If you sell items over $2,000 or your typical transaction is even larger – like $10,000 or $20,000, your options with buy-now-pay-later companies are limited or non-existent.

Some traditional customer financing providers might work with you but they typically have extremely limited eligibility, a clunky user experience and often require documentation and individual approvals for each customer. This is not a great way to attract (or keep) customers in this day and age.

By using easy software like Paythen, you can offer your own payment plans exactly how you want, without additional headaches or admin. Paythen does all the heavy lifting and automates most things including payment collection, attempts, follow ups and lets you offer customer financing exactly how it suits your business and product.

Let’s say you sell farm equipment, or luxury furniture that typically costs $20,000 or more, and has an 8 week manufacturing/lead time, you can choose to charge customer a 50% upfront deposit on order, and charge the rest over 8 easy weekly installments. You can then choose to ship the product only once all payments are completed. This way you eliminate all risk of non-payment involved with offering your own customer financing.

You can also choose to get customers to agree to a legal contract with your business at the time they sign up, and ship the product immediately – even as the customer continues to make the installment payments. With Paythen, you have complete control over how and to whom you offer customer financing. You can add surcharges, deposits and more.

Is each order completely different? Want to offer payment plans only to specific customers? Paythen makes that easy too – you can create and send custom plan links to individual customers based on their amounts and different billing intervals. Want a customer to pay over 6 months, and another one to pay over 12? Easily done. Need to add a surcharge for one customer but not for another? Done with a few clicks.

With Paythen, our goal is to ensure you are in full control of your customer financing – you choose how, when and to whom you provide financing, regardless of your average order value, industry or location.

Offer flexible customer financing to all your customers for any amount, over any time period, in under 2 minutes with Paythen.

A customer financing tool like Paythen is especially suitable for product businesses where there is a lead/manufacturing time between orders and shipping, as this allows you to structure your payment plans to complete before anything is shipped. This essentially eliminates any risk for you – if the customer doesn’t pay, they don’t get the product. Of course, if you have affluent, or trusted customers that are unlikely to renege or default on a legal contract, then the risk is low too, even if you ship the product before all payments are made.

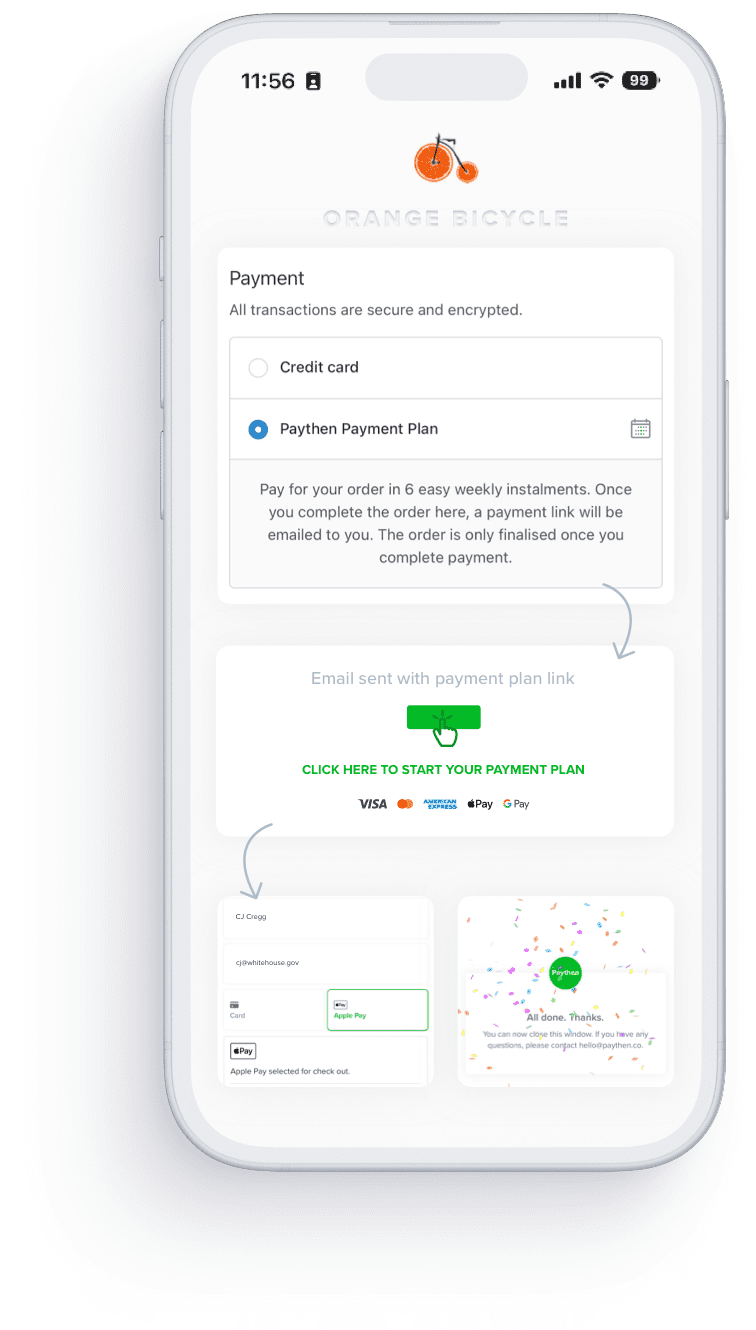

While you can use Paythen plans directly and send links to customers, you can also use Paythen with your eCommerce platform, using our native payment plan plugin for WooCommerce, our Shopify payment plan flow, most third party form tools, or any other platform that can work with Zapier.

Based on our analysis of millions of dollars of transactions processed through Paythen, over 50% of customers choose a financing option when given the choice.

With Paythen, you can offer flexible, low cost customer financing that helps increase sales and remain competitive while retaining full control of everything, including your branding. Paythen makes it easy to connect your Stripe account and offer customer financing exactly how you need to, with maximum flexibility and minimal extra admin, regardless of your average order value, customer location or industry.