Sell more, with easy Shopify payment plans

With our Shopify flow, you can offer flexible payment plans in minutes. Increase sales, not admin, with Paythen. No code or technical know-how needed.

No-code needed. Start your Paythen trial, configure some settings in Shopify and Zapier, and you’re ready to go!

Payment plans make what you’re selling more affordable to more customers. This helps expand your market, order value, and sales.

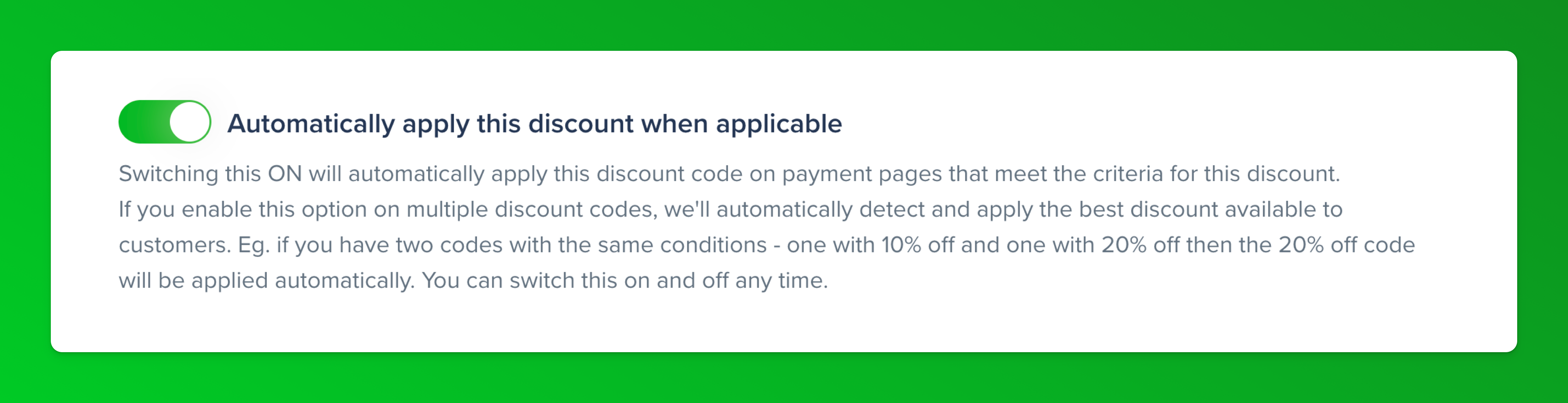

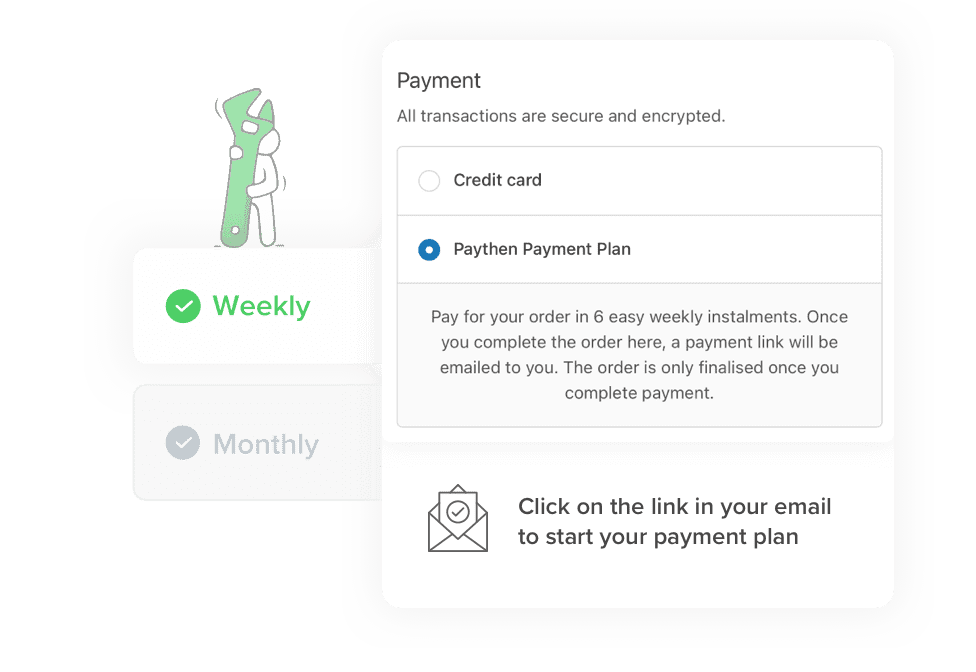

You set the rules.

Unlike buy now pay later companies that limit your payment plans to suit them, Paythen puts you in control. Choose the billing interval – 8 weeks, 8 months or anything else you want, add surcharges, deposits and much more. It’s your business – you’re in full control. Here’s an example of a Paythen payment plan page.

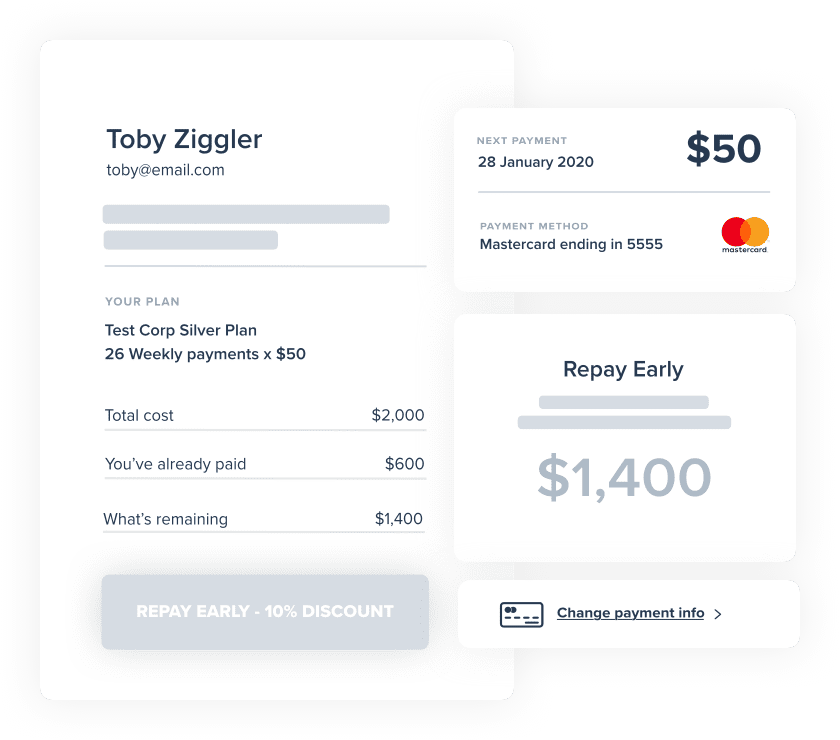

Let your customers help themselves while you reduce support costs.

With self-serve links like this one generated for each customer, your customers can see what they’ve paid, what they owe, repay early, change their card info, access receipts and more – via a secure link they can access 24 x 7. Reduce support and admin costs and delight your customers 😍

Less admin, automatic everything.

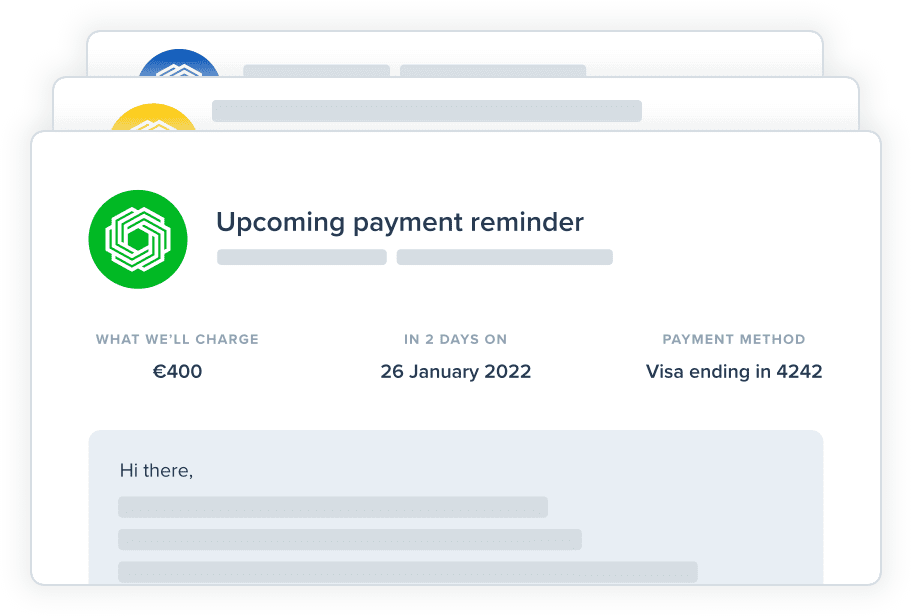

Customers get reminders before each scheduled payment, and there are automatic retries and automated follow-up emails if a payment fails. This reduces failed payments, chances of defaults, and eliminates manual follow-ups. You’ll also get notified any time a payment fails so you’re always in the loop.

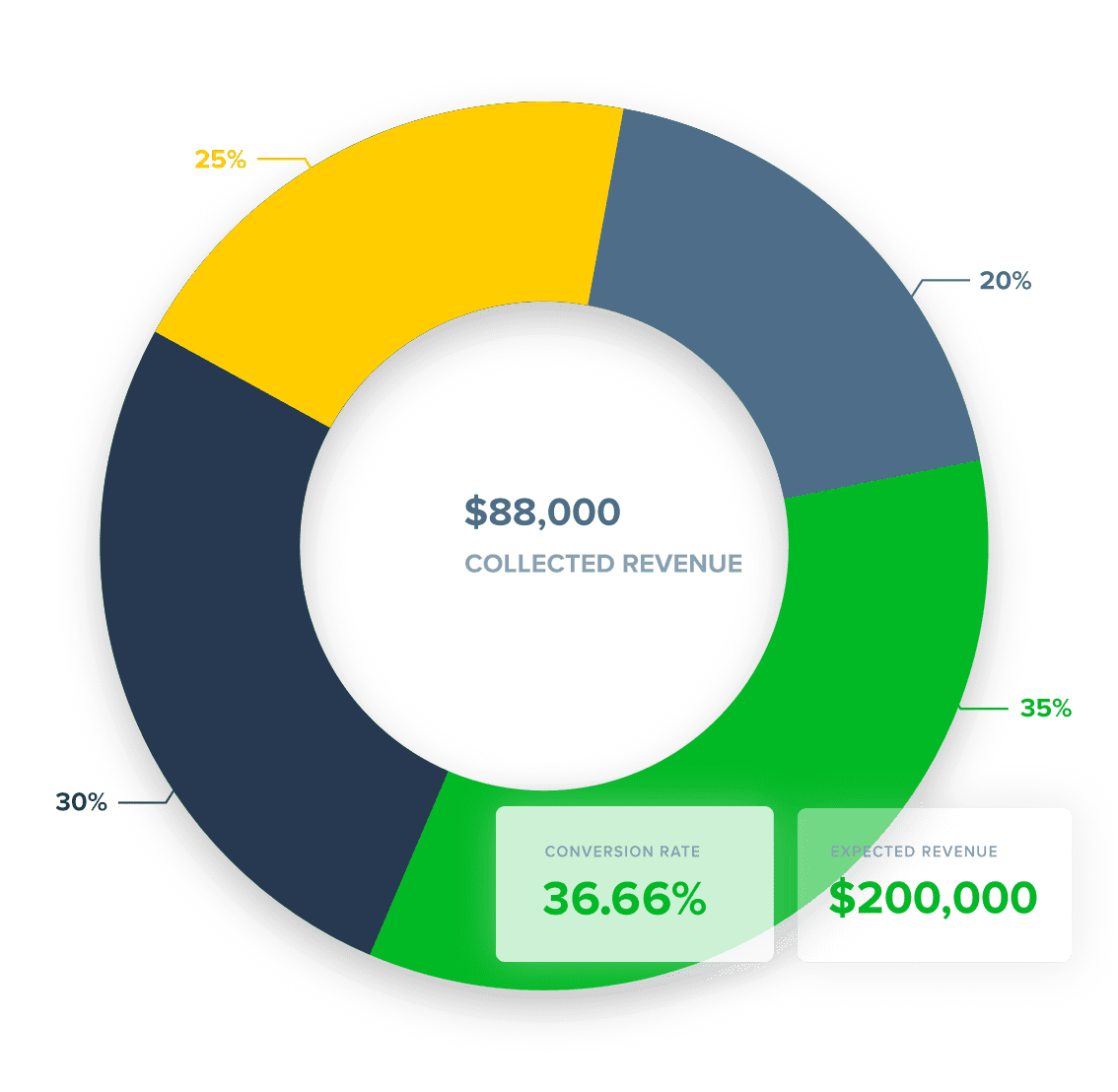

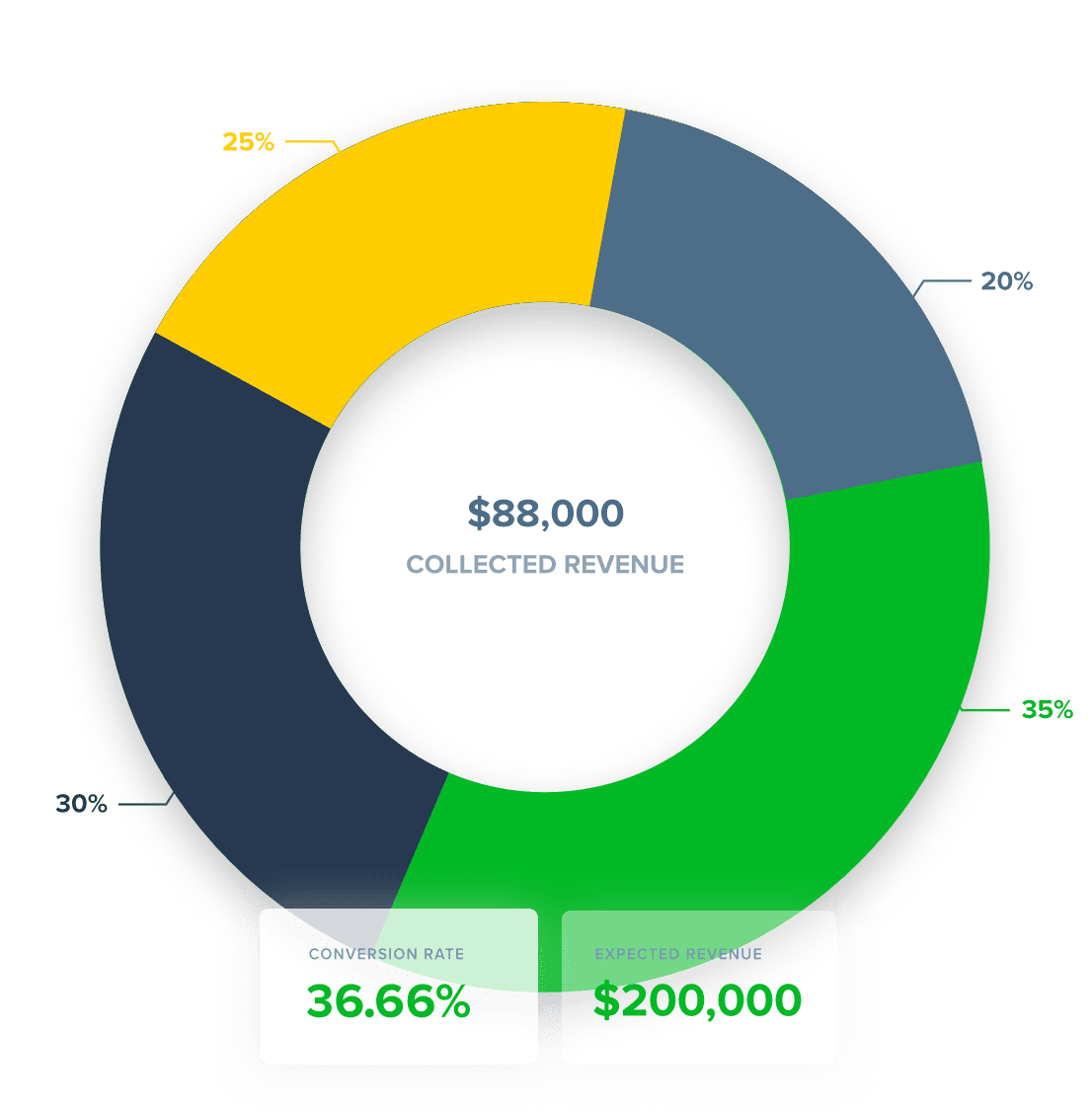

See useful reports you’ll actually use

Instead of dozens of reports you’ll never use, we show you key insights right on your dashboard – for the business, and for each customer.

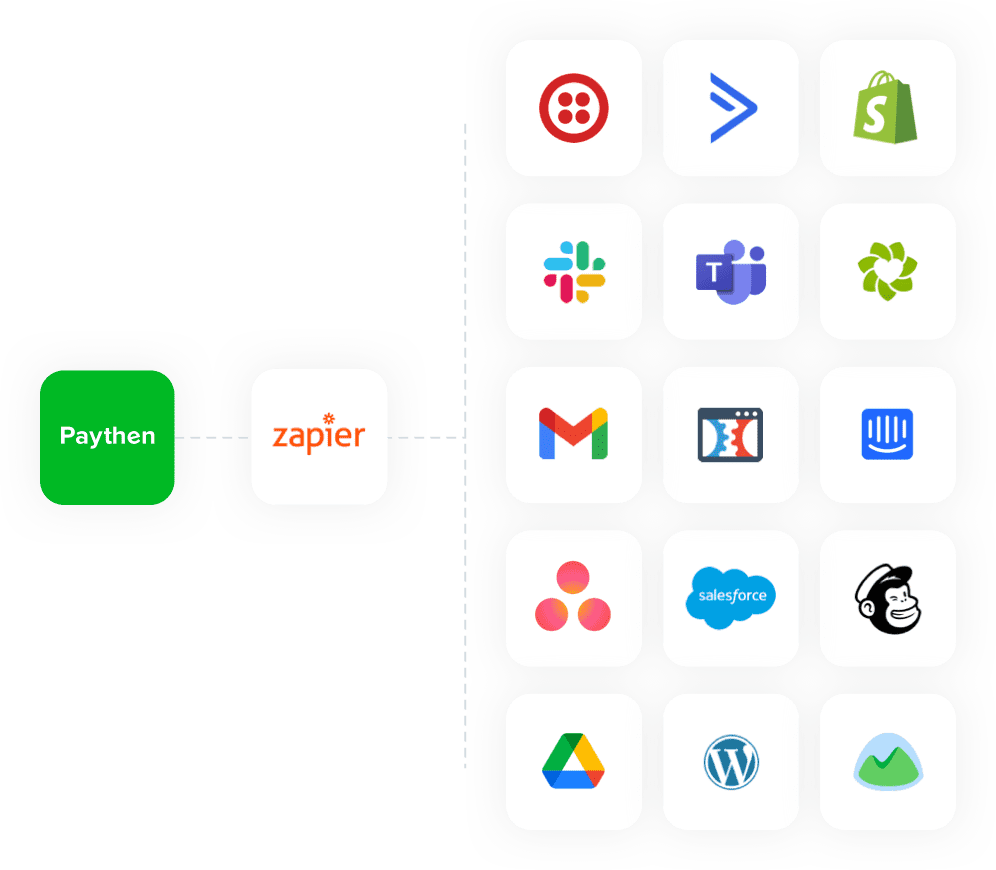

Works with all your apps.

Supercharge your workflow by sending Paythen data to over 7,000+ apps with Zapier – including Slack, Gmail, Google Sheets & more. We’ve highlighted some popular ones here.

How does it work?

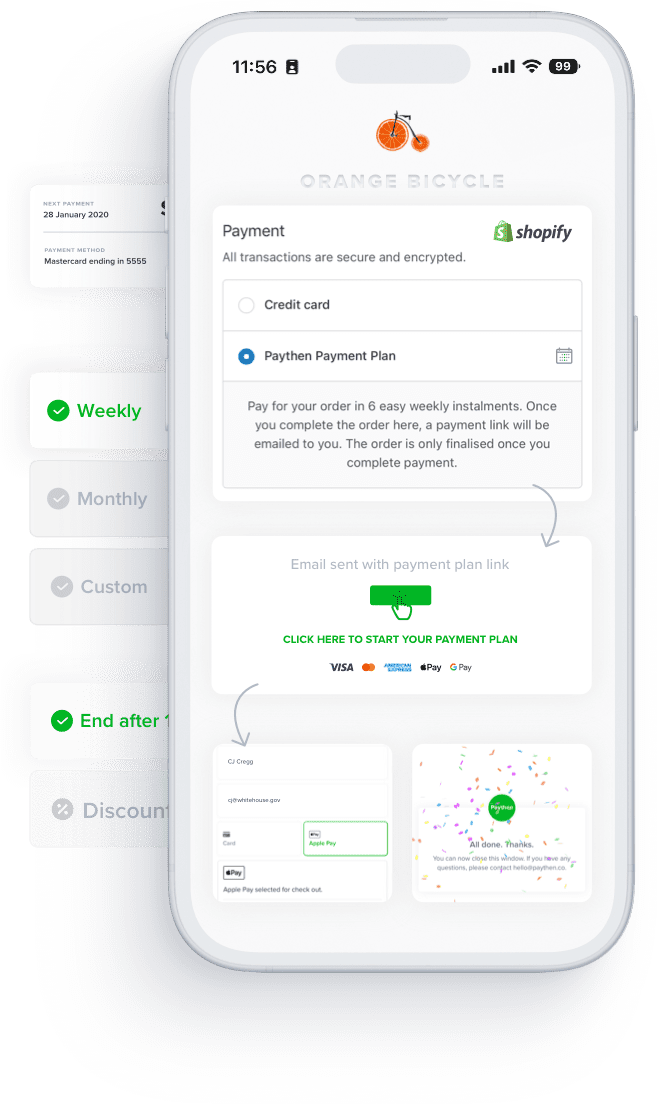

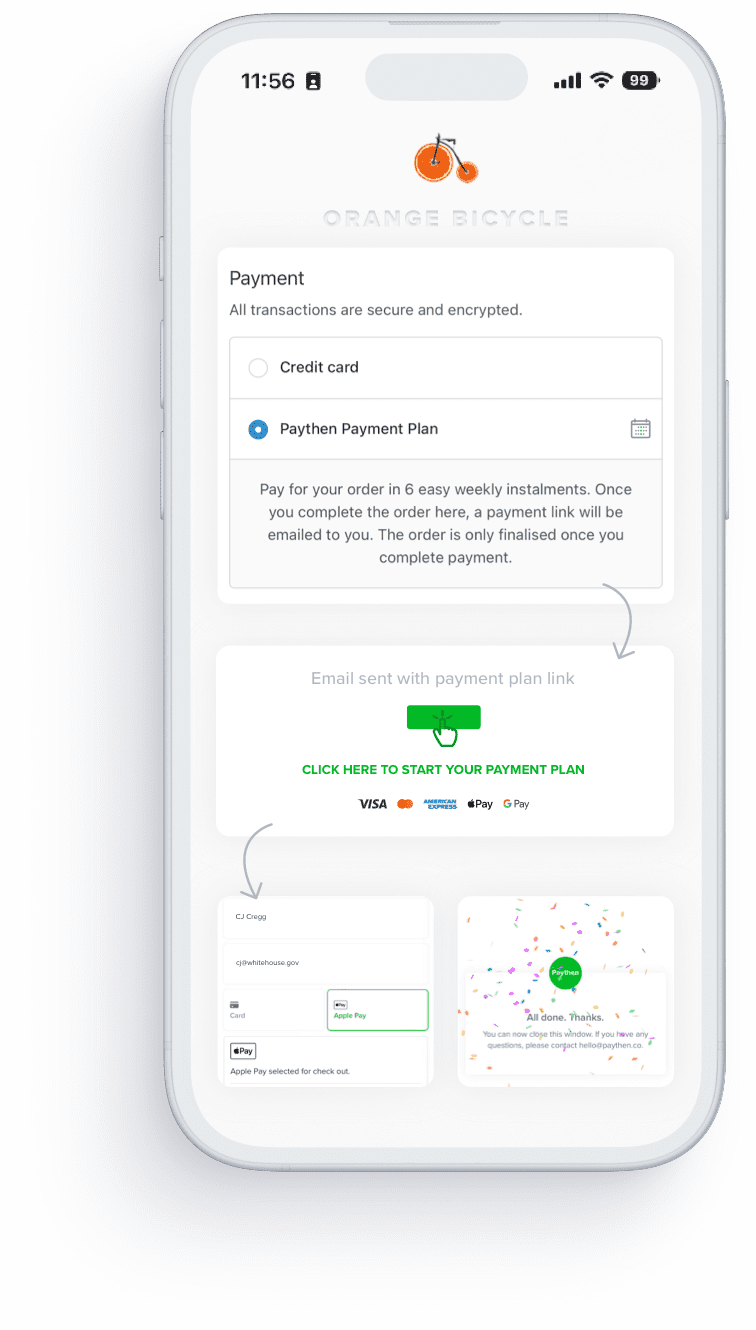

Because of limitations imposed by Shopify on third party payment apps, we are unable to offer a one-click Shopify app. However, with 15 minutes of setup time and a Zapier account, you can easily offer Paythen payment plans on your Shopify store and deliver a seamless experience for your customers.

Here are step-by-step instructions to set up this workflow using Zapier.

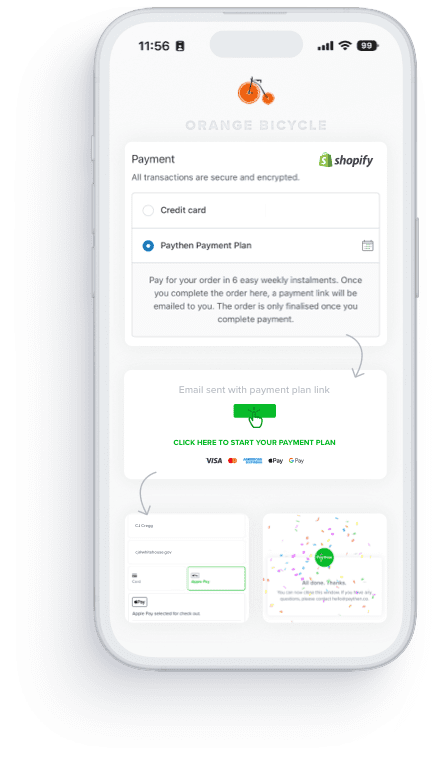

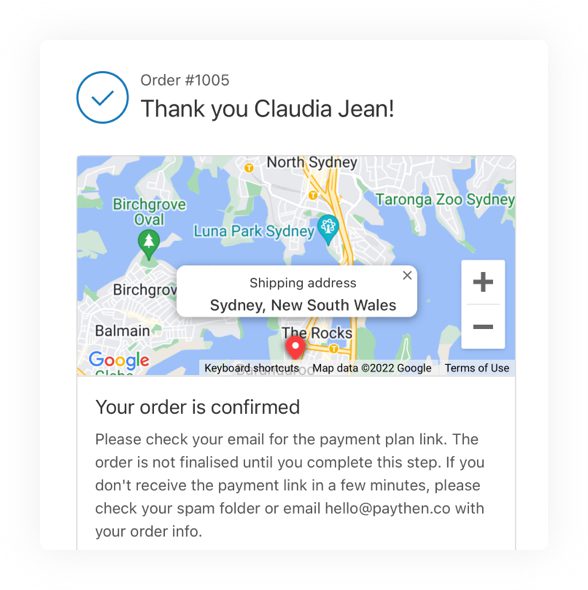

We’re here to help if you need a hand. Here’s how it works for your customers:

Your customers check out on your store like normal, but select the “Paythen Payment plan” option. The order is submitted and all details come through in the Shopify admin.

Your customers get an automatic email with their custom payment plan link that lets them pay and start their payment plan.

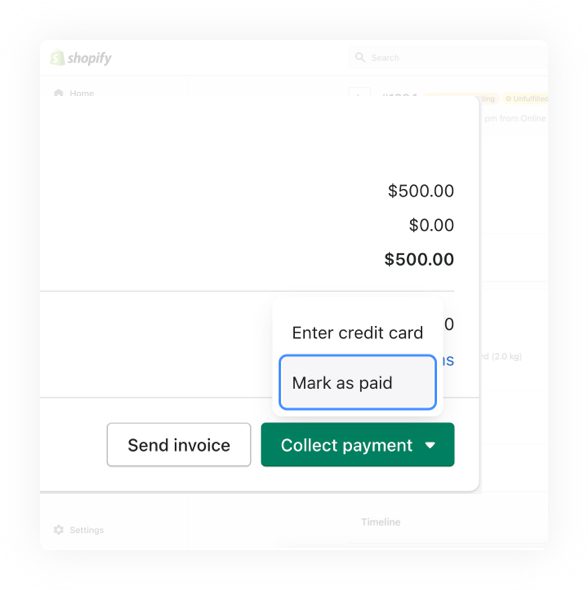

You update the payment status in Shopify to “Mark as Paid” and proceed with order fulfilment as you normally would. That’s it!

- Shopify

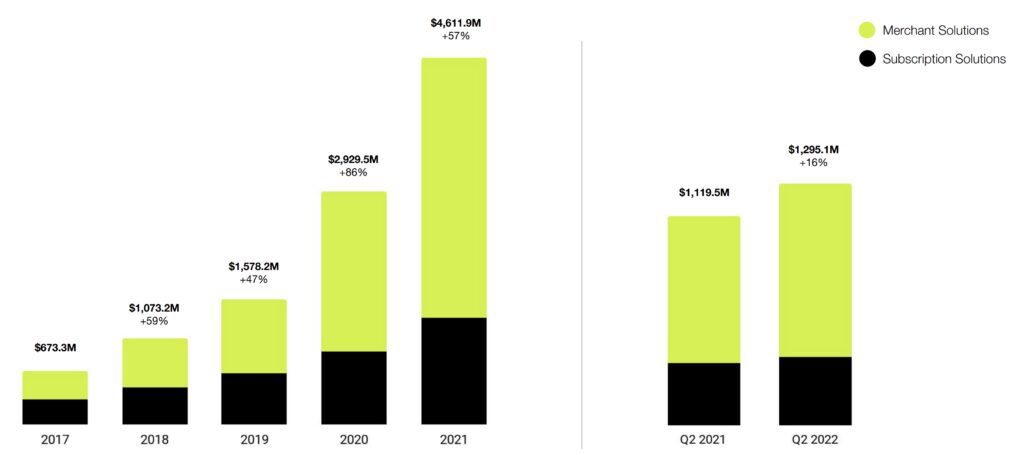

How Paythen stacks up

You have options. We have answers. We’re biased but we believe Paythen is an excellent, more flexible and customisable option for merchants to offer flexible, easy payment plans on Shopify.

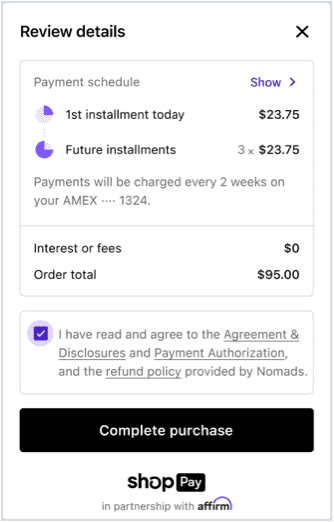

The best option for payment plans on Shopify, if it’s available to you.

Shop Pay Installments is only available to eligible merchants in in eligible industries, based in the U.S.

For totals over $1,000, your customers have to pay a high interest rate on purchases and have to undergo a credit check.

Buy now pay later companies like Afterpay, Klarna and others

You get paid upfront but you give away a large chunk of your profits, lose control of your brand, and most importantly, give away your customer relationships.

Only available in limited countries and your customer has to be in the same country.

See Paythen in action on our demo Shopify store here.

Increase sales, not admin with Paythen payment plans.

See if it works for you with a fee-free 7 day trial.

We’ll ask you to connect your Stripe account or create a new one once you sign up. Paythen works with Stripe.

Easy payment plans

Offer your customers a flexible payment plan set by you, to increase conversions and sales.

Automated reminders & emails

We automatically send handy reminders before payments & follow-ups if a payment fails.

Integrate with other apps

Send Paythen data to over 7,000+ other apps with our Zapier integration.

Encourage early repayments

Offer customers on a payment plan an easy way to repay early at any time – increasing your cashflow.

Change payment info easily

Your customers can change their card info anytime they want, with zero time spent by your team.

We get paid when you do

With our simple, low 2% fee, we only get paid when you do. No fixed or hidden fees. No fees during your free trial either.

Discover more features, check out these examples or see our FAQs