Sell anything other than consumer-focused eCommerce? You’re out of luck when it comes to the standard buy-now-pay-later companies. Most BNPL companies want merchants that sell B2C products, with average order values less than $1,500.

Most businesses that sell services, non-standard products or high value items won’t even get approved to have this option available.

If you sell a $2,000 course, $5,000 workshop, a $10,000 service, you have very limited and often very expensive customer financing options available – typically with a terrible customer experience involving credit approvals, documents, proof of income, expenses and more.

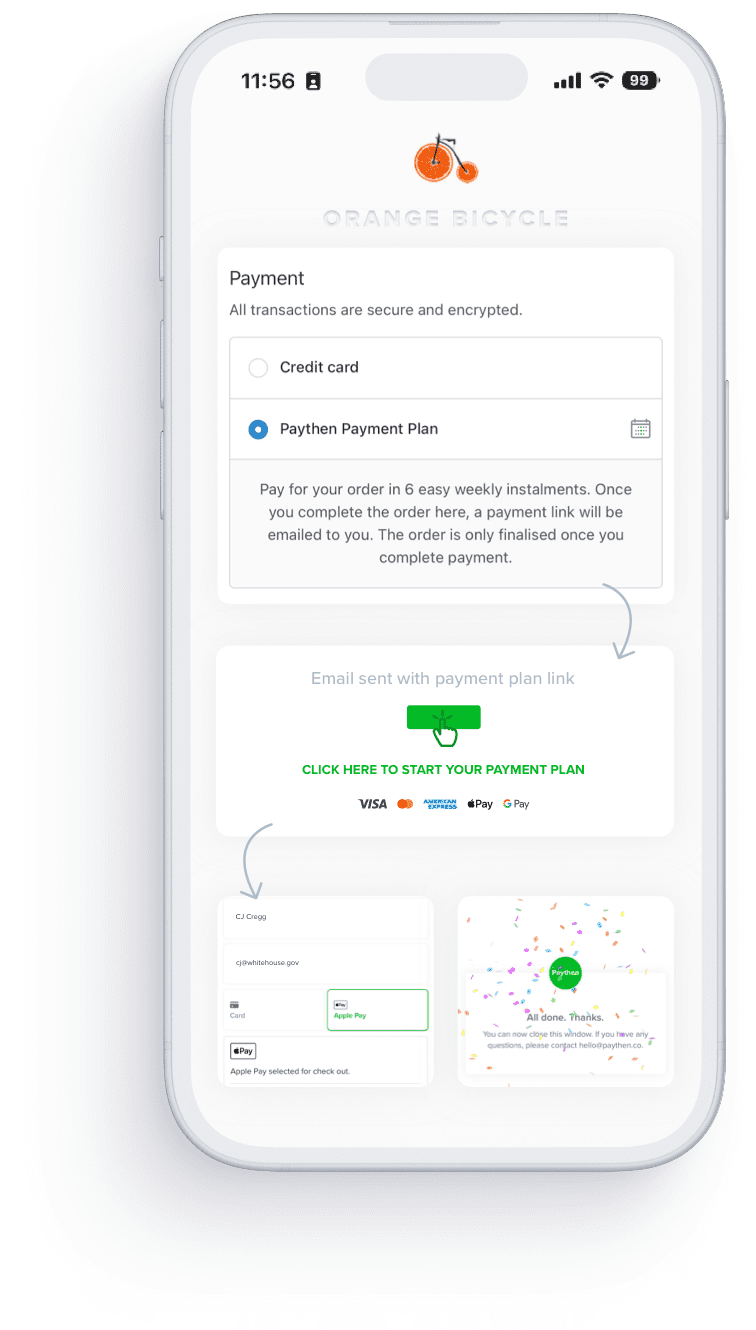

Offer flexible customer financing to all your customers for any amount, over any time period, in under 2 minutes with Paythen.

A customer financing tool like Paythen is especially suitable to service businesses as you can align the payment plan billing intervals to the provision of the service. This essentially eliminates any risk for you – if the customer doesn’t pay, they stop getting the service.

Eg: If you offer a service delivered over 6 months, you can charge the customer an upfront amount, say 20%, and the remainder, over 5 monthly payments, paid in advance. In case a customer defaults/is delayed on a payment, you can simply withhold the service. If you’re selling a digital product or service, the same principle applies – you can withhold it if a customer stops paying.

Based on our analysis of millions of dollars of transactions processed through Paythen, over 50% of customers choose a financing option when given the choice.

With Paythen, you can offer flexible, low cost customer financing that helps increase sales without adding risk for your service business and while retaining full control of everything, including your branding. Paythen makes it easy to connect your Stripe account and offer payment plans exactly how you need to, with maximum flexibility and minimal extra admin.