Easy payment plans for

*We mean extremely flexible

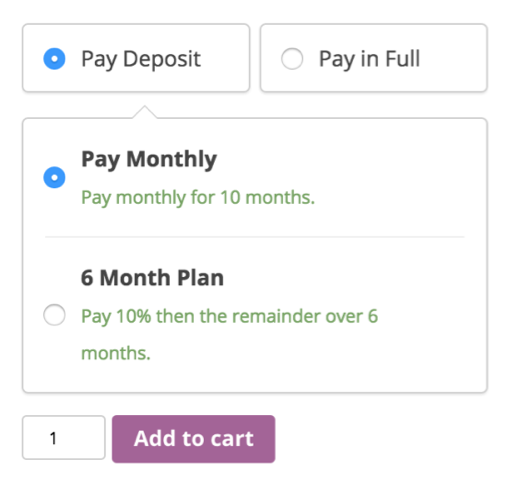

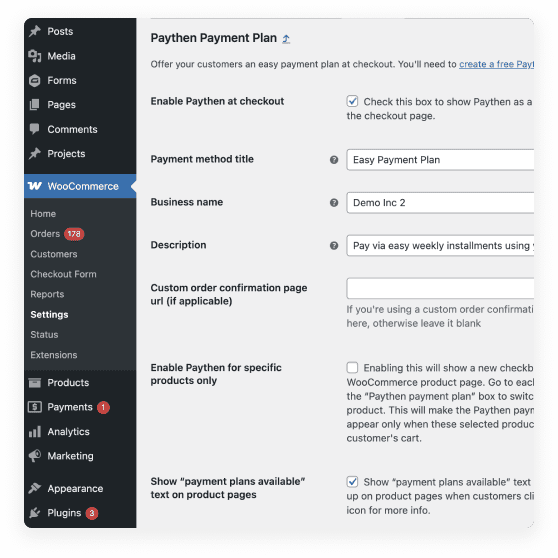

With our WooCommerce plugin, you can offer payment plans exactly how you want, with many customization options – here are some:

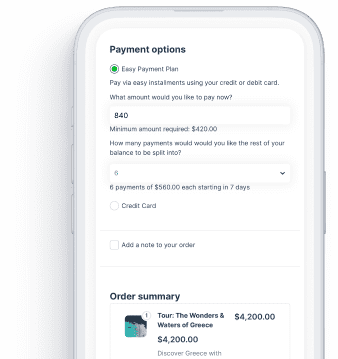

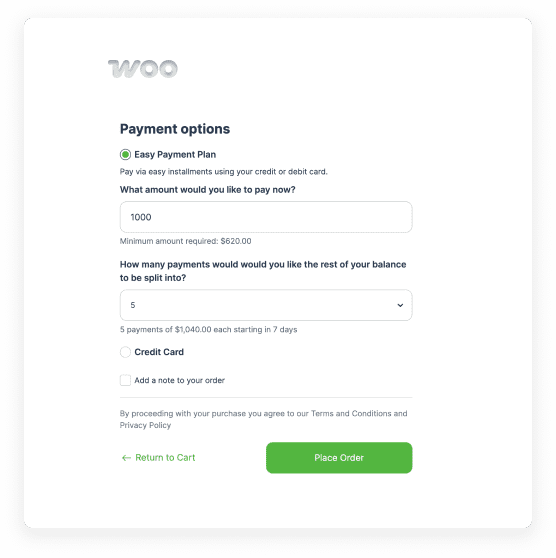

- Let customers choose their upfront payment amount

- Let customers choose the number of installments

- Show payment plans only for order over a certain amount

- Show payment plans only if certain products are in the cart

- Works automatically on stores with multi-currency checkouts

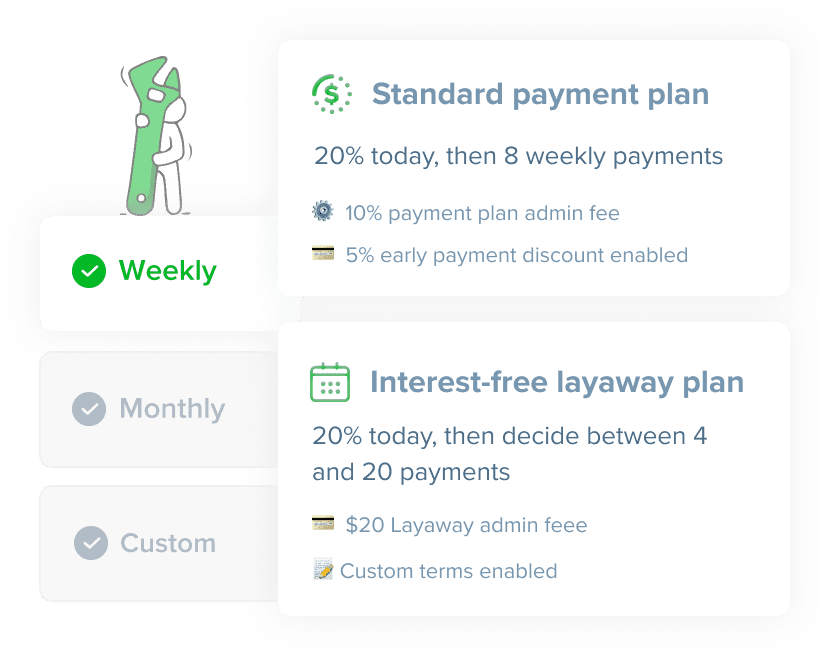

- Offer up to three different payment plan options

- Offer a layaway plan in addition to or instead of a payment plan

- Offer different payment plan options based on the order total

- Add surcharges and fees to suit your business

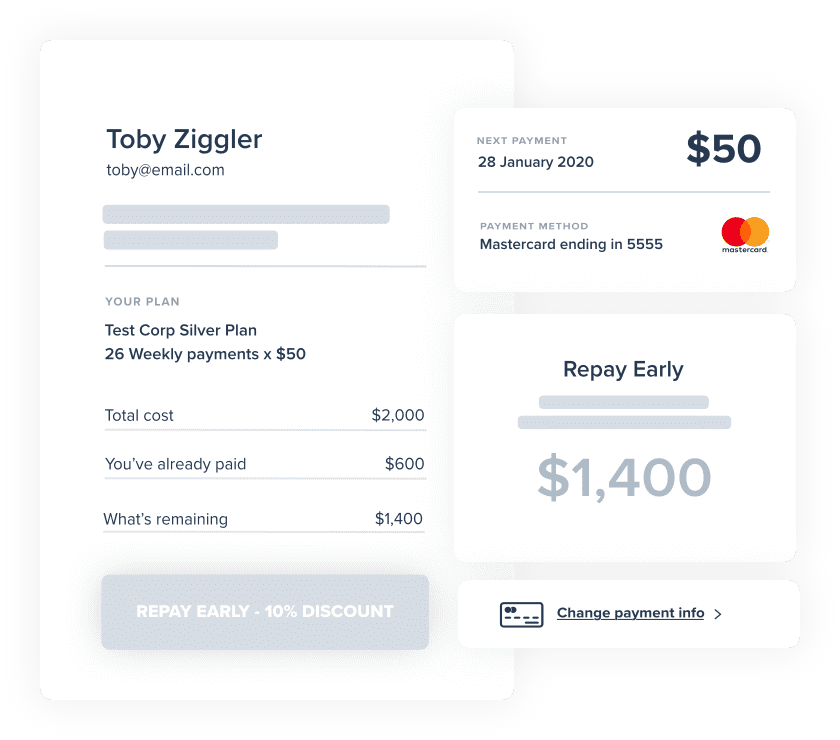

- Allow customers to make early repayments any time – in part or full

- Fully self-serve customer experience to easily manage their plan

- Automated reminders and retries

- Works with checkout customization plugins like Funnelkit and Cartflows

- Works with WooCommerce blocks or the Classic checkout

- Set any order status for customers on payment plans

- Show custom text on the order confirmation page

- Add custom text in the payment plan confirmation email

- Easily send additional data from any checkout fields to Paythen

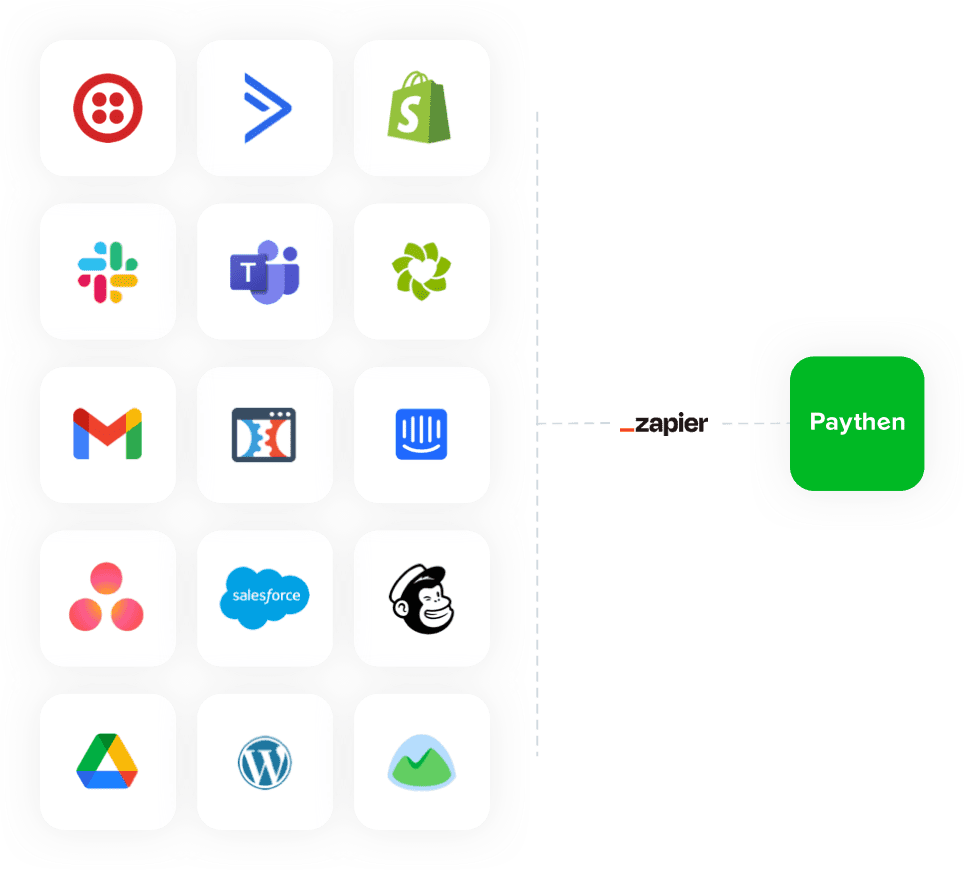

- Set up advanced workflows with Zapier

- Use outside WooCommerce with a fully featured dashboard

Works with your WooCommerce setup

Paythen works with almost any WooCommerce setup including sites using the classic checkout, the new blocks checkout, custom checkouts like Cartflows and Funnelkit, composite products, single page checkouts, Divi, Elementor, and much more. We regularly test Paythen with new versions of major plugins and themes. If you run into any issues on your site, we’ll sort them out for you. Just reach out via chat.

Here are working demos of four common setups:

Classic checkout demo

Blocks checkout demo

This demo uses the blocks checkout that is now the WooCommerce default

This demo uses the checkout customization plugin – Cartflows

This demo uses the checkout customization plugin – FunnelKit

⚡ Set it up now for your store with our step-by-step instructions. Takes under 6 minutes. Reach out via the chat icon if you need a hand 🙋♀️

Payment plans your way

It’s your business – you’re in full control.

Customers can help themselves 24 x 7

Deliver an exceptional experience without extra admin.

More sales, not admin with automatic everything

You’re always in the loop for any failed payments via email notifications and easy to spot overdue statuses in the dashboard.

Works with your workflow

Supercharge your workflow by sending customer data to over 7,000 apps with Zapier, or set up custom workflows like text messages and progress-based emails.

Integrate with almost any tools you use including Slack, Gmail, Salesforce, Google Sheets & more.

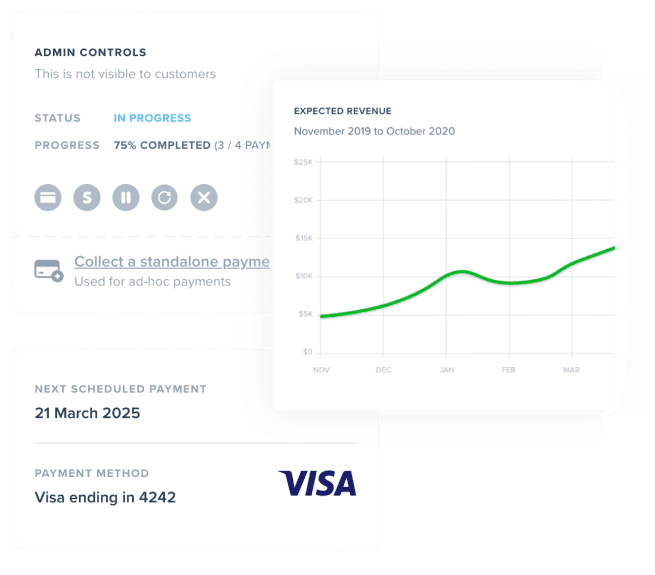

An intuitive admin dashboard for you and your team

Manage all your payment plan customers easily via an intuitive admin dashboard.

You can see handy stats, customers that are in progress, ones that have completed, any with overdue payments and even pause, cancel and change payment dates for individual customers. You can even create directly usable payment links for custom orders or tailored payment plans, create coupon codes, collect one-time payments and more.

Future-proof

No risk, just upside

This means you’re not paying for something that doesn’t help you sell more. We only make money if you do.

⚡ Set it up now for your store with our step-by-step instructions. Takes 5-6 minutes. Reach out via the chat icon if you need a hand 🙋♀️

How Paythen stacks up

We’re biased but we believe Paythen is an excellent option and great value for many businesses. It’s purpose-built to offer flexible payment plans, almost entirely automated and helps you make more money, while saving you time. We cover the pros and cons of the WooCommerce Deposits plugin, buy now pay later company plugins, and how they compare to Paythen here.

See Paythen in action on our demo store.

Deposits plugin by WooCommerce

This means more defaults, more manual admin chasing failed payments and less time to focus on your business.

Buy now pay later companies like Afterpay, Klarna and others

Only available to some merchants in some countries and your customer has to be in the same country.

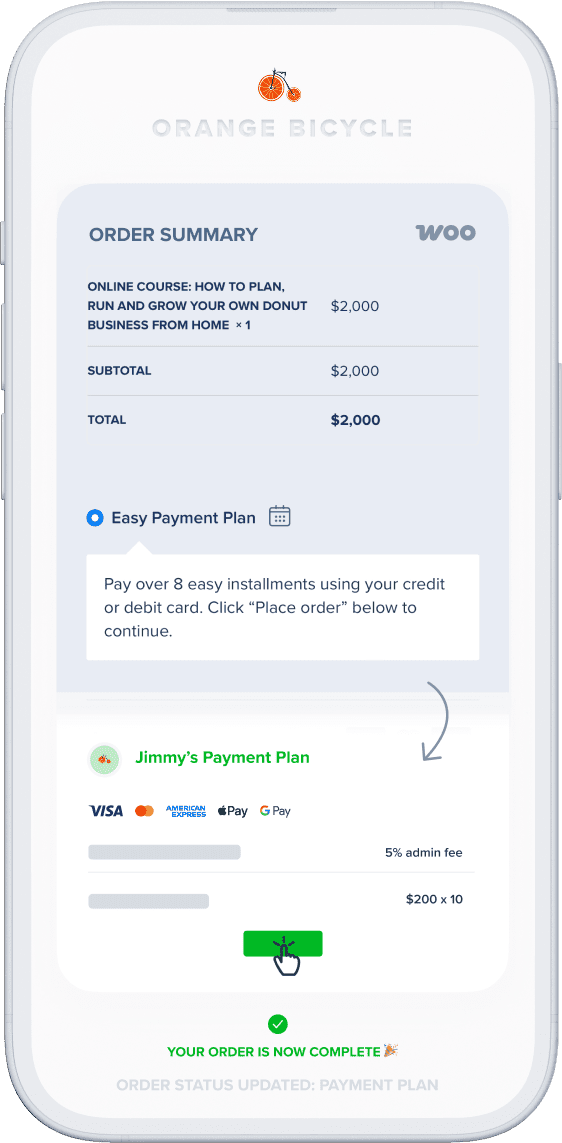

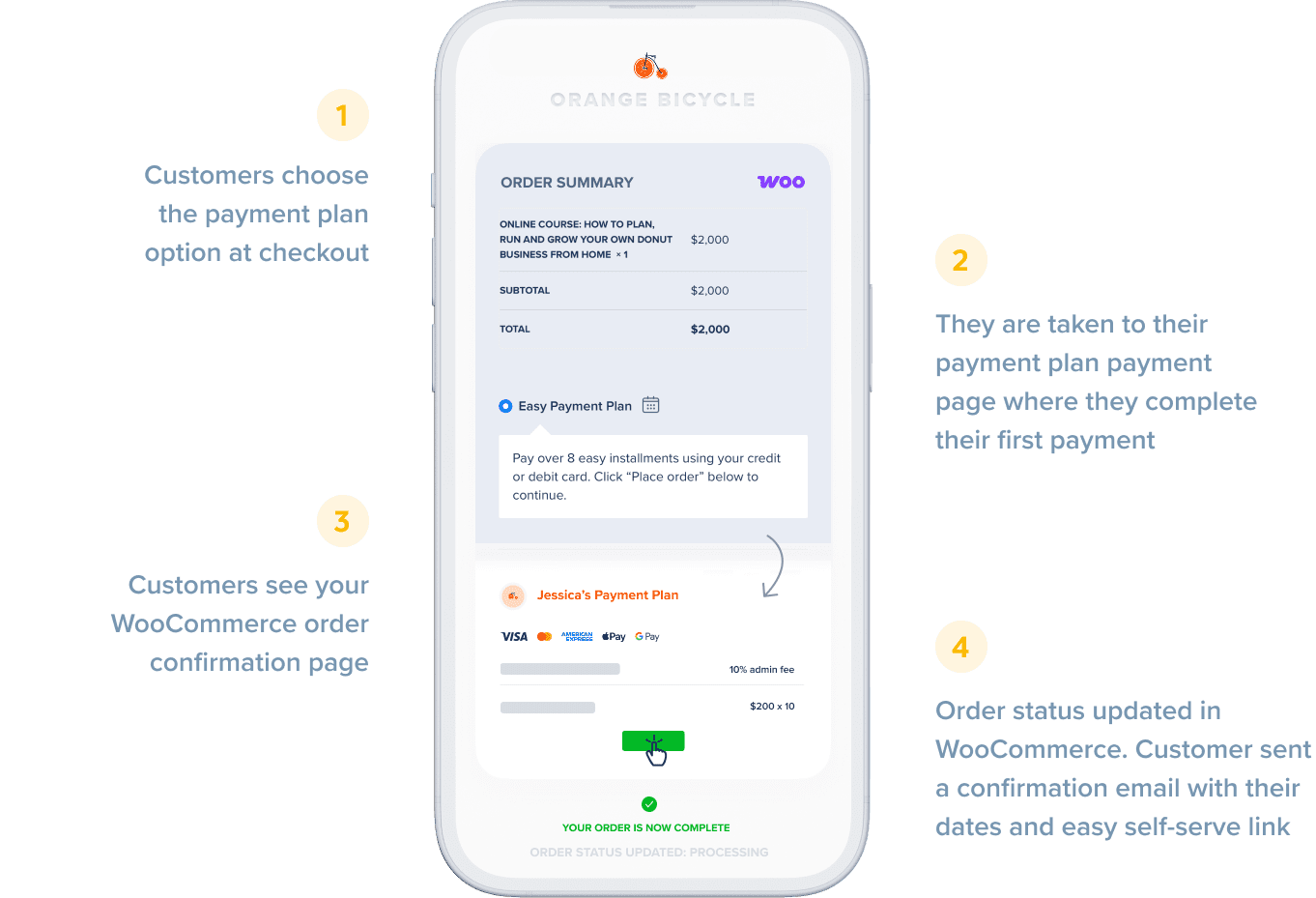

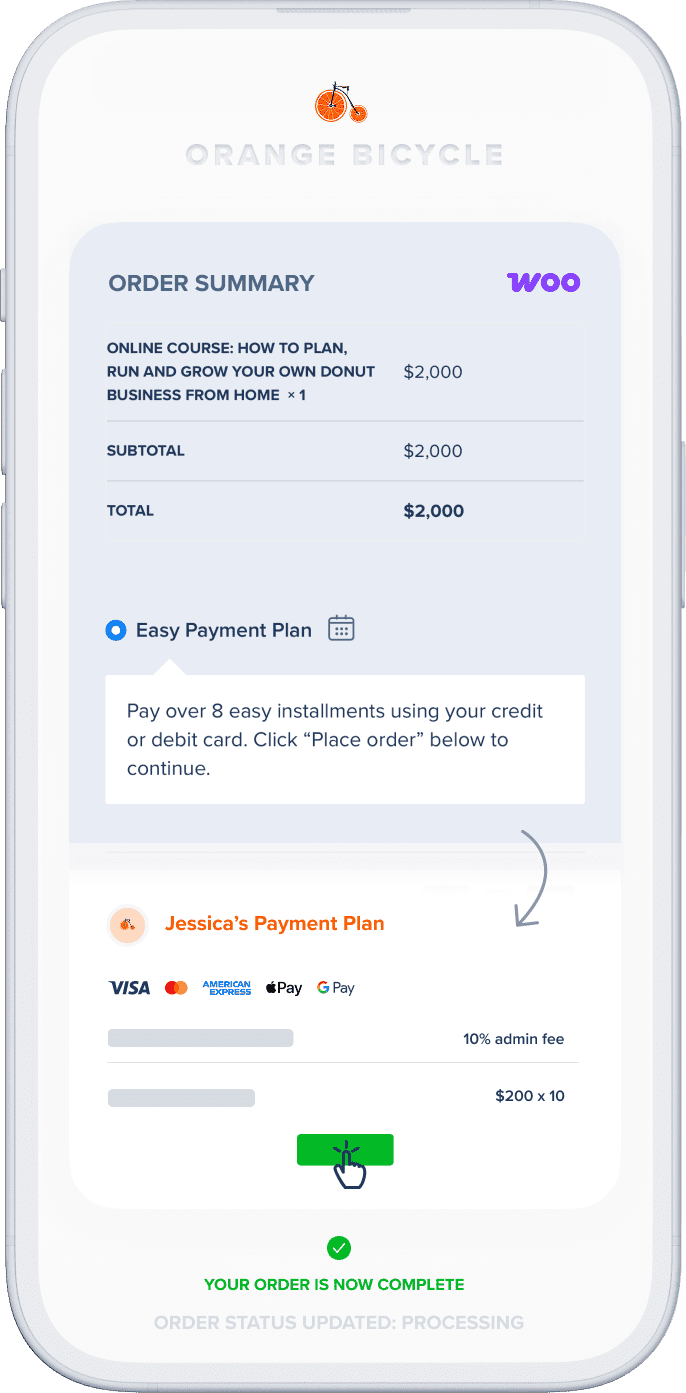

How does it work?

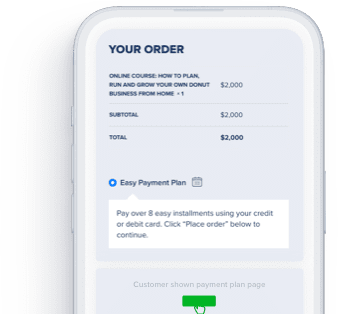

It takes just a few minutes to show the payment plan option in your checkout. Your customers will choose this option, complete the checkout and get taken to the payment plan page. Once they pay, they are brought back to your WooCommerce order confirmation page. See this in action on our demo store.

Here are step-by-step instructions to set this up. We’re here to help if you need it.

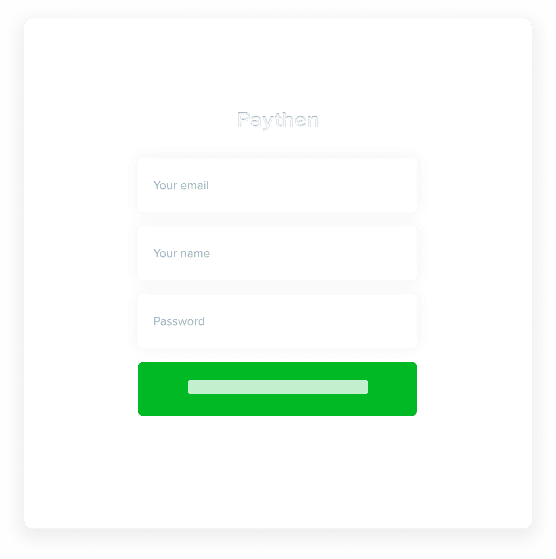

Create your free Paythen account and define some payment plan settings.

Install our free plugin, paste in your Paythen template link from the previous step, and set it live 🎉

Your checkout will now feature the payment plan option and customers can choose it at checkout.

- WooCommerce