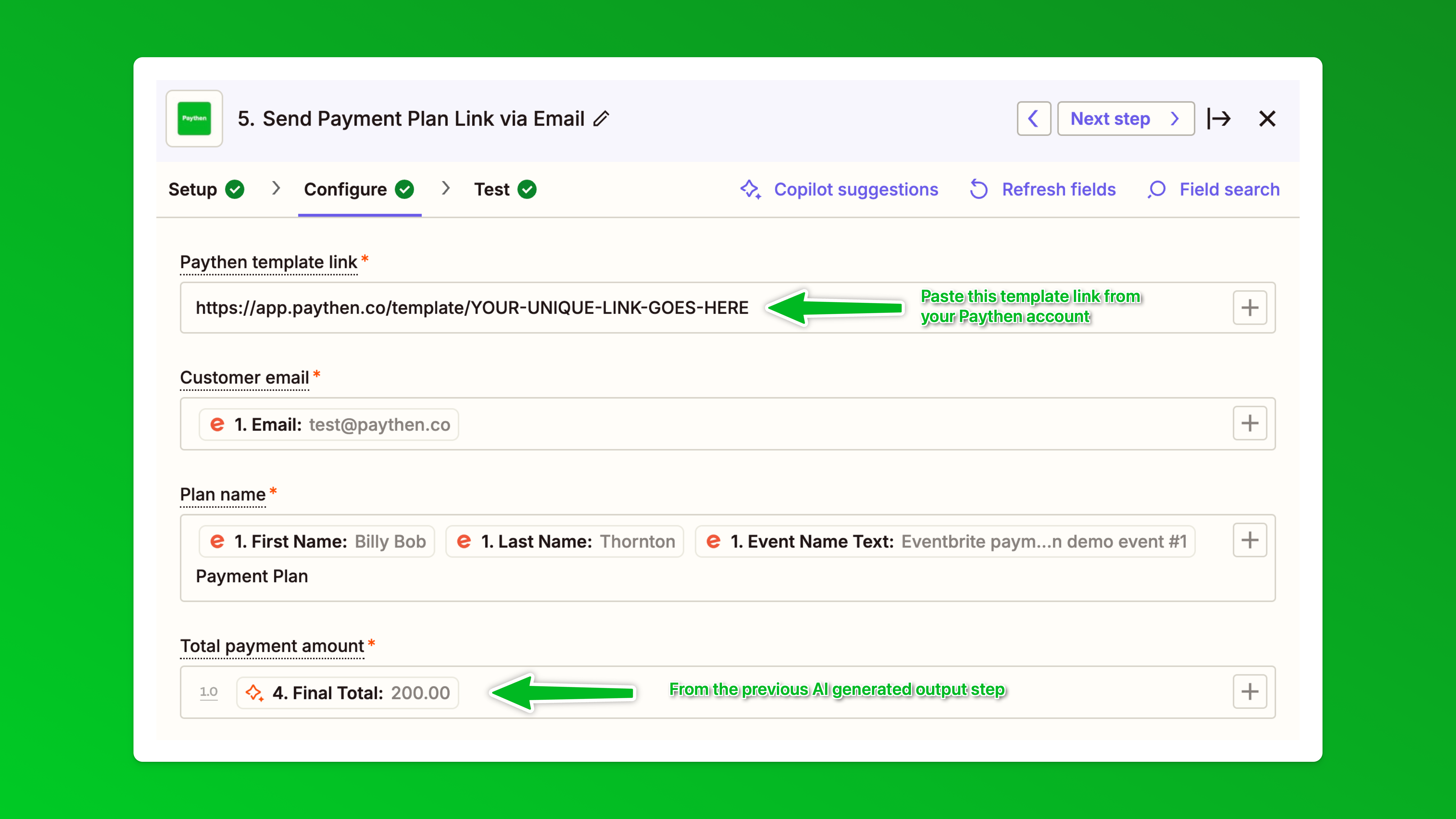

- In the Configure step,

a) paste in the Paythen template link that you generated in your Paythen dashboard,

b) add in the customer email field from Eventbrite and

c) in the plan name, you can choose any format you want but we recommend this: First name Last name Event Name Text and then "Payment Plan" – This is the name of the payment plan shown to customers and also what you see in the plan name in your Paythen dashboard. With this format, the plan name would be created as:Billy Bob Thornton Big Day Out Payment PlanIf you want this to be more granular you can include the Eventbrite order ID, the ticket name, and more. Finally in the "Total payment amount" field inset the "Final total" that was generated from the previous AI by Zapier step

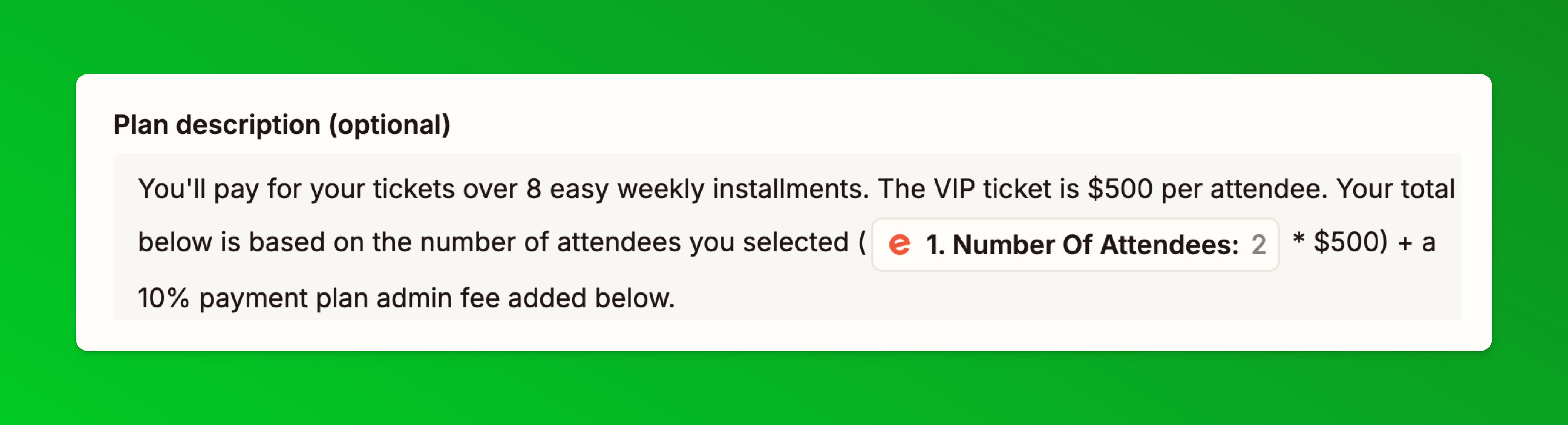

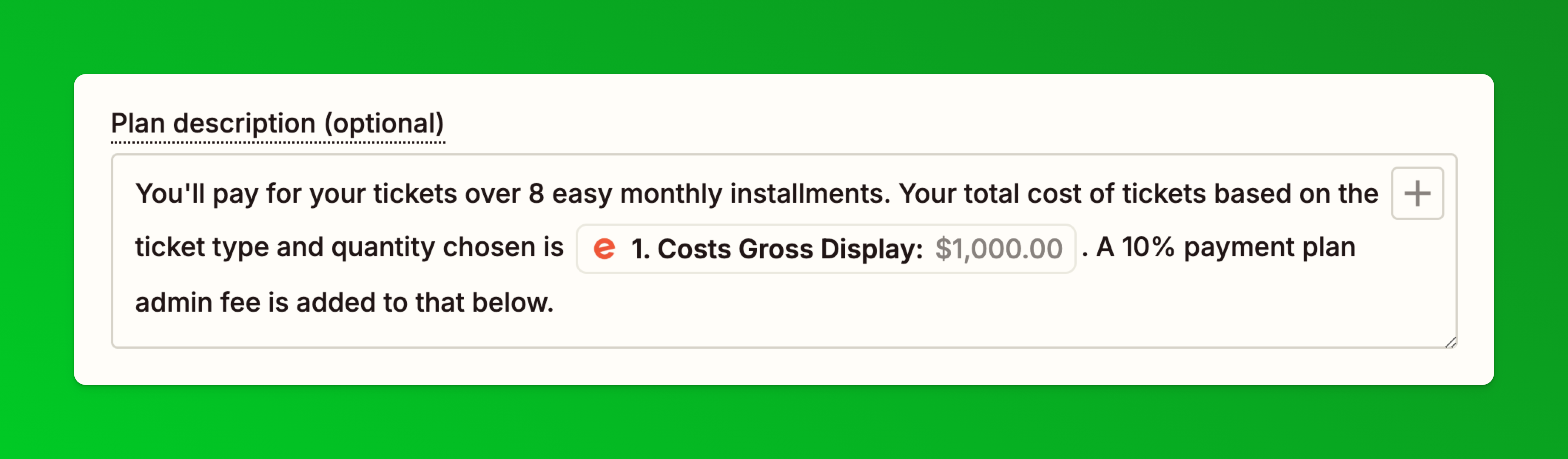

Finally in the "Total payment amount" field inset the "Final total" that was generated from the previous AI by Zapier step - All other fields on this page are optional – but we recommend adding in the Plan description field with data from your Eventbrite order like this:

This is the text we used in our demo you can copy and change:You'll pay for your tickets over 8 easy weekly installments. The VIP ticket is $500 [update ticket price] per attendee. Your total below is based on the number of attendees you selected ([Insert Eventbrite number of attendees field] * $500 [update ticket price] ) + a 10% payment plan admin fee added below.

This is the text we used in our demo you can copy and change:You'll pay for your tickets over 8 easy weekly installments. The VIP ticket is $500 [update ticket price] per attendee. Your total below is based on the number of attendees you selected ([Insert Eventbrite number of attendees field] * $500 [update ticket price] ) + a 10% payment plan admin fee added below. - Repeat steps 10 - 15 above for each different ticket type you have payment plans for.

- Name your zap and publish it to make it live.

- Now place new test orders on your event to ensure everything works as expected. Place a separate order for each ticket type so you can check the totals and all text is as it should be.

- And you're done! 🎉 🎟️ ⚡

Now, if someone buys the payment plan tickets in Eventbrite, they will get an email with their payment plan link. Once they complete the first payment, they will be created as customers in Paythen and can be easily managed there. Each customer gets their own unique customer link like this emailed to them immediately after sign up where they can manage their plan, pay early, and more.You can create separate Zaps to send Paythen customer data into your CRM or other systems to set up more automated workflows.

🙋 If you need help with this or the setup isn't working as expected, just reach out to us via the chat icon and we'll help you get it up and running .

Approach #2 Same ticket types step-by-step setup instructions

Approach 2 which uses a single ticket type for immediate or payment plan payments is shorter and easier to set up vs approach 1 above.

- Before you start, if you haven't already done so, create your Paythen account and a Zapier account.

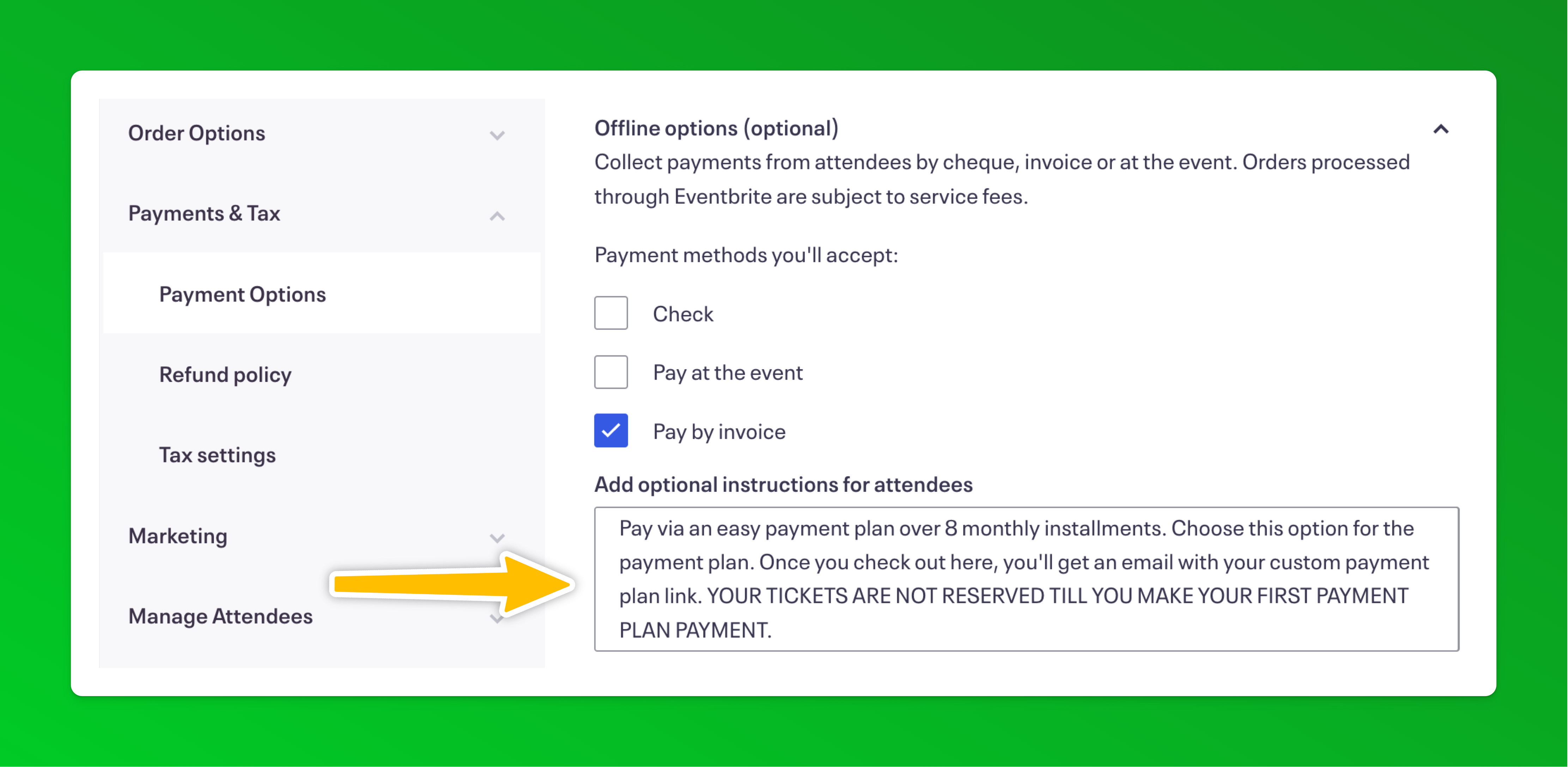

- In Eventbrite, in your event dashboard, go to Payment options and under the heading Offline options (optional) enable one of the offline options - we suggest "Pay by invoice"

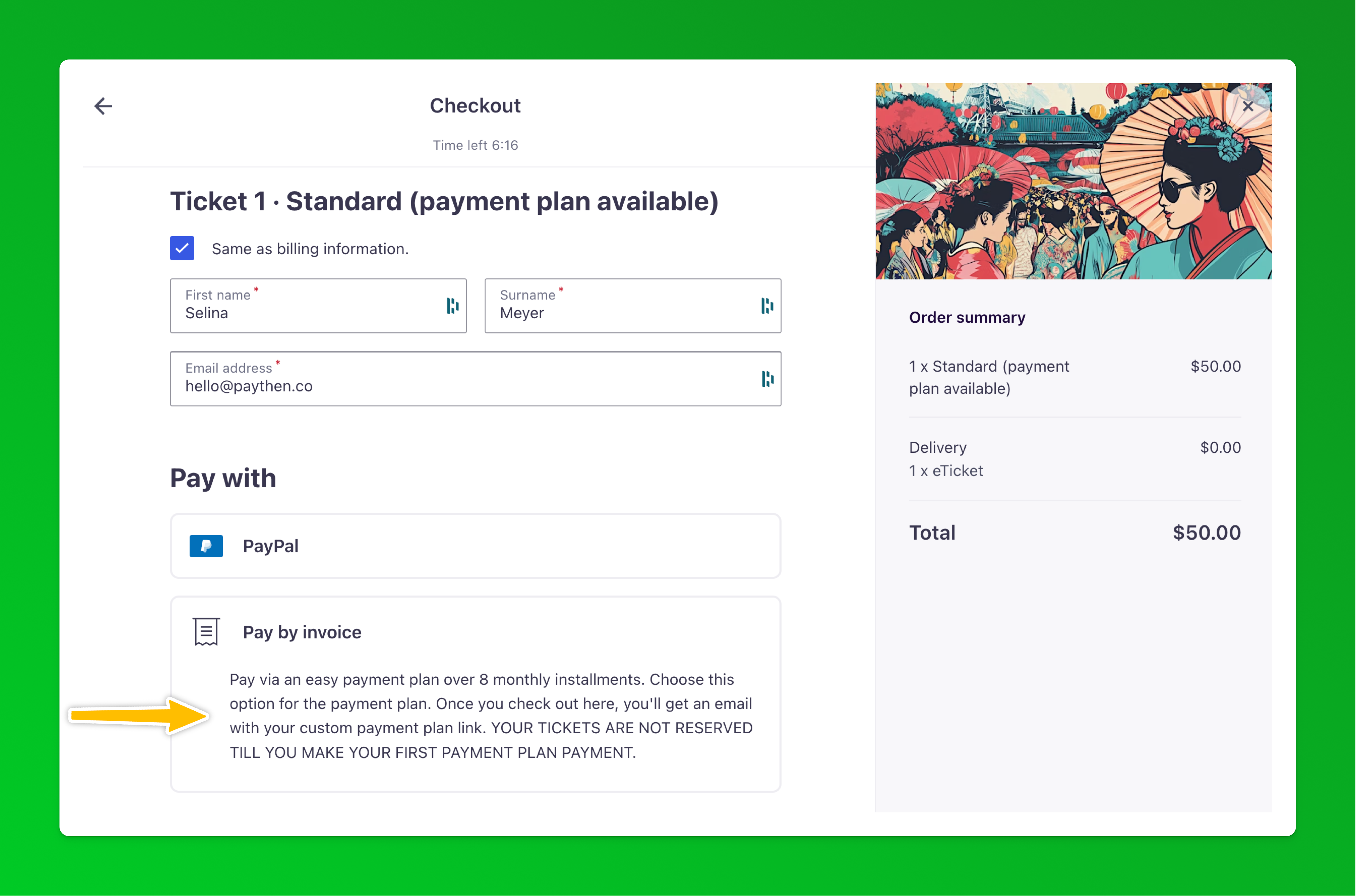

In the Add optional instructions for attendees box we recommend clearly explaining that they should choose this option if they want to pay via the payment plan and providing details on the length of the payment plan and even any surcharge that will be added on the payment plan page. We also recommend clearly stating that their tickets will not be reserved till they click on the link in their email and sign up to their payment plan. This is the text we have in our demo:Pay via an easy payment plan over 8 monthly installments. Choose this option for the payment plan. Once you check out here, you'll get an email with your custom payment plan link. YOUR TICKETS ARE NOT RESERVED TILL YOU MAKE YOUR FIRST PAYMENT PLAN PAYMENT.

In the Add optional instructions for attendees box we recommend clearly explaining that they should choose this option if they want to pay via the payment plan and providing details on the length of the payment plan and even any surcharge that will be added on the payment plan page. We also recommend clearly stating that their tickets will not be reserved till they click on the link in their email and sign up to their payment plan. This is the text we have in our demo:Pay via an easy payment plan over 8 monthly installments. Choose this option for the payment plan. Once you check out here, you'll get an email with your custom payment plan link. YOUR TICKETS ARE NOT RESERVED TILL YOU MAKE YOUR FIRST PAYMENT PLAN PAYMENT.

This is how it shows to attendees at checkout:

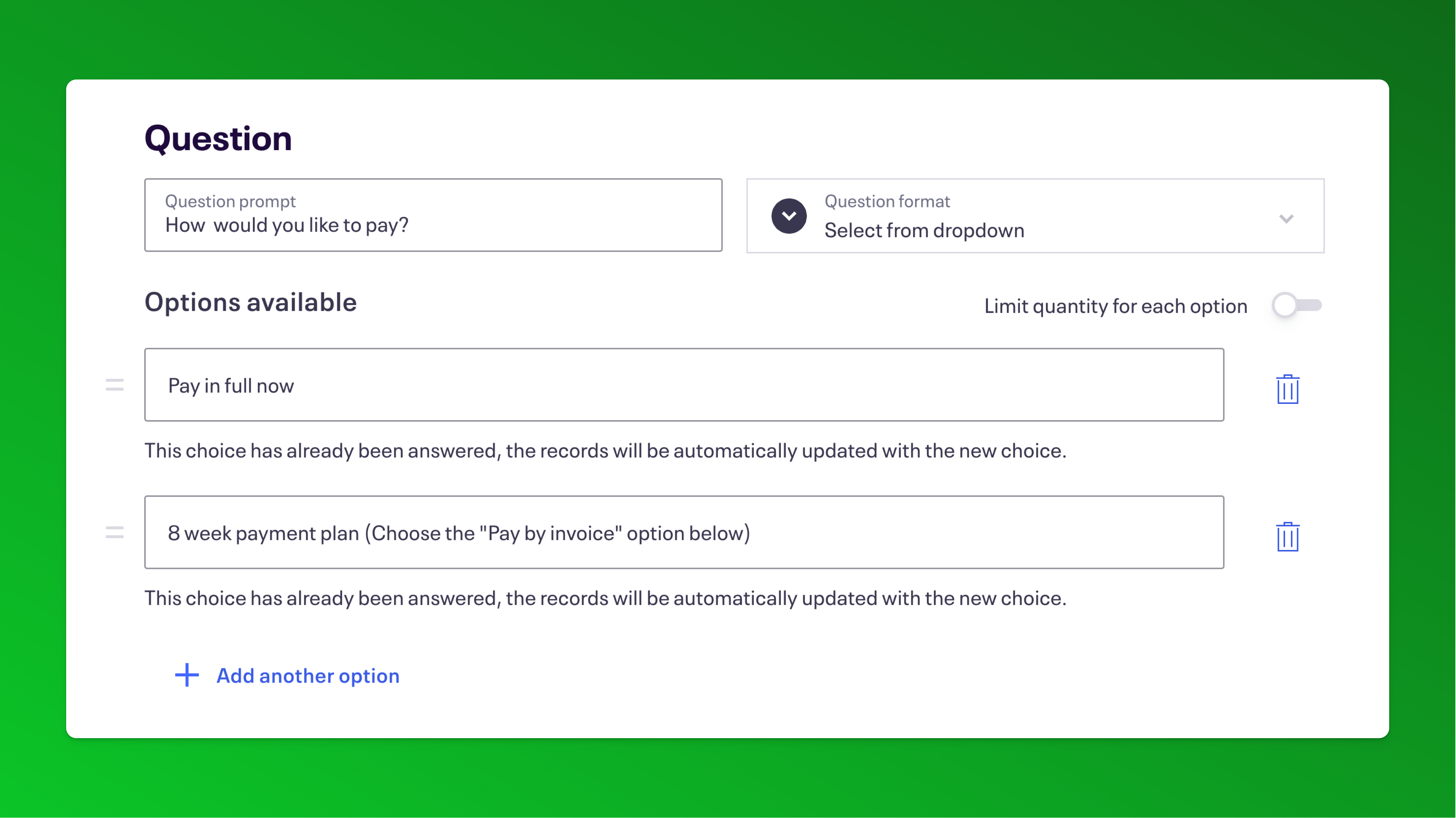

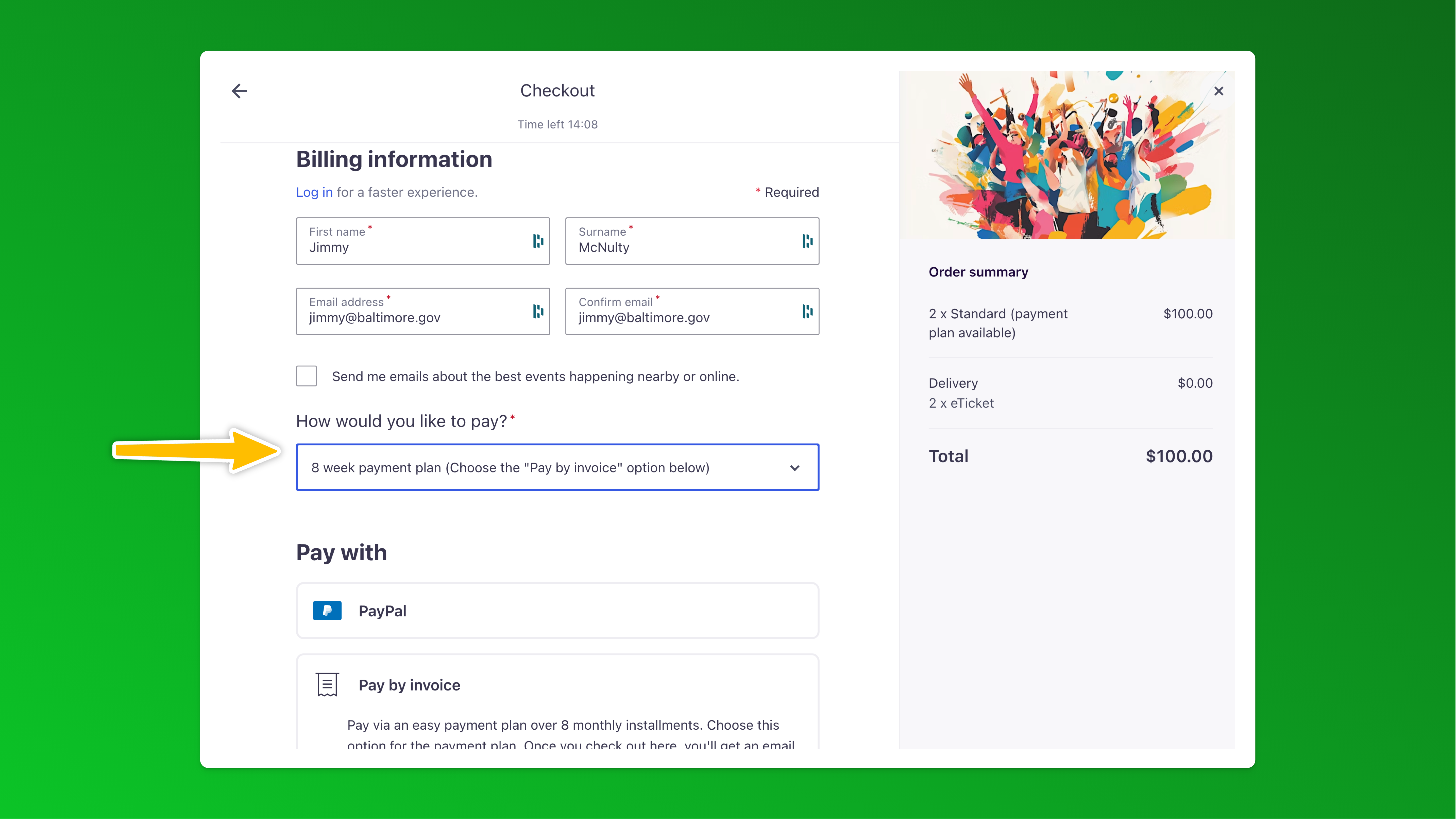

- In Order Options > Order Form add a custom question as a dropdown (or radio button) – as a required field which asks "How would you like to pay?" or something similar and it should give customers two options - Pay in full and pay via a payment plan - see the text we've used below.

This will appear like this when attendees are checking out:

⚠️ This is critical as this is the field we will use in Zapier below to identify payment plan customers and send the payment plan link via email. - This is optional but we recommend changing the ticket names to have the text payment plan available at the end as shown in our screenshots and clearly highlighting the payment plan option on the event description page too

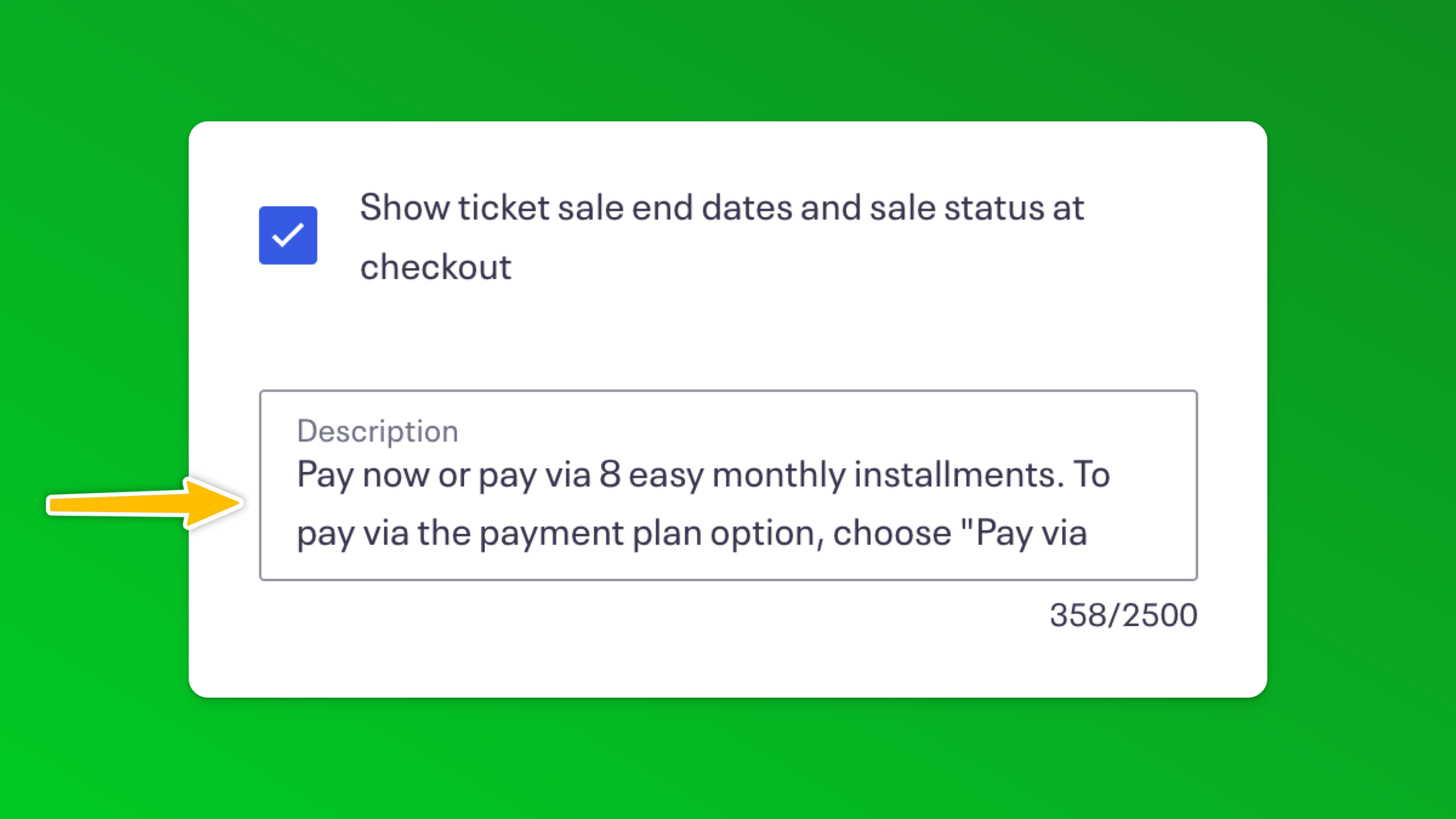

- We also recommend updating the Advanced settings under each ticket type to explain the two payment options available:

You can copy and edit this text to suit your event and payment plan option:

You can copy and edit this text to suit your event and payment plan option:

---------------------------------------------

Pay now or pay via 8 easy weekly installments. To pay via the payment plan option, choose the payment plan option in the dropdown and checkout with the "Pay via invoice" option selected on the payment page. You will get an email with a payment plan link. If you choose the payment plan / pay by invoice option, your tickets are NOT reserved until you click on the link in your email and complete the first payment of your payment plan.

---------------------------------------------

This is how it shows on the event page when attendees click on the "Read more" link on each ticket type:

- We also recommend updating the order confirmation page text as well as the order confirmation email attendees get after registration via the Order Options > Order Confirmation page in Eventbrite.

👉 It's important to repeat this messaging in as many places as possible to counter the Eventbrite default messaging which can make it seem like the order is completed which can lead to attendees who choose the payment plan option forgetting to complete the payment step. 👈

👉 It's important to repeat this messaging in as many places as possible to counter the Eventbrite default messaging which can make it seem like the order is completed which can lead to attendees who choose the payment plan option forgetting to complete the payment step. 👈 - Complete one purchase with each payment plan ticket type so that data is available as test records in the Zapier setup below. Buy each ticket type in a separate order. Eg; if you have three ticket types, complete three separate purchases. When testing with this "Pay by invoice" approach, we recommend changing the ticket prices to something low or immediately refunding the order after testing to avoid paying any / high Eventbrite service fees for test orders.

- In your Paythen dashboard, create a new template

We recommend either the standard payment plan template or if you'd like to align all payment plan buyers payments to the same future dates, consider the date-based payment plan template. You can read more about each template type here.In the template setup, you can choose the amounts, billing intervals, etc – most of these fields can be overwritten and replaced with dynamic data from Eventbrite when we set up Zapier below. You can also edit the template fields any time.

We recommend either the standard payment plan template or if you'd like to align all payment plan buyers payments to the same future dates, consider the date-based payment plan template. You can read more about each template type here.In the template setup, you can choose the amounts, billing intervals, etc – most of these fields can be overwritten and replaced with dynamic data from Eventbrite when we set up Zapier below. You can also edit the template fields any time. - Once you've created the template, it will generate a template link that you will need for the Zapier step below.

- Zapier step 1: Log in to your Zapier account and click on this Zap template to generate a new zap with the steps pre-selected 👉 Zapier easy setup link Your Zap editor should load with these three steps pre-loaded, you will need to click on each one to authenticate your accounts and choose specific information from your account

- Zapier step 2: In the Eventbrite new order step connect your Eventbrite account and choose New order as the trigger. Choose your event and go to the test step. In the "Test" step you should see one or more of your test orders you placed earlier. If you can't we recommend placing an order on your even with the payment plan ticket type selected to make it easier to map data in the following steps. Select a test order and continue your Zap.

- Zapier step 3: In the Filter by Zapier step, in the Configure & test tab, choose Attendees Answers Answer > then (Text) Contains > payment plan ensuring the text you enter here is unique and matches or partly matches what you entered in the custom question you added in step 3 above. This is what is used to identify those attendees that chose the payment plan option vs. those that paid in full.

- When you click continue it should show you a "Your Zap would have continued for this test data" message like this

- Zapier step 4: Click continue and that will bring you to the final step "Send Payment Plan Link via Email" Choose Paythen as the app, then choose the Send payment plan link via email action, and authenticate your Paythen account if you haven't already:

- In the Configure step,

a) paste in the Paythen template link that you generated in your Paythen dashboard,

b) add in the customer email field from Eventbrite and

c) in the plan name, you can choose any format you want but we recommend this: First name Last name Event Name Text and then "Payment Plan" – This is the name of the payment plan shown to customers and also what you see in the plan name in your Paythen dashboard. With this format, the plan name would be created as: Joshua Lyman Blues n Roots Festival Payment PlanIf you want this to be more granular you can include the Eventbrite order ID, the ticket name, and more. Finally in the "Total payment amount" field insert the Costs Gross Major Value field from Eventbrite. Ensure you use this one and not other similar sounding ones as this does not have any currency symbols included in it. The values needs to be just numbers for it to work correctly. This is different from the "Costs Gross Display" field used in the next step.

Finally in the "Total payment amount" field insert the Costs Gross Major Value field from Eventbrite. Ensure you use this one and not other similar sounding ones as this does not have any currency symbols included in it. The values needs to be just numbers for it to work correctly. This is different from the "Costs Gross Display" field used in the next step. - All other fields on this page are optional – but we recommend adding in the Plan description field with data from your Eventbrite order like this:

This is the text we used in our demo you can copy and change:

This is the text we used in our demo you can copy and change:

---------------------------------------------

You'll pay for your tickets over 8 easy monthly installments. Your total cost of tickets based on the ticket type and quantity chosen is [Insert Costs Gross Display field from Eventbrite here]. A 10% payment plan admin fee is added to that below.

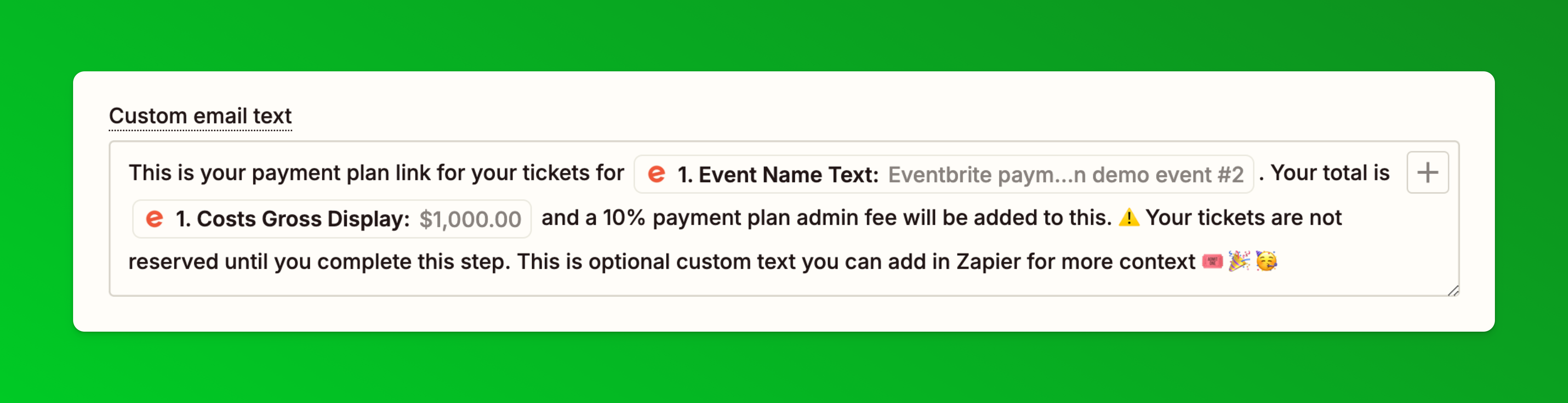

--------------------------------------------- - You can optionally also add custom text into the payment plan email attendees will get for more context. This is also one of the optional fields on this step. You can use this to re-iterate next steps but also add relevant links like your event policies and more.

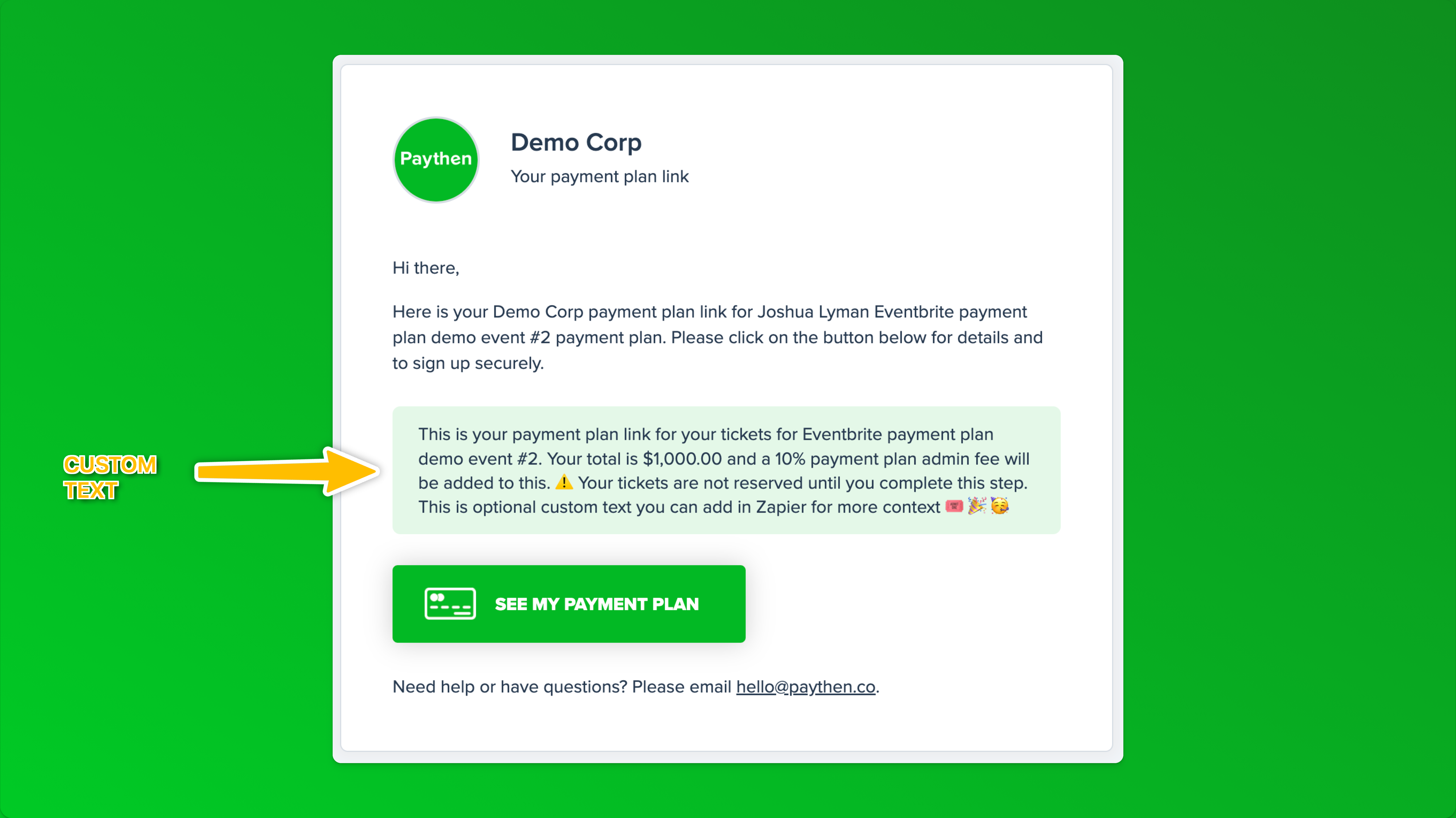

This is how the email will look with custom text added:

This is how the email will look with custom text added:

- Name your Zap and publish it

- We recommend placing orders with each ticket type and choosing the Pay by invoice option to ensure all amounts are correct and as expected.

- And you're done! 🎉 🎟️ ⚡

Now, if someone buys tickets and chooses the Pay via payment plan option in the custom question on Eventbrite, they will get an email with their payment plan link. Once they complete the first payment, they will be created as customers in Paythen and can be easily managed there. Each customer gets their own unique customer link like this emailed to them immediately after sign up where they can manage their plan, pay early, and more.You can create separate Zaps to send Paythen customer data into your CRM or other systems to set up more automated workflows.

🙋 If you need help with this or the setup isn't working as expected, just reach out to us via the chat icon and we'll help you get it up and running.

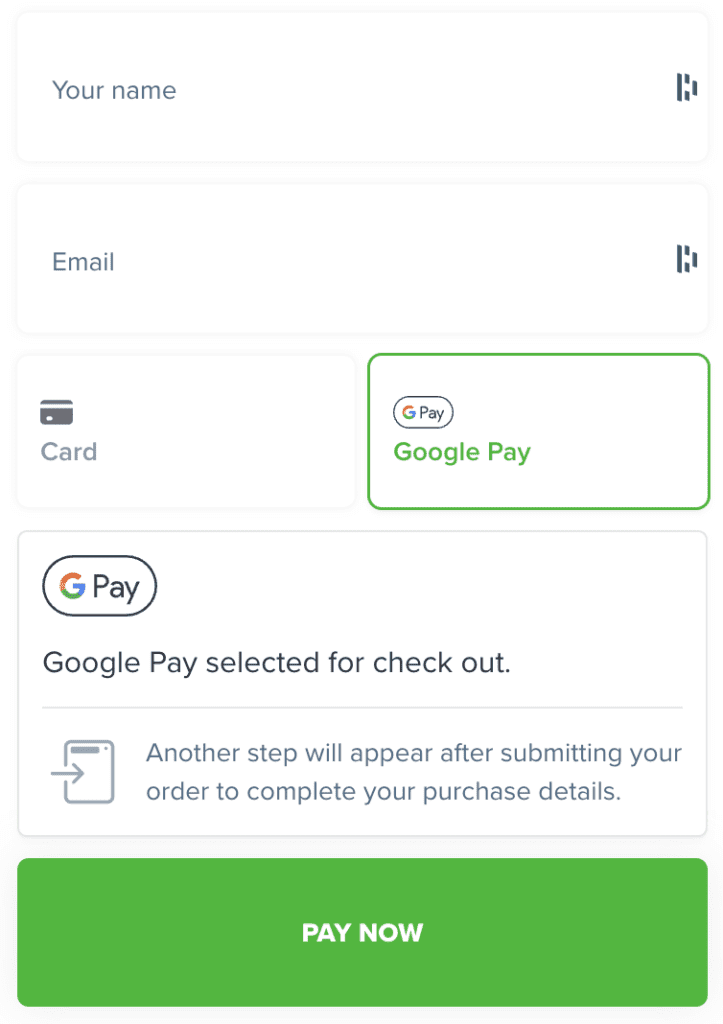

- 14. Can I offer Google Pay payment plans to my customers?

Yes you can. Paythen makes it easy to offer Google Pay payment plans. Your customers can pay in seconds for your Paythen payment plan using their Google Pay account via a compatible browser or device. They will just need to enter their name and email, then click the GPay button to complete payment. This will open the standard GPay authorisation pop up where applicable and then their payment plan will begin.

For the "Pay your way" payment plan type, customers can choose to pay for the upfront or payment plan option using Google Pay. See live examples of Google Pay Payment Plans and other plan types available in Paythen here.

In addition to Google Pay, your customers can pay via any credit or debit card, Apple Pay or even Alipay where applicable (Alipay works for single payments only). Google Pay is automatically ON on your Paythen account.

- 15. Can I offer Apple Pay payment plans to my customers?

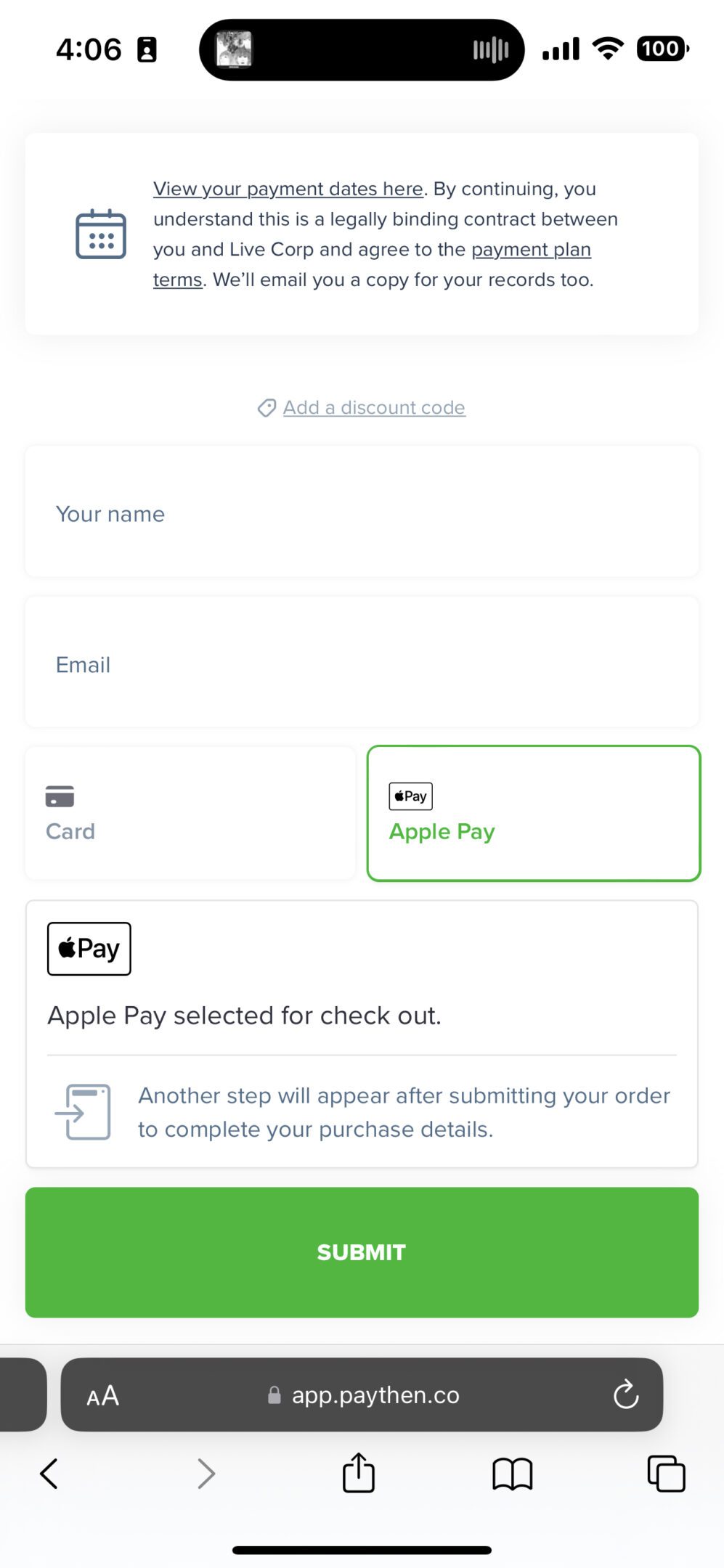

Yes you can. Paythen makes it easy to offer Apple Pay payment plans. Your customers can pay in seconds for your Paythen payment plan using Apple Pay on their Mac, iPhone or iPad. They will just need to enter their name and email, then click the Apple Pay button to complete payment. This will open the standard Apple Pay authorisation pop up where applicable and then their payment plan will begin. How Apple Pay is authenticated differs based on the user's Apple devices.

For the "Pay your way" payment plan type, customers can choose to pay for the upfront or payment plan option using Apple Pay. For all plan types available in Paythen, customers can choose to pay via Apple Pay if they prefer. There is no extra charge from Stripe or Paythen for accepting Apple Pay payments compared to standard credit and debit cards. Offering your customers the choice to pay with Apple Pay and other options typically helps improve conversion rates and increases sales.

In addition to Apple Pay, your customers can pay via any credit or debit card, Google Pay or even Alipay where applicable (Alipay works for single payments only). Apple Pay is automatically ON on your Paythen account. No manual setup is needed.

- 16. What is Stripe?

Stripe is the world’s leading payment processor — they handle the underlying payment infrastructure to ensure your customers’ payment information is secure. Millions of businesses across the world use Stripe as their payment processor. Paythen works with, and requires, Stripe. When you start your free Paythen trial, you can connect your existing Stripe account or create a new one in seconds. Paythen is a Stripe verified partner.

- 17. Can I use Paythen with JotForm or other form tools to offer payment plans?

Yes you can – with most of the popular form builders. As long as your form builder allows you to set a custom redirect url after form submission, you can get your customers to complete the form, then redirect them to the Paythen plan payment link to complete payment (or the other way around).

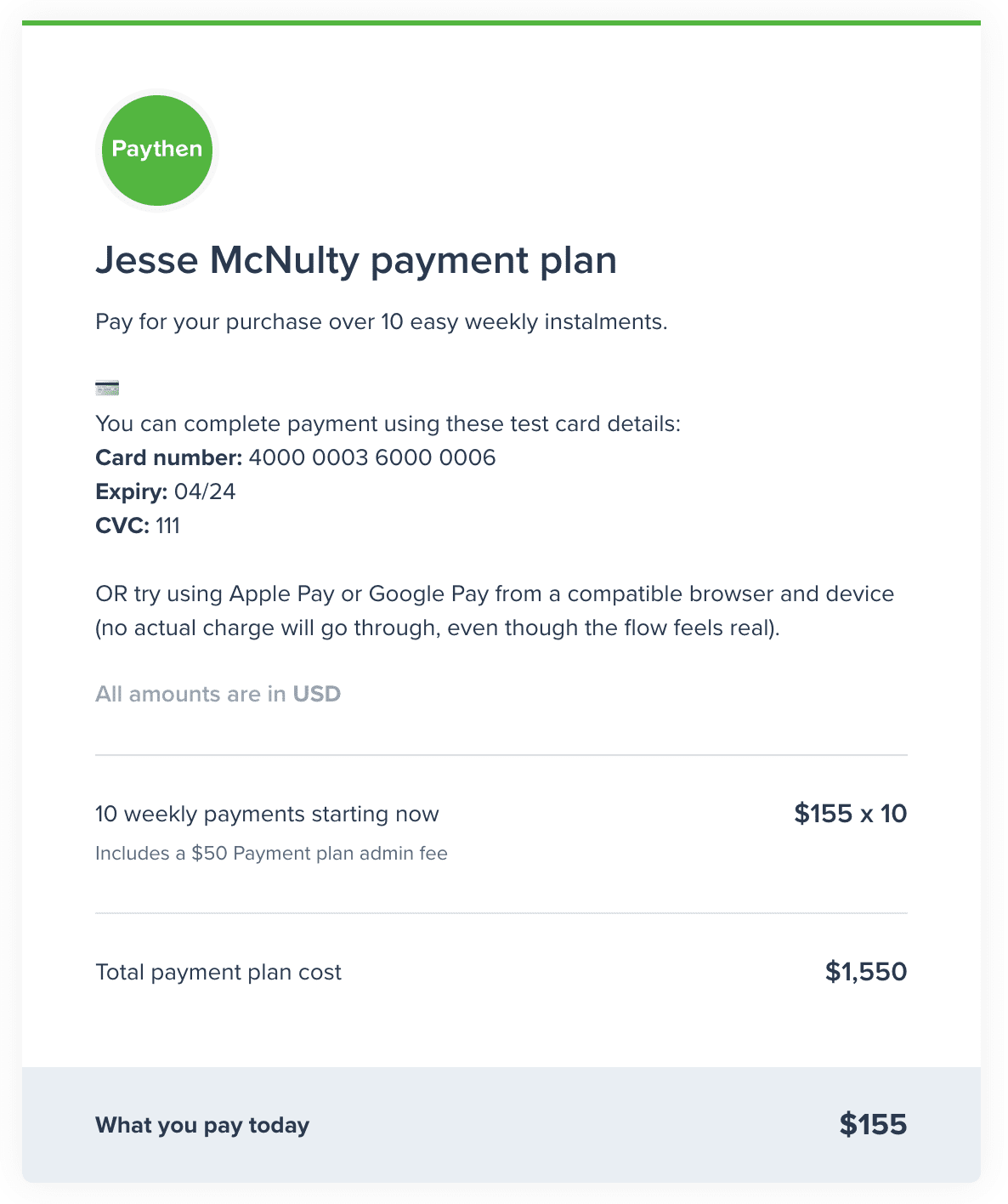

Using Paythen is super easy if you intend to charge all your customers the same total payment plan amount – eg: $1,000 over 10 weekly payments. To do this, all you have to do is create a payment plan in Paythen and add the link to that as the success redirect url in your form submission settings.

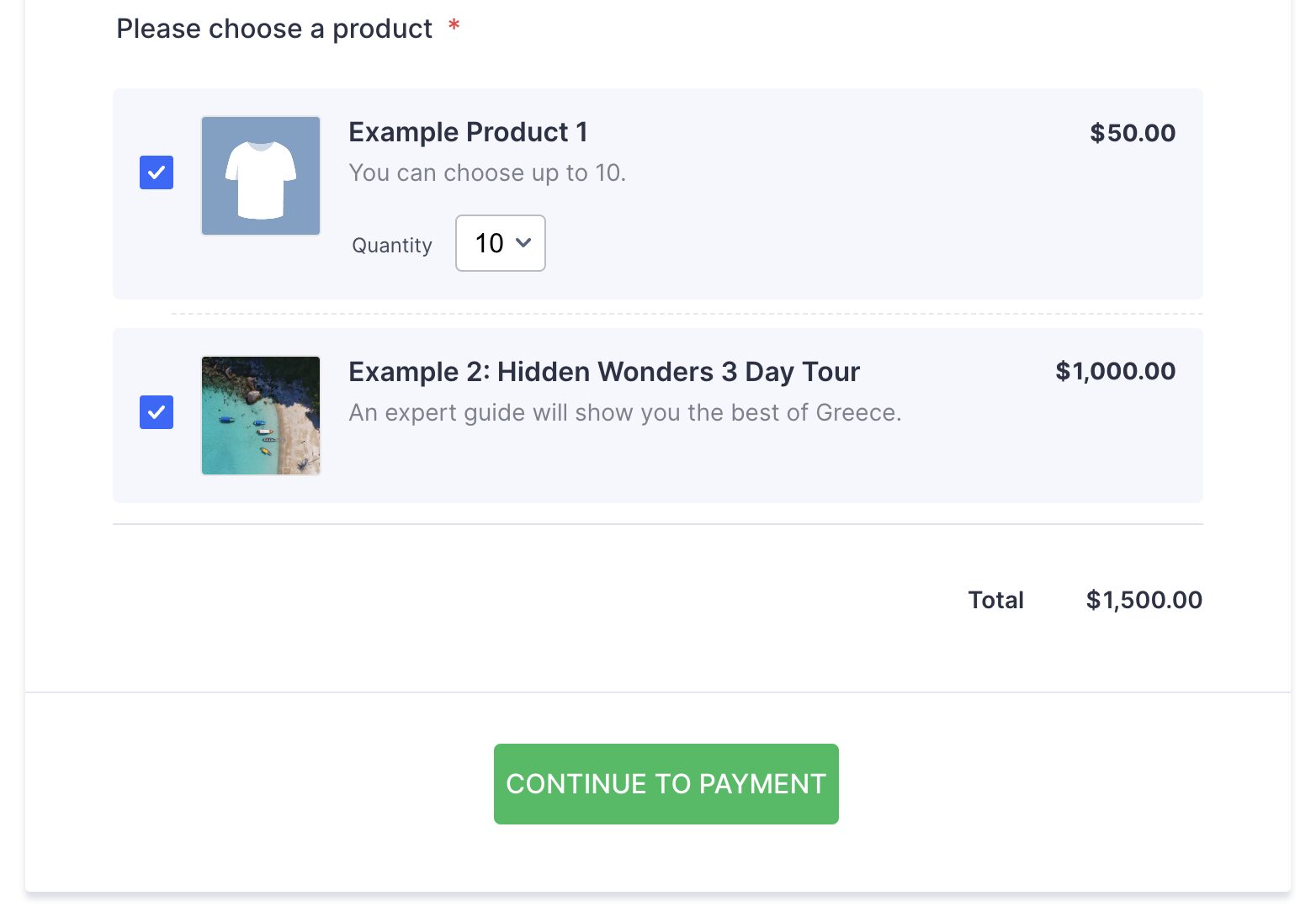

However, Paythen isn't limited to just that – in most cases you're using a form builder like JotForm, Gravity Forms or others because you want to offer your customers a selection of different products or services and the total amount payable for each customer can be different. You can also use Paythen in this instance where each customer's payment plan amount is going to be different, as long as your form tool supports passing the total to the success page url. We know you can definitely do this with JotForm and Gravity Forms but most form builder tools should have this capability.

Here is a demo JotForm form that shows you exactly how the flow would work for customers when you want to offer a payment plan using JotForm and Paythen.

Your customers will fill out the form in your form tool, click on the CONTINUE button, and be shown their own custom payment plan page to complete their payment and begin their payment plan. You can even add optional additional admin fees if you prefer.

To create a similar set up and offer payment plans using your JotForm form (or other form builder), these are the steps. We'll use JotForm as an example below but this works with most form builders:

- Create your free Paythen account

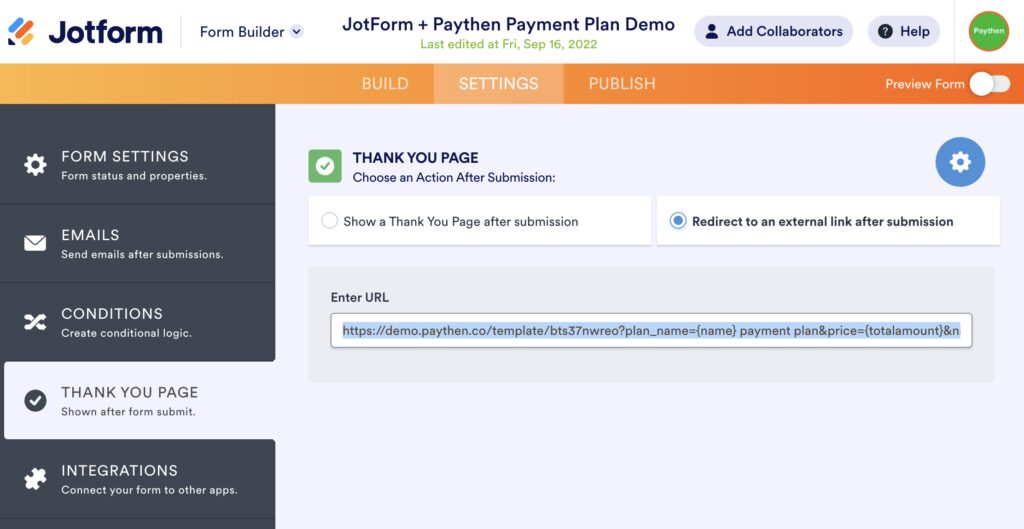

- Create a template in Paythen by following these steps, then copy the template link

- Go to your JotForm dashboard and create your form with all the fields you want

- Open the form settings page where you can edit the behaviour of the form after submission

- Choose the "Redirect to an external link after submission" option and in the url box, paste in your Paythen template link which will be like this: https://app.paythen.co/template/jy76dxr

- Now add the following information after the template link:?plan_name={name} payment plan&price={totalamount}&name={name}&email={email}So once you are done, the full URL field will look like this: https://app.paythen.co/template/jy76dxr?plan_name={name} payment plan&price={totalamount}&name={name}&email={email}Noting that only plan_name and price are the two required fields. The reason we pass name and email is to make it simpler for your customers to not have to fill out their own name and email again on the payment page.The values in the curly brackets eg: {name} and {totalamount} come from your form. These actual values will vary based on the form builder you're using.

- You can complete the steps on this demo JotForm form to see how the flow will work for your customers.

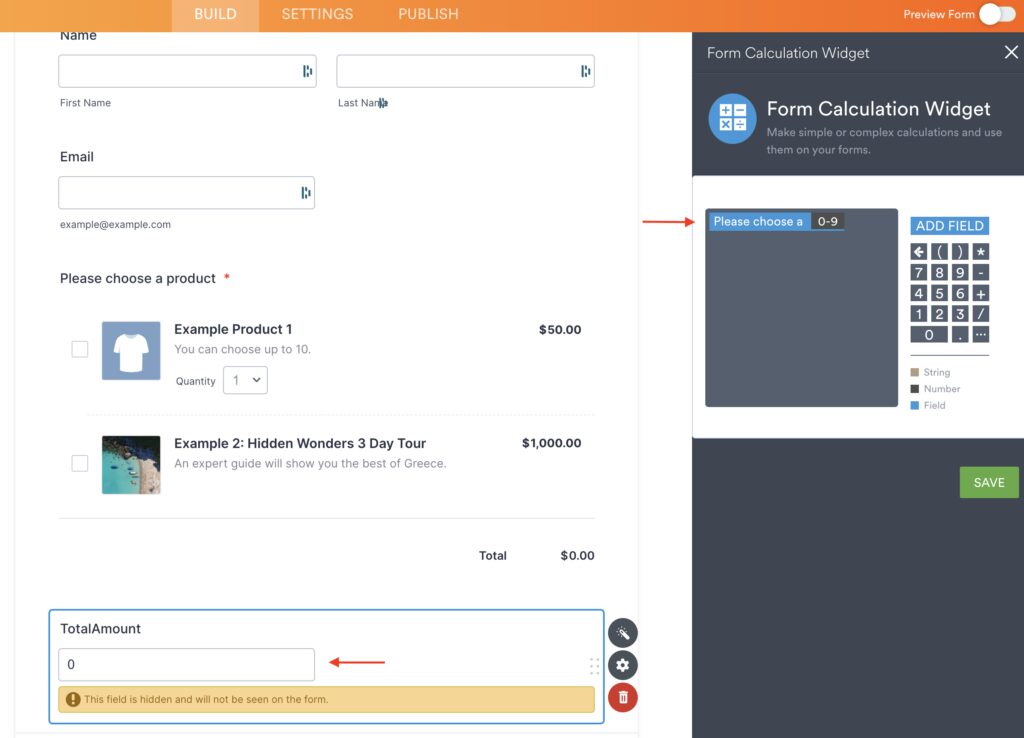

- Specifically for JotForm, there is a hidden field here that gets the total amount from your form and passes that to the success URL. This uses the calculation widget field – you can read how that works here.

If you're trying to set up a workflow with any form builder and Paythen, get in touch with us via the chat icon and we'll help you get this up and running.

- 18. How can I easily split payments in 4 (or 8) using Stripe?

Paythen makes it easy and painless to split payments in 2, 4, 8, 12, or any number of installments using your Stripe account. Create a Paythen payment plan, choose the number of split payments, whether you want these to be charged weekly, fortnightly, monthly or any other custom interval and get a link you can share with your customers or add to your eCommerce site in minutes.

To get started, you just need to create your free trial account with Paythen, connect your existing (or new) Stripe account, and create a new plan link where you configure the number of split payments and a few other details. Our friendly support team is here to help in case you have any questions or get stuck anywhere.

Paythen is a verified Stripe partner and is an easy-to-use tool designed to help you sell more with less hassle by offering split payment options to your customers. Split payments is a powerful way to improve your sales, reach more customers and improve your business.

- 19. Does Shopify offer payment plans?

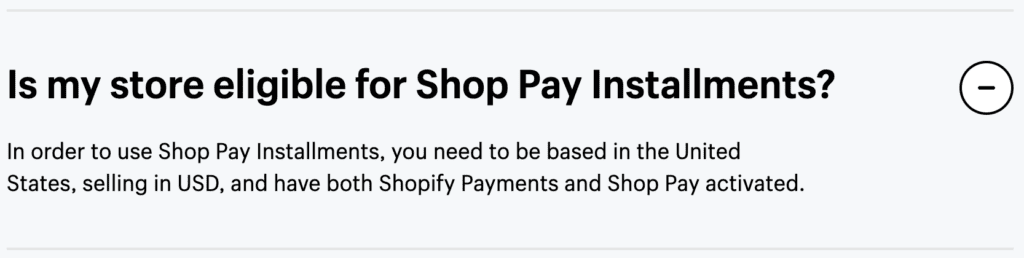

Yes, Shopify does offer payment plans with its own solution – Shop Pay Installments. There is a catch though – it only works for eligible US based merchants using Shopify Payments and the Shop Pay payment method.

And your customers also have to be eligible to use this method. If the cart amount is over $999, your customers have to complete a credit check and pay interest.

If you are an eligible merchant and your customers are based in the US, then Shop Pay Installments is a great solution for payment plans on Shopify. However if you're based outside the US or just want more control over how your payment plans work and you sell to a broader audience, you can try Paythen Payment Plans for Shopify. Your customers choose the Payment plan option at checkout, then get an easy link via email to pay for their payment plan. You decide whether or not you want to add additional fees, how much to charge upfront vs. later, whether you want to charge weekly, monthly and over how long.

An important distinction between Paythen and Buy Now Pay Later providers is that while you pay super low fees (2%) and have full control and flexibility over your payment plans and customer relationships, you get paid as your customers pays you, not upfront.

You can read more about how Paythen's Shopify payment plans work here or see it in action on our Shopify Demo Store. Or ask us anything via the chat icon. We can help get this up and running on your store.

- 20. How do integrations work in Paythen?

Paythen has some direct integrations – a native WordPress plugin that lets you offer Paythen in minutes on your WooCommerce store (more), a companion product called Cardivo (built by us) that lets you offer digital gift cards that are redeemable on your Paythen plan pages, WooCommerce store or even manually for other scenarios (more).

For Shopify, because of API access limitations imposed by Shopify, there is an email-based workflow that sends customers an eamil with their payment plan link once they check out. Read more on that here.

For all other integrations and workflows, we have our fully featured and constantly improving Zapier app that lets you send data from Paythen into other systems, or lets you send custom payment plan links via email based on actions in your other systems. Using our Zapier app, you can send data to and trigger payment plans from over 7,000+ other tools so most workflows you can envision are available.

At the moment, Paythen does not have an open, publicly accessible API. If this is something you're interested in, let us know via the chat icon as that helps as prioritize future features better.

Key features

Paythen is designed to improve your customer payment experience and conversions while giving you powerful and simple features to understand and improve your business. Here are some of the key features, but the best way to see if it works for you is to try it with a free 7 day trial.

Easy payment plans

Offer your customers a buy now, pay later option set by you, to increase conversions and sales.

No-code, no-fuss setup

Once you connect your Stripe account, it takes under a minute to get started using Paythen.

Flexible plan types

Offer payment plans, pay your way plans where customers can choose, subscriptions or one-off payments.

Easy payment links

An easy to share payment link that works on any website and any device - matching your brand.

Flexible discount codes

Offer seasonal discounts & promotions with flexible discount codes that work on all plan types.

Integrate with other apps

Send Paythen data to over 7,000+ other apps with our Zapier integration.

Automated reminders & emails

We automatically send handy reminders before payments & follow-ups if a payment fails.

Encourage early repayments

Offer customers on a payment plan an easy way to repay early at any time – increasing your cashflow.

Payment plans or subscriptions

End charges after a set number of payments or continue indefinitely. Choose what works for you

Change payment info easily

Your customers can change their card info anytime they want, with zero time spent by your team.

Customer summaries

Your customers want to know what they’ve paid, and how much they owe. Now they can.

Payment receipts

Reduce support time spent sending customers copies of their receipts. All receipts available to them 24 x 7.

Get powerful, simple insights

Useful, easy to understand reports at the company, product and customer level.

Custom branding

Easily change the colors and logos shown on customer facing pages and some emails.

Flexible billing intervals & more

Choose any billing interval you can think of, add a setup fee, trial period and lots more for each product.

We get paid when you do

With our simple, low 2% fee, we only get paid when you do. No fixed or hidden fees. No fees during your free trial either.

Many payment methods

Let your customers pay with Visa, Mastercard, Amex, Apple Pay, Google Pay, plus region-specific cards like Discover & UnionPay.

We’re getting better every day

With regular updates based on your feedback, Paythen constantly gets better and more useful for you and your customers.